Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

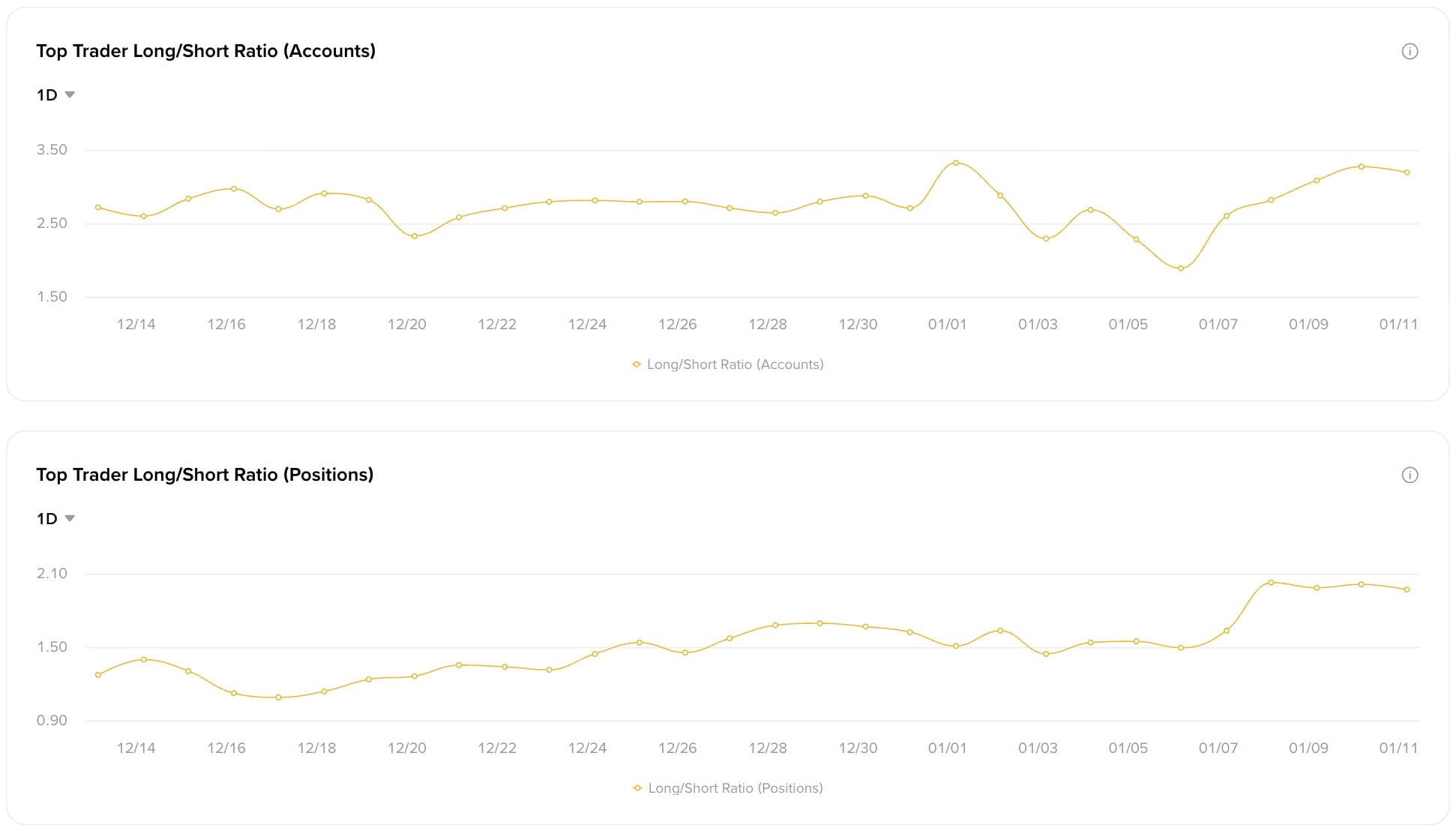

XRP is hot again after Binance's top trader metrics revealed a heavy bias: 76.16% of the best accounts are holding long, with only 23.84% still betting against it. The long/short account ratio has shot up to 3.19, which is one of the most bullish positions in months.

Even more importantly, the position-based ratio also climbed to 1.97, showing that this is not just a crowd of sidelined bulls — these accounts are actually sizing up on XRP.

Just a few days ago, XRP bounced off the $1.80 zone and got back up to the $2.10 level, but the price is still pretty low compared to the early January time when it almost broke through to $2.40.

While the chart still shows some selling pressure, derivatives sentiment has flipped decisively, and that rarely happens without reason. This is not a neutral crowd hoping for direction — it is a packed bus heading north.

Why long XRP?

Partly due to short-side exhaustion. Funding rates are cooling, and the market has digested a month-long altcoin cycle. While Bitcoin consolidates, high-beta assets like XRP are attractive candidates for catch-up plays, especially if the ETF narrative sustains.

But a ratio of almost 3.2 long/short often suggests local overconfidence or front-running. In the past, there were similar imbalances before XRP's big moves in March 2021 and November 2023.

If things keep going the way they are, we might see a rise to somewhere between $2.80 and $3 before the end of the month, as long as the current pace does not slow down around the $2.40 mark.

For now, it is plain to see that whales are loading up, and they are doing it quickly. If $2.40 cracks, January has a chance of a final run.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin