Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The final trading day of the week turns into the most punishing session of November as Bitcoin’s relentless slide locks in an abnormal low at $82,000, triggering a violent liquidation chain across all major assets. Nearly $2,000,000,000 in long positions evaporated in 24 hours, according to CoinGlass, forming one of the largest destruction waves since early October.

TL;DR

- BTC tags an exact $82,000 bottom after losing over $10,000 this week.

- XRP falls to $1.8467, but monthly Bollinger Bands keep bullish bias alive.

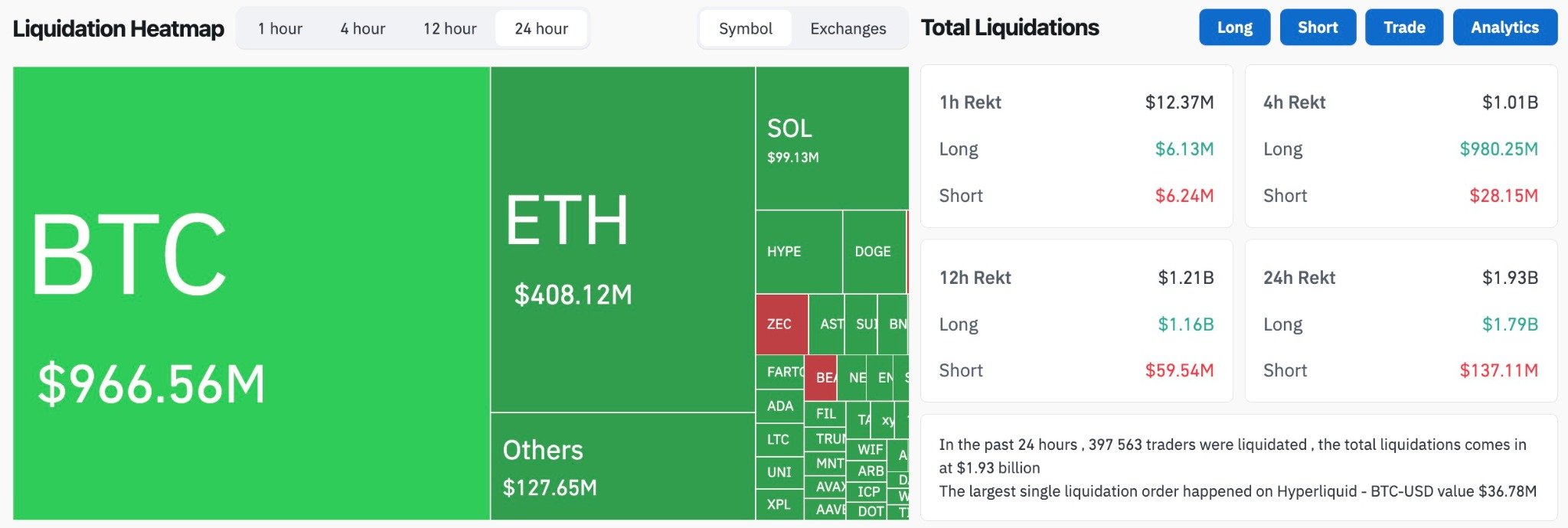

- Liquidations hit $1.93 billion in 24 hours, almost entirely long-sided.

Bitcoin finds abnormal $82,000 bottom

Since the start of the week, Bitcoin has lost more than $10,000, but the most brutal moment came this morning. Within a single hour, BTC collapsed by 5%, slicing directly into a mathematically perfect $82,000 bottom — not a cent less, not a cent more, across Bybit spot and Binance futures.

Such round-number inflection points rarely appear with this precision, which makes the wick notable rather than accidental. The five-minute chart shows a rapid cascade from $85,000 into the mid-$83,000s followed by a vertical flush into $82,000. This level held on first contact, indicating that either a large resting bid absorbed the dump or the liquidation engine exhausted itself at that exact depth.

Whether this becomes a textbook final capitulation wick or simply the midpoint of a deeper slide depends on immediate recapture attempts. A return to the $84,000-$85,000 area would signal market stabilization.

The weekly context remains severe. Traders face a Friday close with BTC stuck near the bottom of the multiweek downtrend. The Oct. 10 shock continues to echo across leverage markets, and today’s flush looks like its delayed aftershock.

XRP loses $2, but there is a silver lining

XRP finally slipped under the symbolic $2 level during the morning flush, hitting $1.8467 at peak stress. The move was expected given Bitcoin’s fall toward $82,000, though the magnitude stayed relatively moderate compared to BTC’s collapse.

The key point comes from XRP’s monthly Bollinger Bands, which remain structurally bullish even under pressure.

Despite the red candle, XRP did not break the midband. The price remains in the upper Bollinger region, meaning broader trend classification has not deteriorated. The asset still needs to lose another 10% to breach the structural threshold, and that has not happened.

Volatility expanded big time on the monthly chart, but the absence of a midband breakdown makes this pullback a correction, not a trend reversal. If BTC stabilizes above $82,000, XRP’s rebound path begins immediately at the $2-$2.10 resistance pocket.

$2 billion liquidation tsunami stuns crypto market

CoinGlass confirms $1.93 billion liquidated in 24 hours. BTC alone saw $966.56 million liquidated. ETH added $408.12 million. Solana contributed almost $99 million, while smaller assets filled the remaining $127 million. The BTC/ETH concentration tells the entire story: majors snapped first, and everything else followed.

The largest single liquidation came on Hyperliquid, where a whale long in BTC/USD was erased with a $36.78 million order. But the carnage extends beyond futures.

Twitter circulates claims of multiple crypto funds collapsing under the weight of the October wipeout and November continuation. Allegedly, large players are "liquidating assets worth billions" to cover internal losses. Confirmation is absent, yet the price action aligns with forced deleveraging.

At the same time, Bloomberg reports that JPMorgan sees a high probability of Strategy (MSTR) being removed from the MSCI and Nasdaq indices due to digital assets being over 50% of its balance sheet. That scenario may cause $2.8 billion in capital outflows from MSTR. A decision is expected on Jan. 15, 2026.

Crypto market outlook

Friday’s session becomes a leverage-clearing event, and future direction depends now on whether the intraday stabilization above the mid-$83,000s turns into sustained bidding or slips back into the week’s lower stress zones. The $2 billion liquidation wave resets positioning across the market, and the weekly close will tell whether the worst is behind us or the next leg lower will start immediately.

Bitcoin (BTC): Trading around $83,800 with pressure at $85,000-$86,500 and support at $82,000, then $79,500.

XRP: Sitting near $1.94 with a ceiling at $2.00-$2.10 and support at $1.86, then $1.74 (monthly midband).

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov