Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

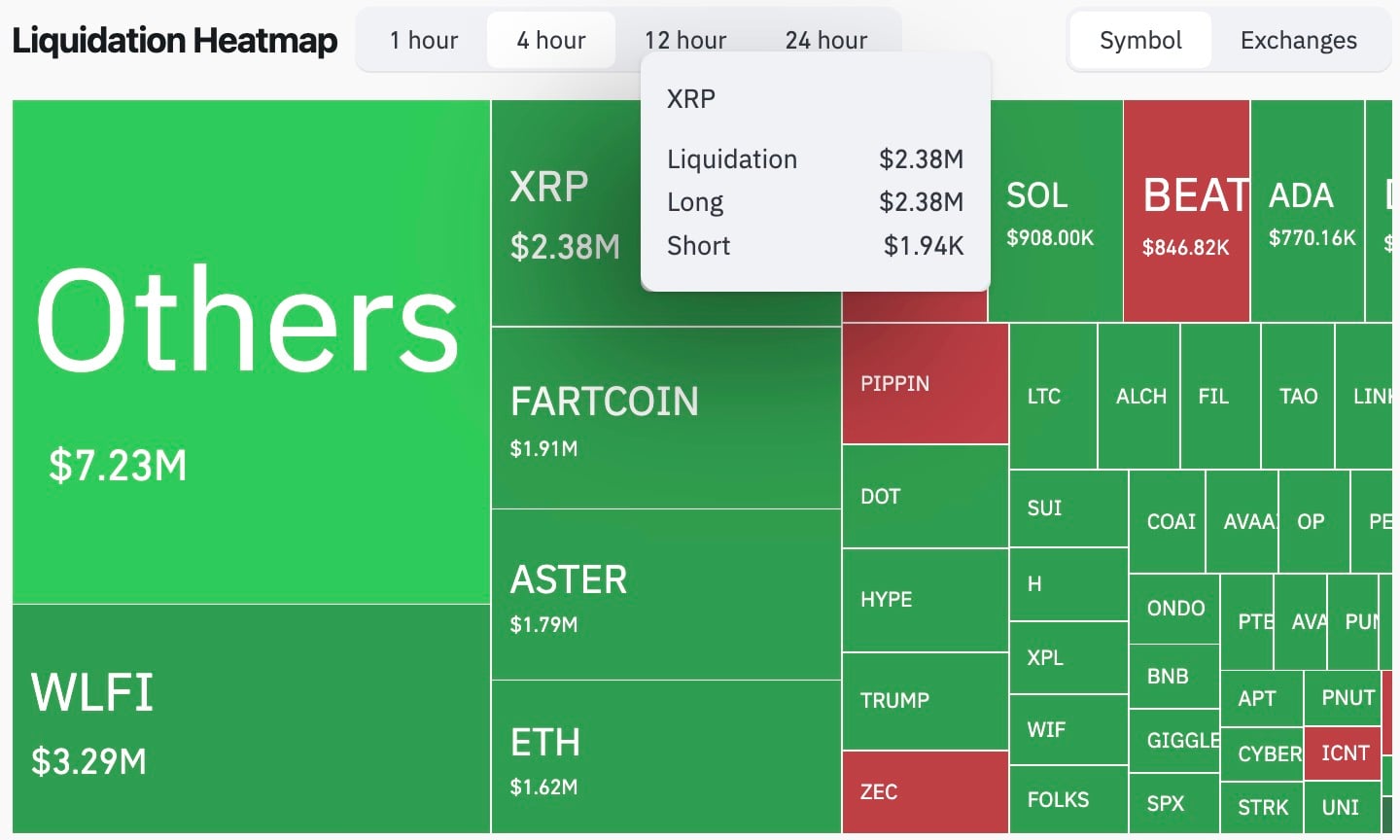

XRP just colored a liquidation heatmap on CoinGlass in a way that looks almost fake at first glance, as $2.38 million were liquidated, and it was basically all longs, with shorts at only $1,940. That split is where the headline number comes from.

Long liquidations were about 1,226.8 times larger than shorts, which converts to a 122,680% liquidation imbalance, all inside a four-hour window full of a roller coaster of price action for XRP.

The bigger heatmap reveals this was targeted — not a full-market wipeout. Others led the purge at $7.23 million, and WLFI showed $3.29 million, while XRP’s $2.38 million sat above FARTCOIN at $1.91 million, ASTER at $1.79 million, ETH at $1.62 million and SOL near $908,000.

Size matters, but the story here is the positioning: bull traders piled into upside bets, and the crypto market only needed a mild push lower to wipe them out.

What happened to XRP price today?

On Binance, XRP/USDT traded through a sell-off-and-stabilize sequence.

The price dropped from the high $1.86 area into the low $1.83s, spent time chopping in that band and then lifted back toward the mid-$1.83s. That lines up with the liquidation profile: late longs chased small bounces, stops stacked under the range, forced selling hit and once it ended, the price could rebound on regular bids.

If XRP fails to reclaim $1.85-$1.86 soon, the same long-heavy behavior can reload and set up another flush. If XRP does reclaim it, today’s long washout can leave a lighter derivatives book and give the next move more room.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin