Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The crypto market opens with a return of risk after Nvidia delivered numbers that forced traders to reassess their appetite. Bitcoin is out of its $90,000 trap, Ethereum gets a potential structural catalyst through BlackRock’s staked ETH filing, XRP enters a fresh staking discussion that may redirect institutional attention and SHIB gains a new derivatives route through Gemini.

TL;DR

- BlackRock files for iShares Staked Ethereum ETF, RippleX revives XRP staking debate.

- Bitcoin rebuilds its case for a run toward $112,000 on the Bollinger Bands and seasonal flows.

- Gemini lists Shiba Inu (SHIB) futures with leverage up to 100x.

BlackRock files for staked Ethereum ETF as Ripple pushes XRP staking

BlackRock, managing about $11 trillion, entered another upgrade phase of its crypto product suite by filing for the iShares Staked Ethereum ETF in Delaware. The logic behind it is that institutional clients want exposure not only to Ethereum itself but to the native yield mechanics tied to its proof-of-stake system.

The filing positions BlackRock to capture inflows that currently move through liquid staking protocols, centralized staking pools and wrapped-yield products, but without the operational complexity that most funds avoid.

The timing overlaps with an internal revival inside RippleX, where developers began outlining the conceptual path toward native XRP staking. Ripple's dev arm is examining whether staking can strengthen network security and utility without rebuilding its core consensus design.

Ripple CTO David Schwartz offered two structural models:

- Dual-layer validator system with distinct roles for block production vs. stake validation.

- Fee-based structure that incorporates zero-knowledge proofs for securing the staking path.

This parallel between BlackRock’s staked ETH product and Ripple’s staking research triggered speculation about XRP’s position in the institutional ETF queue. BlackRock already dominates flows in spot Bitcoin (IBIT) and Ethereum (ETHA).

If the firm ever decides to push an XRP vehicle, staking would become an obvious narrative. Investors prefer assets that produce yield, and a native staking mechanism would place XRP in the same functional bucket as ETH for the first time.

Bitcoin aims for $112,000 as Bollinger Bands show open runway for Santa Rally

Bitcoin is becoming attractive again, breaking free from the multiday trap around $90,000. The trigger was simple: Nvidia’s earnings beat forced global risk to normalize. With the stock printing numbers above expectations, traders rotated back into high-beta assets, which lifted BTC and kept sellers from building new downside pressure.

The question now is whether Bitcoin can recover the 30% drawdown it suffered since early October. The seasonal window suggests that the asset could mirror previous late-year recoveries. The market often moves into a pre-NYE accumulation phase known as the Santa Rally and BTC has historically matched that pattern when macro conditions did not deteriorate.

The Bollinger Bands give a numerical map for such a push. The midband sits at $100,383 and the upper band at $112,000. Price trades on the lower edge of the range, which indicates available upside space without breaking trend classification. The market does not require extraordinary inflows to reach the midband; it only needs consistent bid formation without large-scale selling.

Gemini lists Shiba Inu (SHIB) on its futures market

Gemini expanded its derivatives portfolio by listing futures on major meme assets, including Shiba Inu (SHIB). Eligible traders now gain access to up to 100x leverage, making SHIB one of the highest-beta instruments in the U.S.-regulated perimeter.

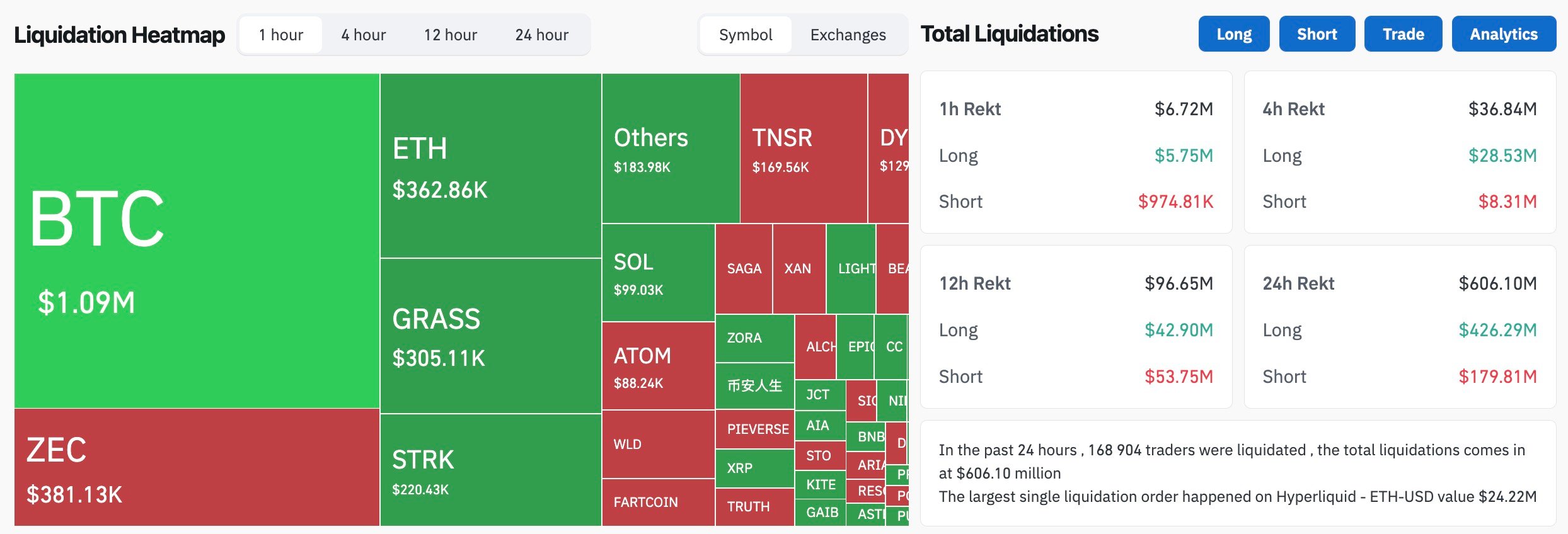

This comes at a moment when the derivatives market remains punishing. CoinGlass reports $603.34 million in liquidations over the last 24 hours, with $423 million coming from long positions alone. Perpetual futures remain the primary source of forced selling during intraday volatility bursts. SHIB’s addition to Gemini introduces more volatility flow into the asset but also raises the liquidation risk across retail-heavy positions because of the high leverage offered.

For SHIB itself, listing on a major U.S. exchange’s futures segment increases its liquidity footprint and makes it more visible to traders running systematic strategies. Given SHIB’s reaction profile, the new derivatives route can only increase both upside surges and forced-downside cycles.

Crypto market outlook

Future direction depends on whether yesterday’s rebound can flip into a sustained bid or fade back into the month’s lower bands.

Bitcoin (BTC): Stuck around $91,800 with resistance at $92,500-$94,000 and support at $90,000, then $88,300.

Shiba Inu (SHIB): Stable near $0.00000865 with pressure at $0.00000890-$0.00000900 and support at $0.00000840, then $0.00000812.

XRP: Trading at $2.12 with a ceiling at $2.20-$2.24 and support at $2.05, then $2.00.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov