Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

XRP just showed the market how quickly control can change hands when positioning gets biased one way.

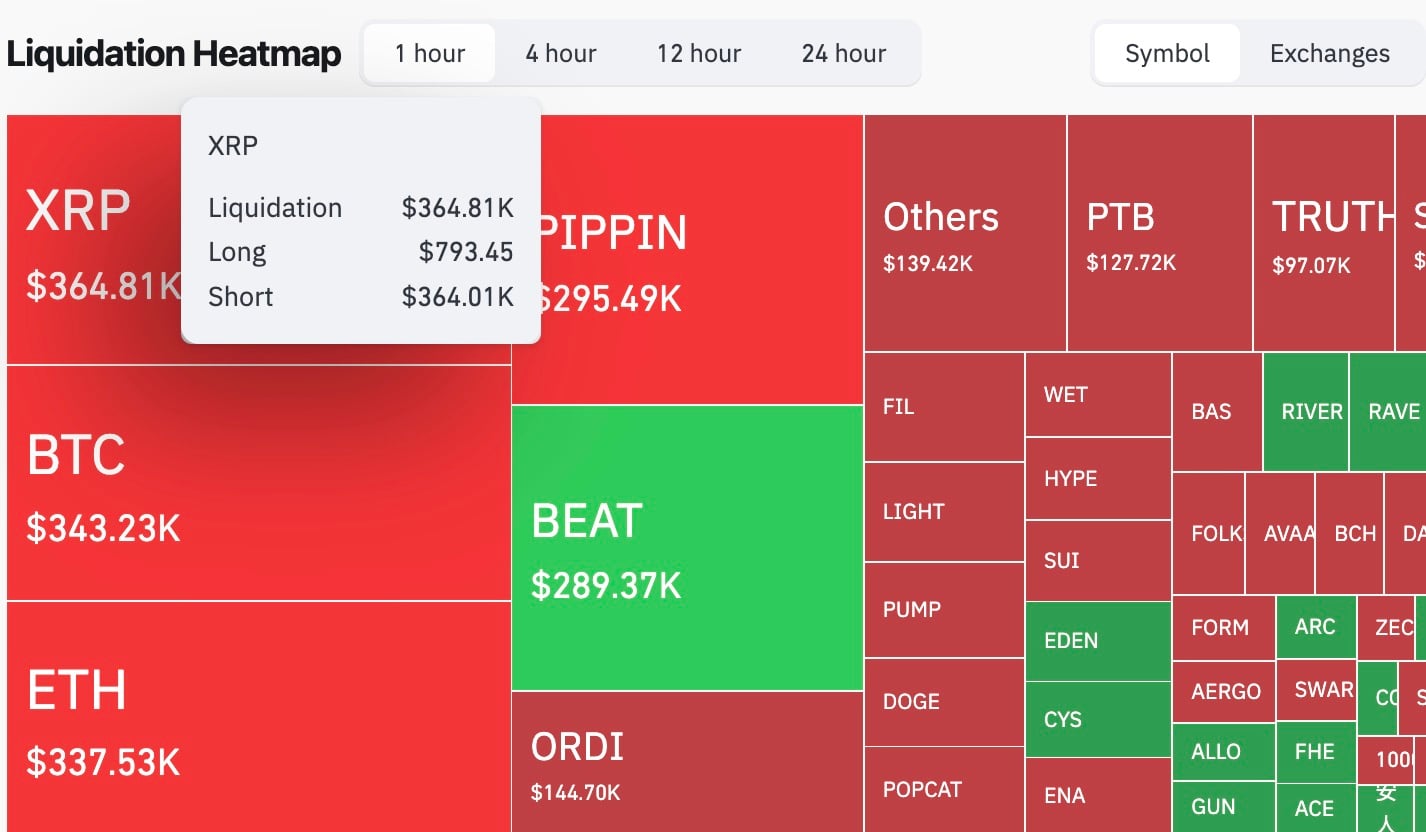

Just in the last hour, XRP printed a 45,901% liquidation imbalance, which is one of the most extreme readings seen across the majors in recent days. Total liquidations hit around $364,800, but the split shows the real story. Shorts absorbed roughly $364,010 in forced closures, while long liquidations barely crossed $793, as per CoinGlass.

Compared to Bitcoin and Ethereum, which both had similar headline liquidation totals of about $340,000 but with much more even distributions, XRP stood out.

The pressure was on the sellers, and once the price started moving, there was no support cushion. Stops were triggered, positions blew out and bids kept absorbing supply without needing a dramatic spike.

XRP price chart reveals it all

In the meantime, XRP climbed from the low $1.86 area earlier in the day and worked its way up to $1.94, printing higher lows throughout the session. The move was not just a quick squeeze candle that fades quickly but a confident intraday advance, where each pause invites another round of short covering.

That kind of structure usually shows where the most pressure is, not just a rush to make a decision.

What's important now is not the initial headline but what comes after. When shorts are cleared like this, the price often stops falling for a simple reason: the most motivated sellers have already sold.

As long as the XRP price stays above $1.90, there will not be much downside pressure, and if interest grows again, it might just recreate the same imbalance that just broke.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin