Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The overall market mood is cautious after yesterday’s liquidation wave flushed out $824,470,000 in leveraged positions, leaving crypto market sentiment rattled but not broken. Bitcoin remains stuck at $110,258, while altcoin capitalization, excluding BTC and ETH, sits at exactly $1 trillion, even after a 5.48% monthly drop.

The Fed confirmed a 25 bps rate cut with QT set to finish in December, feeding a slow liquidity return narrative. Yet the greater weight on traders today is immediate flow: SpaceX wallets moving again, XRP securing a Nasdaq ticker and U.S.-China headlines driving chaotic volatility across all markets — and crypto, of course.

TL;DR

- SpaceX shifts another 281 BTC worth $31,280,000.

- XRP ticker changes to XRPN on Nasdaq, backed by $1,000,000,000 in fresh capital.

- U.S.-China pact sparks $824,470,000 liquidations, wiping out overleveraged bulls.

- Bitcoin in limbo at $110,000 with $100,000 support and $120,000 resistance.

Bitcoin news: Elon Musk's SpaceX wallets on the radar again as $31,280,000 BTC move

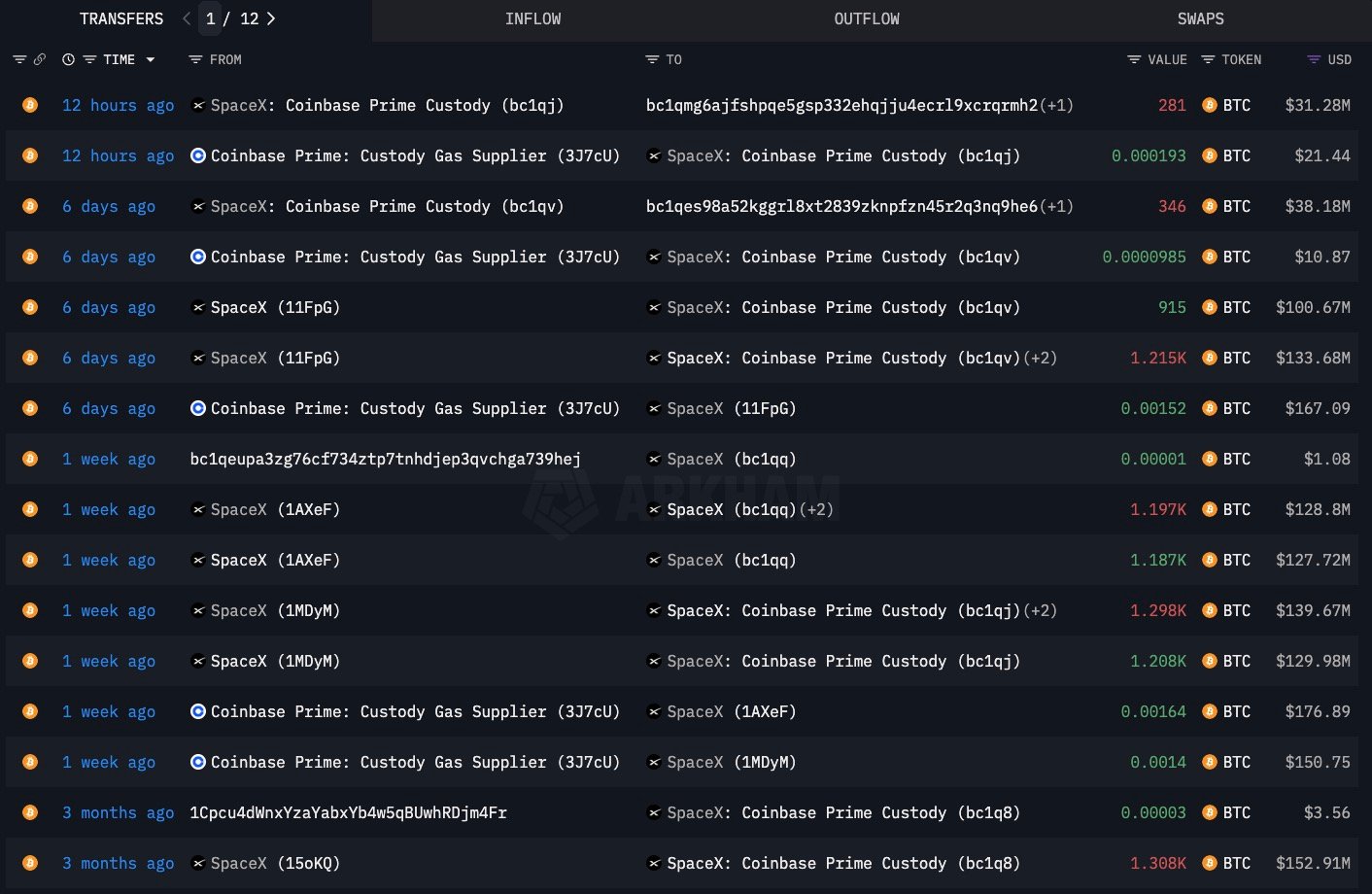

Data from Arkham shows that SpaceX, led by Elon Musk, has transferred 281 BTC worth $31,280,000 to a fresh new address, continuing a sudden streak of mysterious moves. Earlier this month, 2,130 BTC and 2,495 BTC were transferred, and July marked the first transfer in three years when 1,308 BTC worth around $153,000,000 were transacted.

Whether it is a change in the money management team, a mix of investment vehicles or a stress test for liquidity, the big question is: why now?

On the charts, Bitcoin is at $110,258, with this month's range defined by a high of $126,195 and a low of $102,329. The $100,000 psychological mark and $81,697 breakout level are supporting it. But if the price keeps pushing past $120,000, it could open up the door to reach around $130,000.

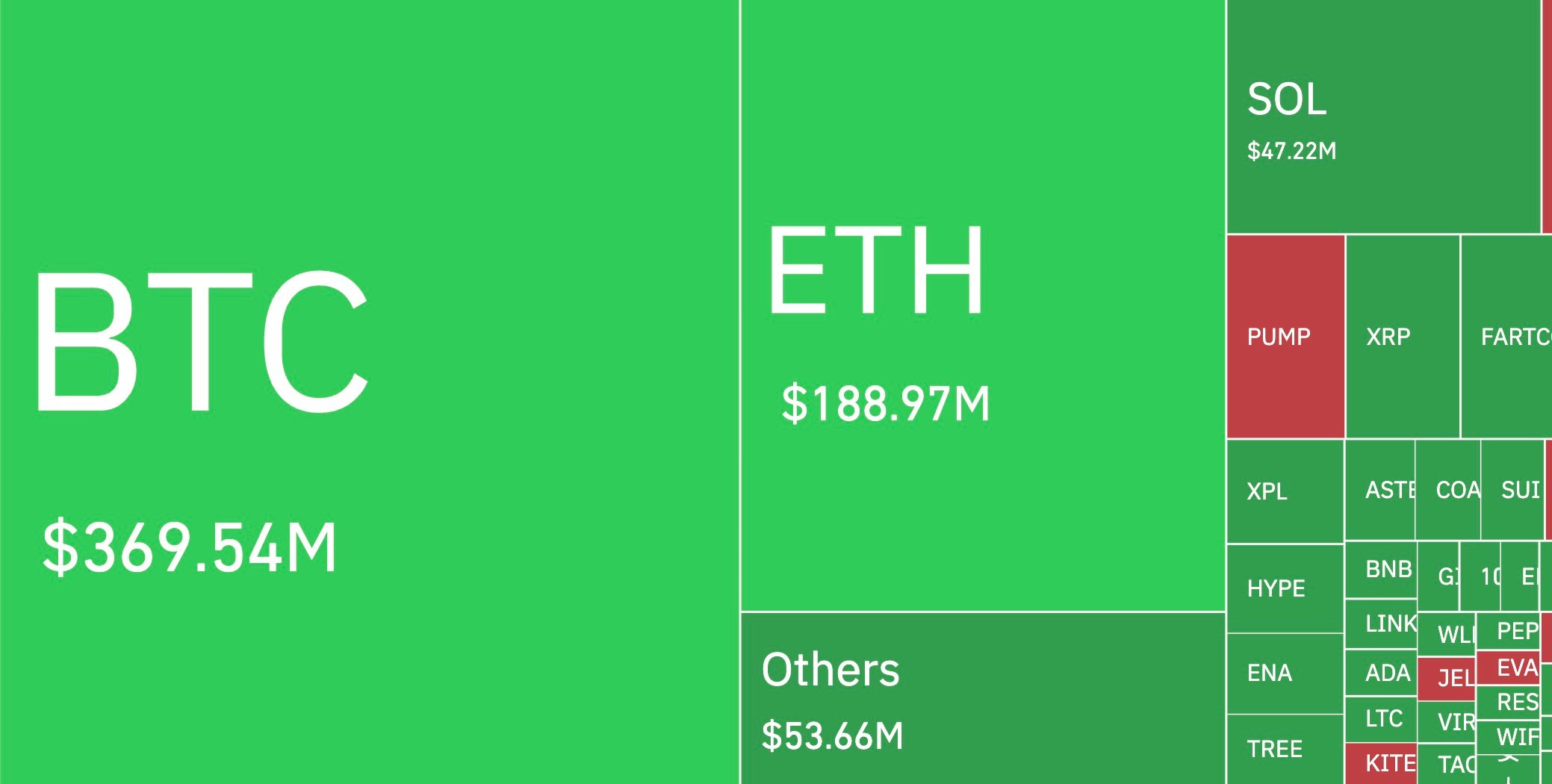

Liquidation data confirms Bitcoin as the main driver of the market, erasing $369,540,000 in 24 hours. Most losses were absorbed by longs, defusing the overheated bullish leverage, a setup that prepares the market for another attempt higher.

XRP news: Nasdaq debut gives XRP ticker new identity

Arrington XRP Capital's Armada Acquisition Corp. II has officially changed its Nasdaq identity. Its Class A shares now trade as XRPN, units as XRPNU and warrants as XRPNW. This follows a merger with Evernorth Holdings that raised over $1 billion to purchase XRP on the open market, an institutional XRP treasury model unprecedented in the crypto industry.

Michael Arrington described the move as a sign of strong belief in the XRP ecosystem, citing integrations with Hidden Road, GTreasury and Standard Custody as examples. By linking a listed equity vehicle directly to XRP flows, the ticker change provides the asset with new exposure to regulated markets.

Price action is less dramatic: XRP is trading at $2.55, down 3.28% for the week. Resistance sits at $2.71, with support between $2.40 and $2.45.

Only a clean break above $3 will allow for larger movements. Failure to defend $2.40 could lead to a steeper decline.

$824,470,000 liquidations: U.S.-China tariff deal shocks leveraged traders

The markets were caught off guard by liquidation cascades after a one-year U.S.-China trade pact on rare earths and minerals was confirmed by both parties.

Tariffs were cut from 57% to 47%, and China signaled openness to discussions about chips and agricultural imports. This macroeconomic relief spilled over into risk assets, triggering forced unwinds across the crypto market.

Bitcoin led the way with $369.54 million liquidated, followed by Ethereum with $188.97 million and Solana with $47.22 million. Altcoins as a group lost $53.66 million, as per CoinGlass.

Overall, longs absorbed $656,09 million, while shorts lost $168,16 million. This imbalance shows how crowded long positioning had become. Once again, crypto did not react to native catalysts but rather to global trade flows, proving its dependency on macro.

Evening outlook

Heading into the U.S. evening session, four pivots dominate:

- Bitcoin: Needs to hold $110,000 or risk a drop toward $100,000 — down 10%.

- XRP: Nasdaq debut narrative vs. fragile $2.40-$2.70 technical corridor.

- Altcoin market cap: Defending $1,020,000,000,000 or slipping to $900,000,000,000.

- Macro backdrop: Follow-ups on commodity clauses and Fed December rate cut probabilities.

With $824,470,000 in leverage flushed, markets enter the evening with lighter positioning. That leaves spot flows and headline catalysts free to dictate the next leg.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov