Thirteen years is a long time to do nothing, yet one early Bitcoin player has managed exactly that, sitting on a stash pulled from Mt.Gox back when the entire pile was barely the price of a used car, and now, with the market shaken and traders scrambling, he finally twitched as revealed by Lookonchain.

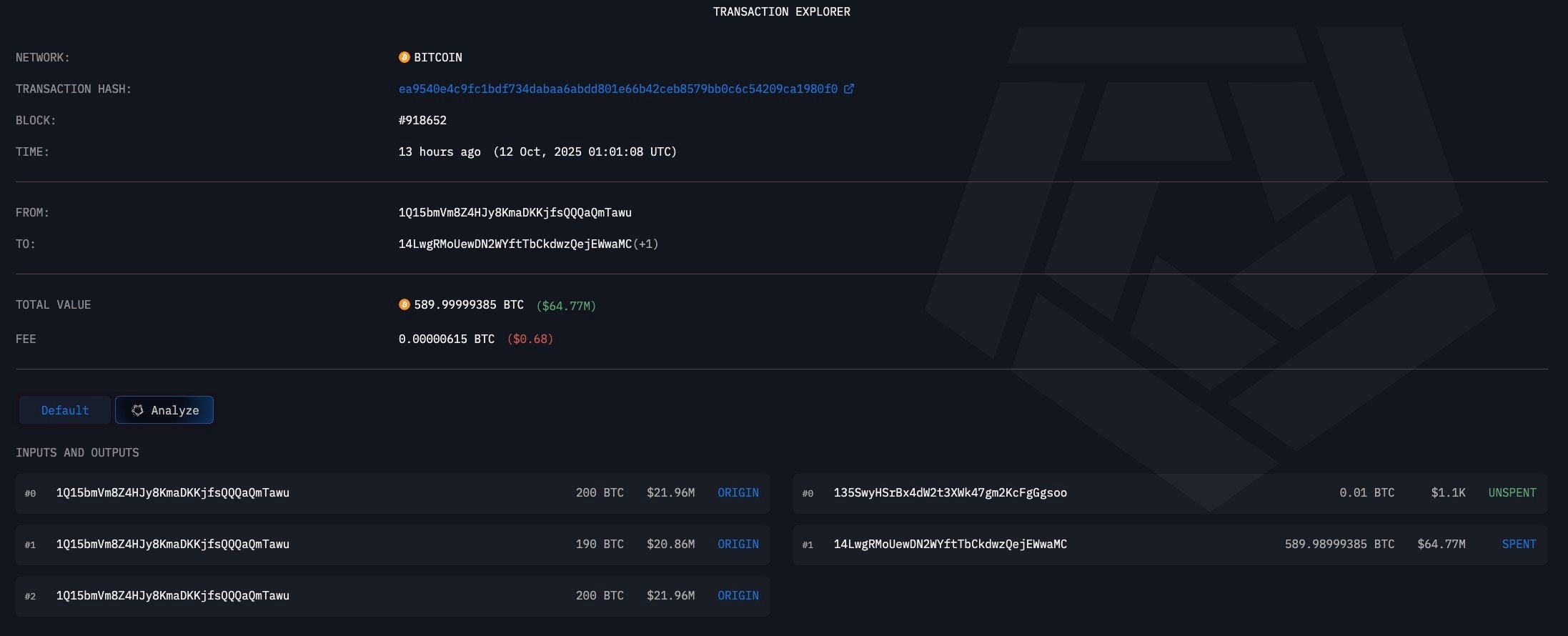

A single push sent 300 BTC — about $33.47 million — into Binance, and that’s not a paper gain, that’s the kind of move that rewrites the math on why anyone ever called this "magic internet money."

The numbers are absurd: Coins bought at $11, total withdrawal worth $8,151 back then, now marked up by more than 410,624%, and that’s before counting the remaining 590 BTC still sitting in the original cluster of addresses.

This wasn’t random wallet rotation either. Last year he shuffled 159 BTC into a new wallet and left it untouched. This time is another — actual coins in the exchange wallet, sell button within reach, history folding into the present in one click.

Bitcoin market under pressure

The market background is what is even more important here as BTC just took a violent trip down to the $100,600 zone before bouncing back toward $111,900, liquidations piling up $16 billion minimum, traders wiped big time, leverage drained.

Into that mess drops an OG with coins older than most exchanges, and whether he sells it all or just part, the signal is already out: The old supply isn’t gone, and the potential damage is immeasurable, as these coins lie dormant deep within the blockchain.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin