Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

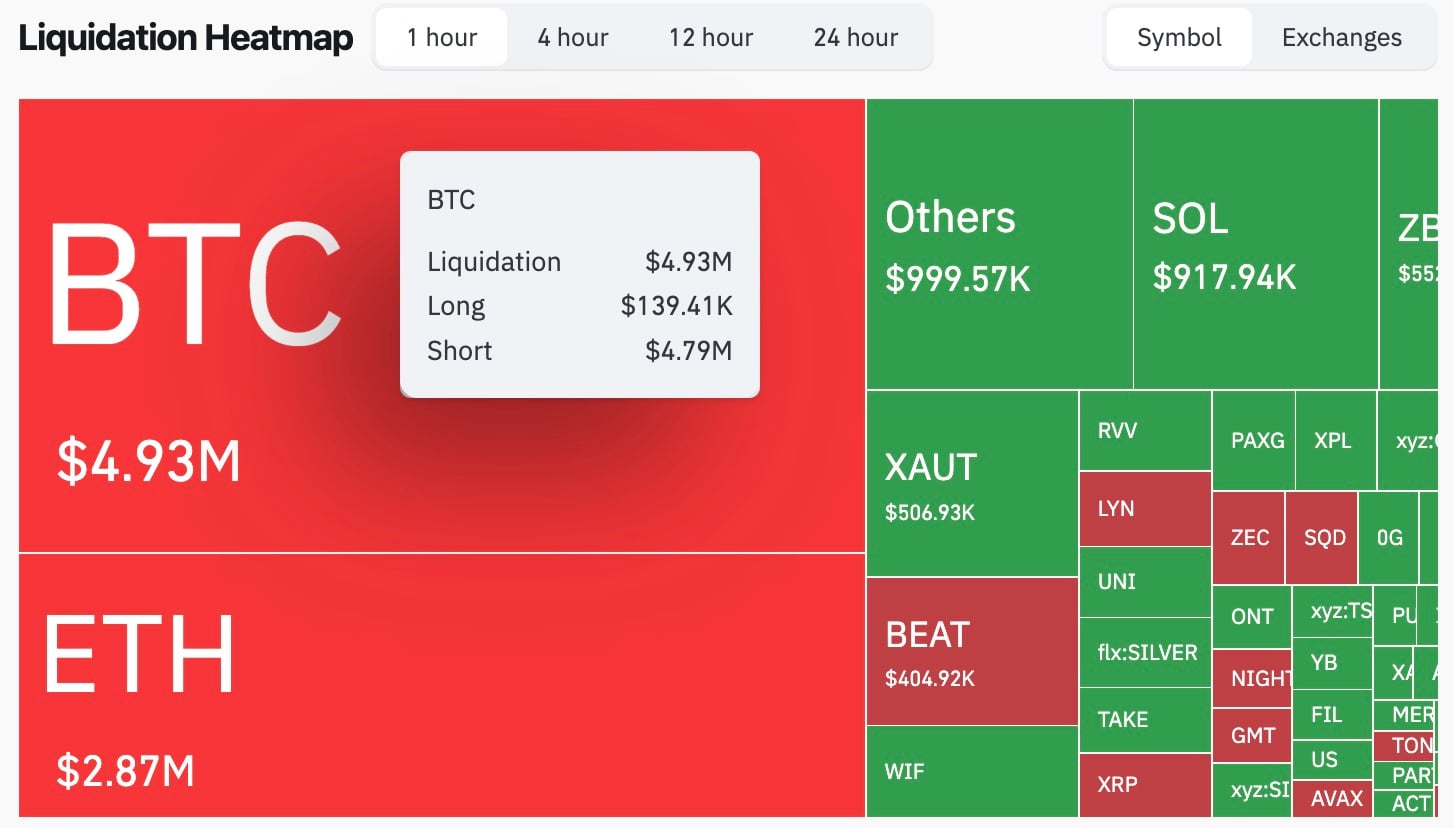

The Bitcoin liquidation data of the last hour revealed a stunning ratio, with shorts being forced out at a rate of about $4.79 million compared to just $139,410 in longs, resulting in a 3,436% imbalance. Overall, total liquidations for the leading cryptocurrency reached $4.93 million, according to CoinGlass.

While it reads like a squeeze, it happened on a market also watching its “safety trade” crack. The gold spot was down about 3.1% for the day. The rest of the metals complex looked worse: silver was down about 8.37%, platinum was down about 12.67% and palladium was down about 16.07% — all of these metals hit fresh intraday lows.

That combo is the setup that traders watch for rotation: when the winners get hit hard in a single session, the first reaction is profit-taking, and the second is capital looking for the next liquid venue that has not been the hero trade.

Gold is still up 64.9% year to date, and silver is up 132.5% even after today’s hit, while Bitcoin is down 6.5% over the same time period, the underperformer of the year, which makes BTC the obvious “catch-up” board when metals start leaking.

Is this the flippening?

The liquidation imbalance matters here because it shows positioning getting flipped in real time. Shorts in BTC were punished, longs barely got touched in that one-hour window and that kind of forced buy pressure often pulls fresh spot interest behind it.

Over the last 24 hours, 95,012 traders were liquidated for a total of $293.55 million, with longs at $153.88 million and shorts at $139.67 million. A standout hit was printed on Hyperliquid: a single BTC/USD liquidation worth $5.23 million — the kind of trade that turns a chart into a headline.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov