Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Despite the substantial growth of the on-chain metrics of XRP, the anticipated pacing is not there. With only 589 million growth in payments volume in the last 24 hours, XRP is not hitting the expected target of 1 billion.

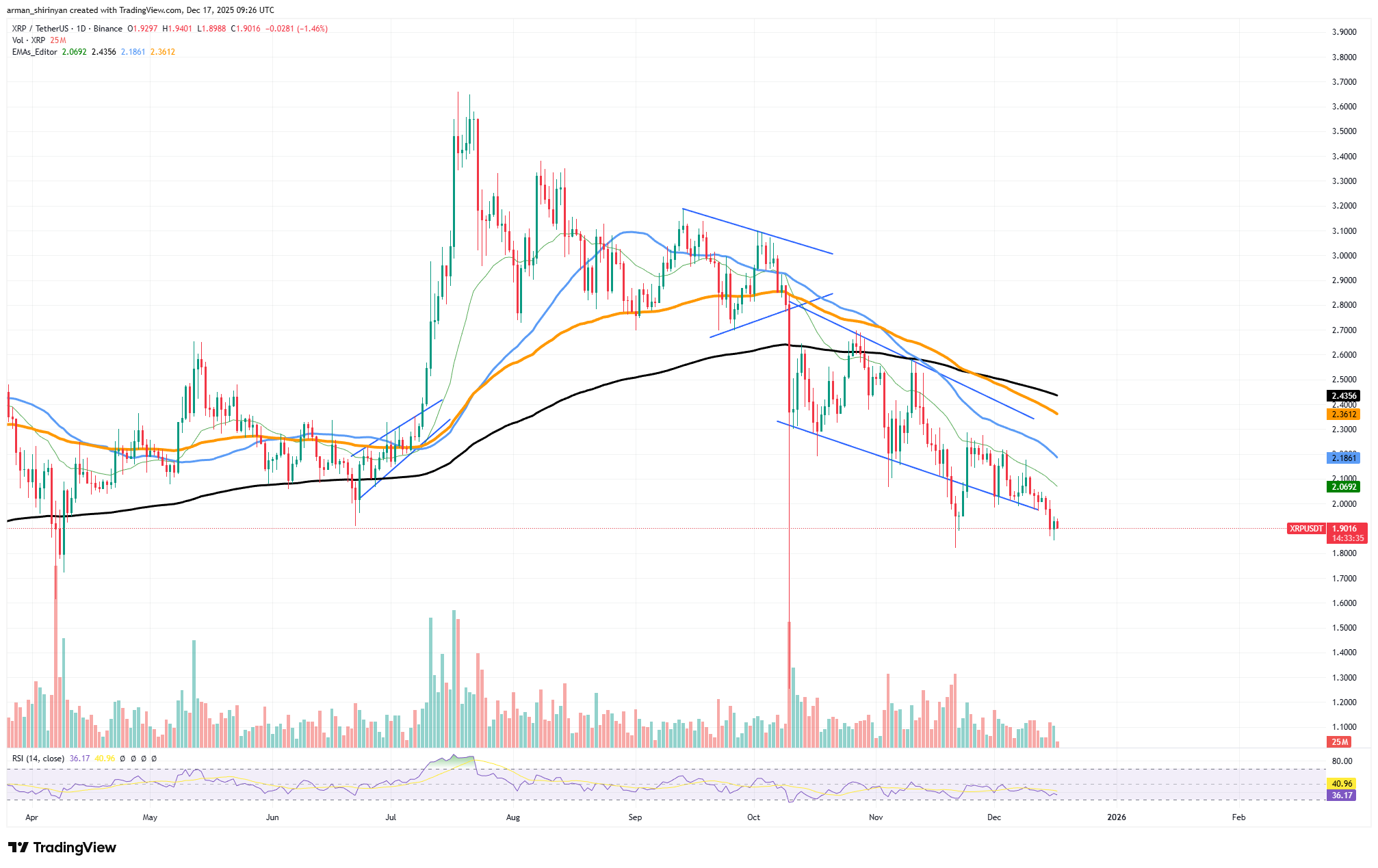

From a market standpoint, XRP is still under pressure. The price is trading below important moving averages on the daily chart, which displays a distinct pattern of lower highs and lower lows. The momentum shifted strongly in favor of sellers, when the midrange support around the $2.10-$2.00 zone was lost.

Still in downtrend

However, the rate of decline has slowed. Wicks are emerging on the downside, candles are compressing and the RSI is in the mid-to-low 30s, all of which historically indicate that aggressive selling is waning rather than picking up speed.

Things get interesting in the volume story. The previous 10x payment volume spike was a classic speculative surge, characterized by quick distribution, heavy positioning and rapid capital rotation. Even without the mania, the current 4x-equivalent activity level still indicates higher network usage than baseline.

Put differently, activity cooled rather than disappeared. That is important. Sustained but reduced payment volume is more indicative of institutional and utility flow than of pure short-term speculation.

XRP's usage dip

Timing is another important consideration. Weekdays still account for the majority of payments, which is consistent with institutional behavior rather than retail-driven hype. Even when the price corrects, this pattern supports the notion that XRP's underlying network usage has not collapsed.

These divergences, which consist of steady on-chain activity and declining prices, have historically preceded either a prolonged accumulation phase or a dramatic relief bounce.

There are two main scenarios that investors should be aware of. A relief rally toward the $2.20-$2.40 zone will be feasible if XRP can maintain the $1.85-$1.90 range and recover short-term moving averages.

On the other hand, rather than completely collapsing, XRP runs the risk of slipping into a deeper consolidation range if payment volume keeps declining and the price loses its current base.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov