Peter Schiff, the notorious Bitcoin critic and popular financial commentator, is once again telling investors to buy the dip. This time, however, the target of his attention is not cryptocurrency, gold or even silver. According to Schiff, equities tied to metals production are now trading at levels that make little sense given where the underlying commodities landed.

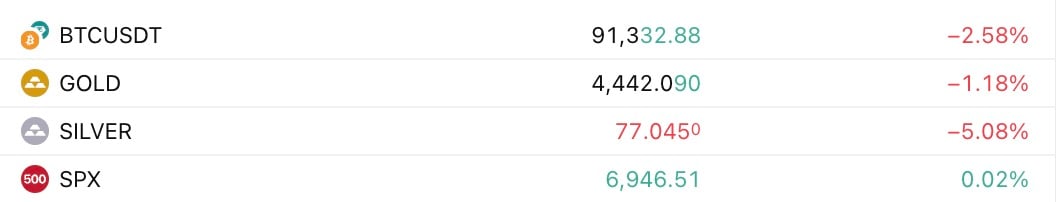

Gold finished the session at $4,443, down 1.14%, while silver dropped 4.71% to $77.34, extending the decline that has already put pressure on miners. Schiff believes these stocks have already absorbed downside risk from earlier sessions and are now trading at prices far below the current spot price.

In the meantime, Bitcoin fell 2.14% to $91,742. This would normally trigger a round of commentary from Schiff, whose social media presence often pivots off crypto volatility. This time, however, he remained silent, keeping his message entirely within the realm of metals.

What is Schiff talking about?

He pointed out a specific valuation mismatch between physical pricing and publicly traded mining firms. With the S&P 500 flat at 6,947.39 and no major risk-off flows in play, the selling pressure on miners was not part of a broader equity unwind or cross-asset de-risking.

Schiff believes the sector sold off independently, driven by mechanical sentiment spillover from commodity price screens rather than any fundamental deterioration in forward demand, cost structure or production outlook.

Neither is he offering a bullish call on metals nor repositioning his long-standing views on monetary policy. Rather, Schiff is pointing out a pricing inefficiency between two directly linked markets. And, for once, he let Bitcoin fall without using it to make his point.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin