Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

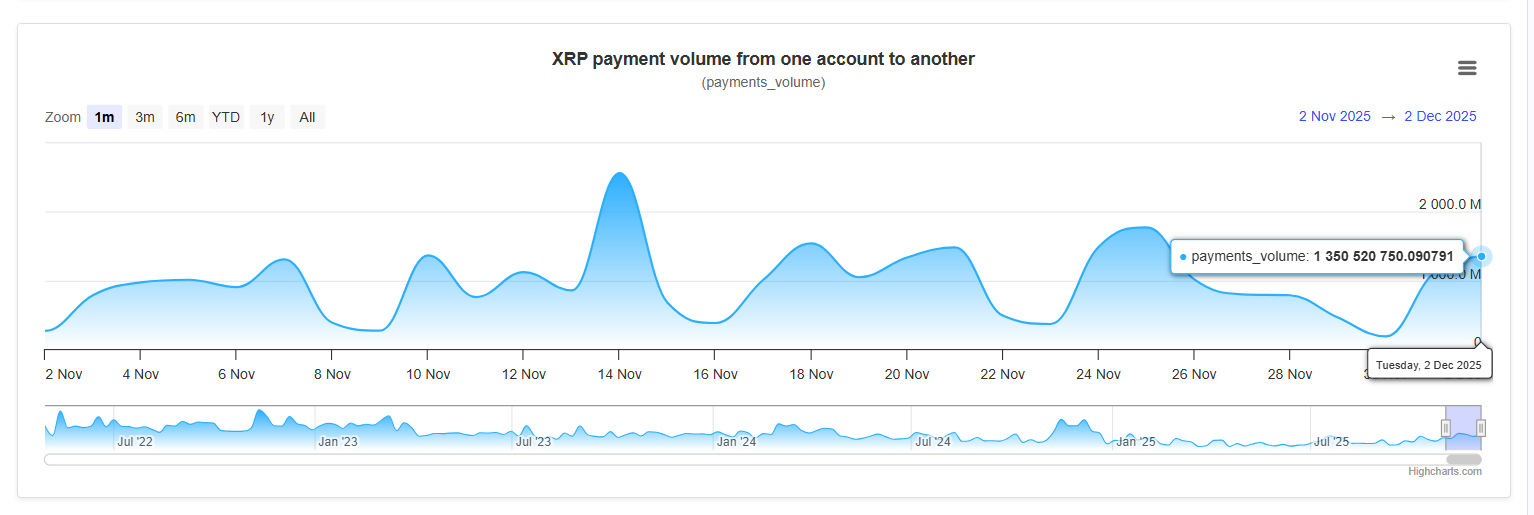

With payment volume surging by almost 10x over its baseline earlier in the cycle, the most recent XRP Ledger metrics indicate one of the strongest on-chain expansions the network has witnessed in months. The metric jumped to 1.35 billion XRP transferred in a single day, marking a surge far above the typical 150-200 million range seen through November.

What this growth actually means, and whether it affects XRP's price — which is still struggling inside a clearly defined declining channel — are the questions.

On-chain metrics: Real activity

Through November, the payment-volume chart displays a very steady increase that ends in a nearly vertical spike. The pattern, which is probably related to institutional settlement, liquidity routing or automated high-volume flows across exchanges and custodial services, indicates widespread network usage rather than a single isolated whale.

This type of steady rise in XRPL throughput has historically preceded XRP market liquidity expansions, though price appreciation has not always happened right away. Another important point: the jump is accompanied by rising volatility in the payment-count chart, meaning the network is not just moving larger sums —more users and more accounts are participating. That is usually a stronger long-term bullish signal than simple volume spikes.

Not yet for price

The XRP chart is still extremely pessimistic despite the on-chain strength. Once more, the price rejected the descending-channel midline and was unable to maintain momentum above about $2.15. Selling pressure hit immediately afterward, dragging XRP back toward the lower boundary of the pattern.

The EMAs reinforce the story:

- 50 EMA is below 100 EMA (mini-death cross recently verified).

- Price below all major moving averages.

- RSI is barely maintaining its mid-40s, momentum is lacking.

Short-term price volatility persists. Falling out of the channel again would open the door to $1.90-$2.00. But in the medium term, the network's activity spike is meaningful; networks rarely expand this aggressively without eventually pulling the asset upward.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov