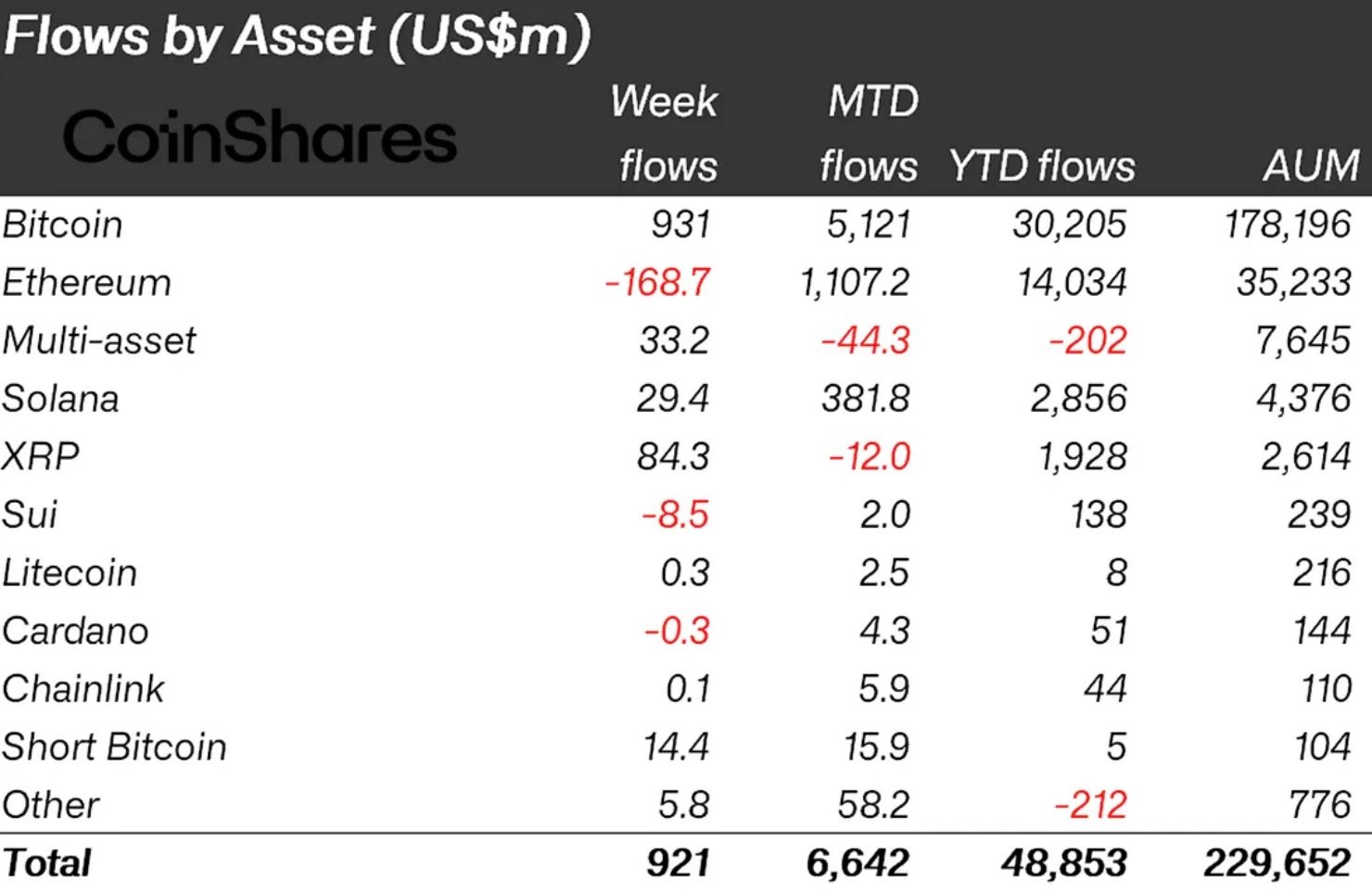

According to CoinShares, digital asset ETPs pulled in $921 million last week, with Bitcoin, as expected, taking the lion's share at $931 million, showing that even in weeks of fragmented macro signals, BTC remains the default allocation for professional managers seeking immediate market exposure.

The more interesting line, though, is XRP pulling in $84.3 million - almost 11% of the total - with speculation over a U.S. spot ETF putting the spotlight on the token's institutional future.

XRP's YTD number is now at $1.9 billion, making it one of the top-tracked single-asset products, despite regulatory issues. For comparison, in the same week Ethereum had its first outflows in over a month, losing $169 million. Solana, in the meantime, posted $29 million, keeping its year-to-date total above $2.8 billion.

Thus, XRP gained almost three times more inflows than SOL last week but still lags behind on the yearly chart.

When XRP ETF?

ETF filings remain the key drivers behind the crypto investments, in product form too. According to Bloomberg's Eric Balchunas, there are 155 active applications across 35 assets, with XRP having 20 of them. None of them received a full-fledged greenlight yet, and the reason is the U.S. government shutdown.

Analysts like Nate Geraci say the situation is like a dam holding back approvals. Once the shutdown ends, XRP's $1.9 billion in inflows this year might not be a peak but the groundwork for a bigger institutional leg.

The fact that ETP volumes touched $39 billion last week against a $28 billion average underscores that institutional capital is not just circling but actively positioning, waiting for clarity.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov