Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Mike McGlone, a senior commodity strategist at Bloomberg Intelligence, is raising a red flag about a metric that rarely gets as much attention as dollar prices but often tells the story earlier: how much gold one Bitcoin can actually buy.

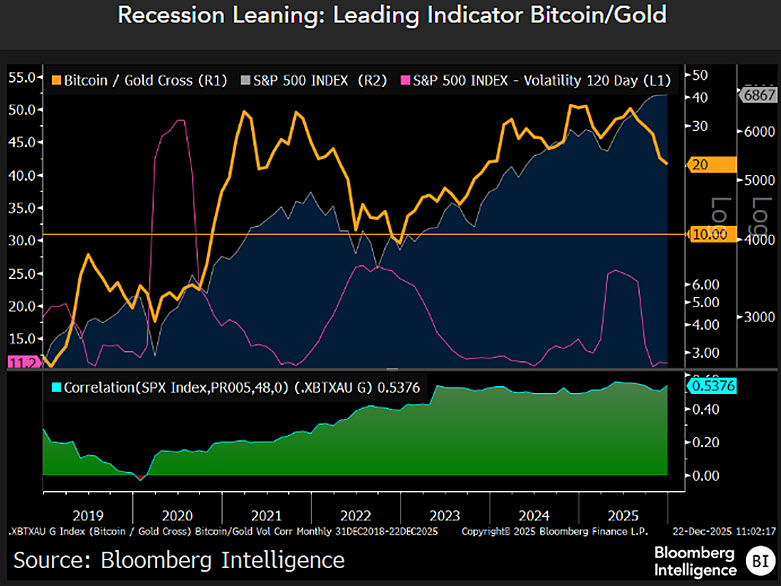

In his latest notes and charts, McGlone points to the Bitcoin-gold cross sitting near 20x on Dec. 22 and says the balance of risk is ugly. In essence, he's saying that it's more likely that Bitcoin's value will drop to 10x rather than rise to 30 times its current value in 2026.

If that happens, the purchasing power of Bitcoin compared to gold would be cut in half, even though the USD chart might not look as dramatic.

McGlone is basically saying the Bitcoin-to-gold ratio acts like an early warning chart: when recession risk rises, this ratio tends to get pressured, and right now it’s shown next to the S&P 500 and market volatility for a reason. The key takeaway from that frame is that stocks, volatility, and the Bitcoin/gold cross are still moving together more than people admit, with the correlation sitting near 0.5376, meaning it’s still one “risk-on, risk-off” package.

$50,000 for Bitcoin in 2026

Ultimately, McGlone zooms out to a “where could the lows be” sketch for 2026: core CPI easing toward 1%, oil near $40, gasoline around $2, and Bitcoin around $50,000.

He’s not claiming dates and exact targets, he’s saying that if U.S. stocks fall about 10% and stay down instead of making it back to the "north," those are the kind of cycle-level prices that often show up when markets finally reset.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov