Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

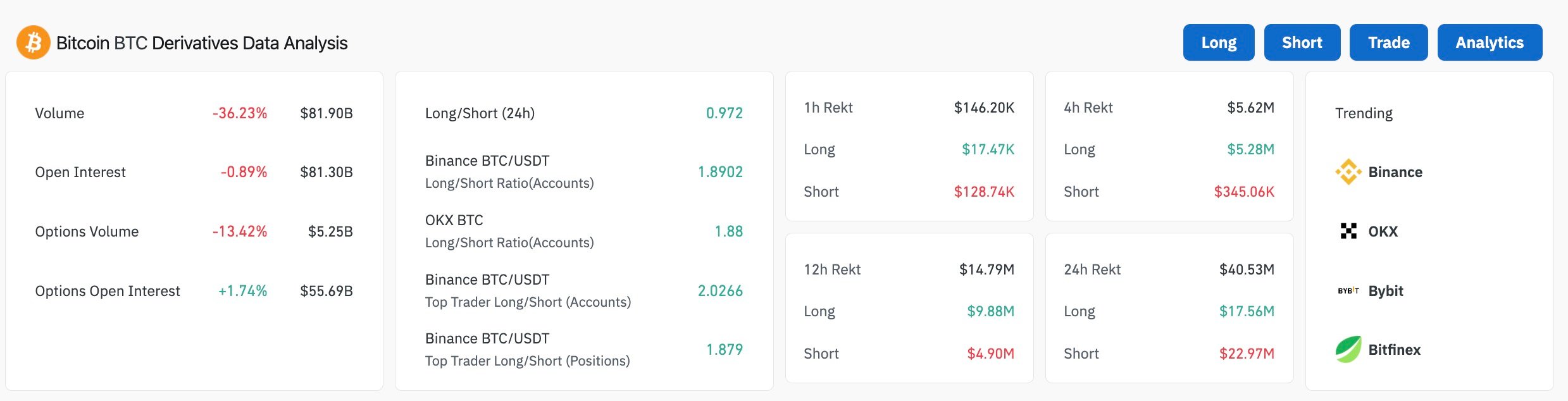

Bitcoin’s latest derivatives data by CoinGlass shows an unusual tilt in liquidations, with the past four hours producing a total of $5.62 million in positions that received margin calls. The split is the main thing here, as about $5.28 million in longs were squeezed out compared to just $345,000 in shorts, which works out to an imbalance of as much as 1,530%.

This shakeout was caused by Bitcoin moving between $111,000 and $111,300, with the price failing to hold early gains and sliding back toward the lower band of that range. A lot of accounts that were ready for a rebound were hit when they were not expecting it.

The thinness of the trading compared to how much was liquidated shows that there is a lot of overtrading on the market right now.

More numbers

It is interesting that account ratios on the major exchanges do not show the pain that longs just took. Binance's BTC/USDT ratio is close to 1.89, OKX has a similar 1.88 and top trader accounts on Binance hold more than twice as many long positions as shorts.

That positioning gap is what leaves room for liquidations to snowball quickly whenever the price does not go as expected.

Right now, Bitcoin is sitting close to $111,140 — almost unchanged in general — but the data behind it suggests leverage is still skewed heavily to one side.

If things stay the same, short sales might keep having a major impact on long positions even if the spot price does not change much.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin