Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Crypto markets open Dec. 16 with their attention split between U.S. labor data expectations and exchange-driven liquidity updates. Price action is secondary. Listings, trading pairs and derivatives coverage are setting the tone.

TL;DR

- Binance adds XRP/USD1 spot trading.

- Coinbase Derivatives lists SHIB under U.S. perpetual-style futures.

- Cardano-backed Midnight (NIGHT) reaches the top 100 by market cap.

Binance opens new XRP dollar route

Binance has confirmed that it will open spot trading for DOGE/USD1, SUI/USD1 and XRP/USD1, but the real story here is USD1.

USD1 is a fiat-backed digital asset designed to maintain a strict 1:1 peg with the U.S. dollar, launched in April 2025 through World Liberty Financial, a Miami-based fintech company. The stablecoin is issued and legally managed by the BitGo Trust Company in South Dakota.

USD1 is not a small or experimental stablecoin, with a market capitalization of $2.71 billion and a daily trading volume of $880.7 million — numbers that place this digital dollar firmly in the category of actively used dollar proxies rather than passive settlement tokens.

For XRP, the new pair changes the access mechanics. XRP/USD1 gives traders another direct route to the dollar equivalent without going through legacy stablecoins. During macro-sensitive sessions, traders gravitate toward the cleanest on-ramps and off-ramps. Binance just added one more for XRP, tied to a stablecoin that already facilitates close to a billion dollars in transactions daily.

This is not leverage. It is not derivative. It is spot liquidity expansion at the base layer. This matters more than it appears when positioning tightens and capital becomes selective.

Shiba Inu (SHIB) secures fresh Coinbase listing

Coinbase made its own move by announcing that U.S. perpetual-style futures are now live on Coinbase Derivatives for a bunch of altcoins. The list includes Shiba Inu (SHIB) as well as Avalanche, Bitcoin Cash, Cardano, Chainlink, Dogecoin, Hedera, Litecoin, Polkadot, SUI and Stellar.

These contracts are offered through Coinbase Derivatives and are available to both retail and institutional traders via approved Futures Commission Merchant partners listed on Coinbase's derivatives platform. Trading runs 24/7, so there is no time-based friction like you still see on traditional futures markets.

For SHIB, this is a meaningful step. It puts the token in a regulated derivatives environment where exposure can be built, hedged, reduced or neutralized without touching offshore venues. The Shiba Inu coin has always had liquidity. What it lacked was consistent access to U.S.-linked derivatives infrastructure.

This listing will not make SHIB a blue-chip asset. It makes it seem like a tradable instrument for desks that care about compliance, margin structure and execution, rather than memes. That change usually is not seen in spot fireworks but in more consistent derivatives activity during weeks with a lot of macro news.

Coinbase’s decision signals one thing clearly: SHIB volume and participation are no longer treated as temporary.

Cardano's "new ADA" reaches top 100

While exchanges were making it easier to trade, Cardano's ecosystem hit a major visibility milestone backed by real market data. Thus, Midnight (NIGHT), the token linked to Cardano's privacy-focused network and dubbed the "new ADA," made it into the top 100 on CoinMarketCap. It is currently ranked around 61.

Of course, Charles Hoskinson, the main man in the Cardano ecosystem, highlighted the achievement with a repost like a proud father.

As of now, NIGHT is trading at $0.0566, down 10.4% over the past 24 hours. Even with the pullback, there is still a lot going on. The trading volume is at $1.6 billion, which is over 220% higher than the day before, and the market capitalization is holding near $940 million.

The big jump in volume shows that Midnight's entry into the top 100 was driven by participation, not thin liquidity. The volume-to-market-cap ratio is 177%, one of the highest readings among assets in this range, pointing to aggressive turnover even as the price retraced from recent highs. The price correction, in the meantime, shows post-breakout digestion, not a collapse, with the price stabilizing after a sharp expansion phase.

Midnight is a programmable privacy network built on zero-knowledge proofs, a dual-ledger architecture and selective disclosure tooling. It is designed for enterprise use cases, identity frameworks and compliant DeFi rather than short-term narrative trading.

One thing to watch is if Midnight's rise can help the Cardano ecosystem evolve beyond a single-chain structure into a multinetwork stack.

Crypto market outlook

Tuesday trading starts with the market checking whether new listings and trading routes can translate into actual demand amid important macro releases. Infrastructure has expanded, but price action across large names remains under pressure. The next sessions will show if access upgrades attract fresh volume or remain cosmetic. For now, traders are reacting to levels, not announcements.

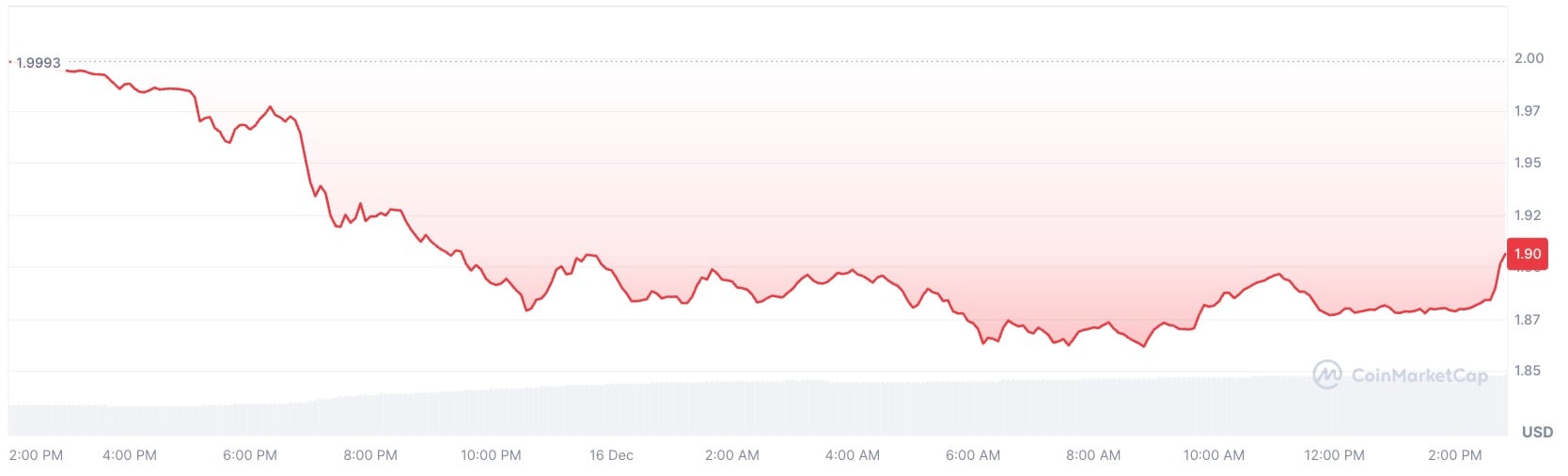

- XRP: Failed at $2 earlier this week with a base forming after a drop from $2.10, and upside capped near $2 without USD1-driven volume.

- Shiba Inu (SHIB): Lost $0.0000082-$0.0000083 zone with sequence of lower highs, needs bids above $0.000008 to stop compression.

- Midnight (NIGHT): Down around 10% on the day after getting rejected at $0.07, now holding focus on $0.055 as near-term support.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov