As noted by VanEck's Matthew Sigel, Bitcoin's long-term holders have turned into net accumulators. This likely means that their largest selling spree since 2019 is likely over.

Earlier today, the leading cryptocurrency spiked to an intraday high of $89,201, CoinGecko data shows.

A major sell pressure event

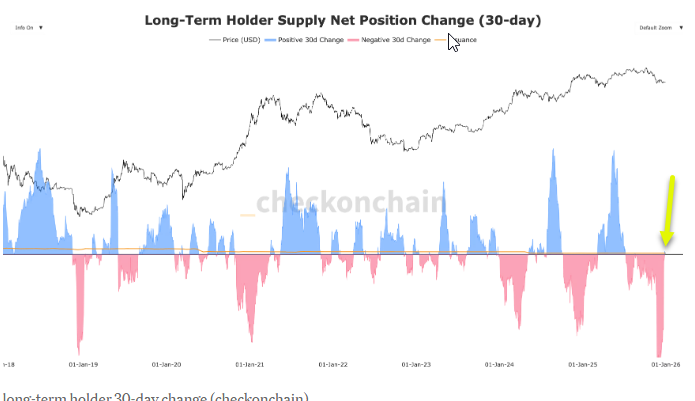

The chart shared by Sigel measures the 30-day change in the supply held by Long-Term Holders. In on-chain analysis, an LTH is typically defined as an entity that has held coins for 155 days or more.

When the bars are blue and above the zero line, LTHs are buying and locking away coins. This usually happens during bear markets or price dips. Conversely, when the bars are red and below the zero line, LTHs are selling their coins into the market. This usually happens during bull markets when prices are high.

LTHs tend to do the opposite of the retail crowd. They buy when everyone is fearful and sell when everyone is greedy.

The arrow indicates that the period of heavy profit-taking by LTHs is essentially over. They have finished selling the inventory they intended to offload at these price levels.

When LTHs stop selling, a massive source of sell-side pressure is removed from the market. If demand remains constant or increases, there is more potential for a substantial rally since there are fewer "whale" sellers suppressing the price.

During previous cycles, a return to the zero line after heavy selling often marks a consolidation phase or a transition back into accumulation.

Bitcoin is so far down 5.19% on a year-to-date basis. Every year that the flagship cryptocurrency has had a red yearly candle, the following year has been green with an average yearly return of 124.5%.

That said, as noted by Mike Novogratz, Bitcoin bulls first would have to reclaim the $100,000 level for Bitcoin to flip bullish.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov