Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Three most popular cryptocurrencies — Bitcoin, XRP and Shiba Inu (SHIB) — ended the week under visible strain as on-chain data flagged simultaneous distribution waves across the three major assets.

BTC is trading around $101,663, down 0.64% for the session and roughly 12% below October highs near $115,000. XRP is holding $2.26, while SHIB is slipping to $0.00000974. The synchronized unwind caps a volatile start to November that saw profit-taking accelerate even as spot volumes thinned.

TL;DR

- XRP profit-taking surged ~240% while the price fell 25%, signaling distribution into weakness, as per Glassnode.

- A SHIB whale withdrew 73.88 billion tokens ($721,800) from Binance in one move.

- Bitcoin OG Owen Gunden transferred 3,549 BTC ($361.84 million) to Kraken, completing an 11,000-BTC offload worth $1.12 billion.

- Broad sentiment stays risk-off heading into the mid-November CPI week.

XRP holders cash out as Glassnode flags 240% profit surge

Glassnode’s 14-day moving average of realized profit shows that XRP’s distribution phase is accelerating, even though the price has dropped. Since late September, XRP has fallen 25% to $2.30, while realized-profit volume per day has ballooned from $65 million to $220 million — a 240% increase.

Unlike in previous phases, when profit realization paralleled rallies, this phase tracks weakness. Glassnode interprets this as evidence that holders are selling into falling prices — a dynamic that historically precedes mid-cycle corrections rather than final capitulations.

The metric's surge mirrors late 2024 distribution peaks when similar volume spikes occurred just before XRP's retreats in December and July. With the coin trading near $2.26 — roughly 27% below its August high — technicals now show compression near $2.20-$2.40.

On-chain profit margins above 300% are shrinking fast, indicating momentum exhaustion among long-term holders who bought below $1 in 2024.

Shiba Inu coin billionaire empties Binance for 73.88 billion SHIB

Arkham Intelligence detected a new Binance to self-custody transfer totaling 73,880,192,530 SHIB worth about $721,800 just two hours ago.

The recipient address, "0xaECe67," now holds 171.6 billion SHIB valued at $1.68 million as well as smaller amounts of ETH.

On-chain history shows consistent inflows from Binance’s hot wallets over the past two months to this anonymous address, including:

- 48.97 billion SHIB ($500,480) on Oct. 11.

- 24.63 billion SHIB ($252,670) again on Oct. 11.

- 24.13 billion SHIB ($249,510) on Oct. 26.

Considering that the accumulation started right in time of "Black Friday" after a brutal liquidation cascade erased about $40 billion in leveraged positions, it can be argued that the whale is willingly absorbing Shiba Inu coins at low prices.

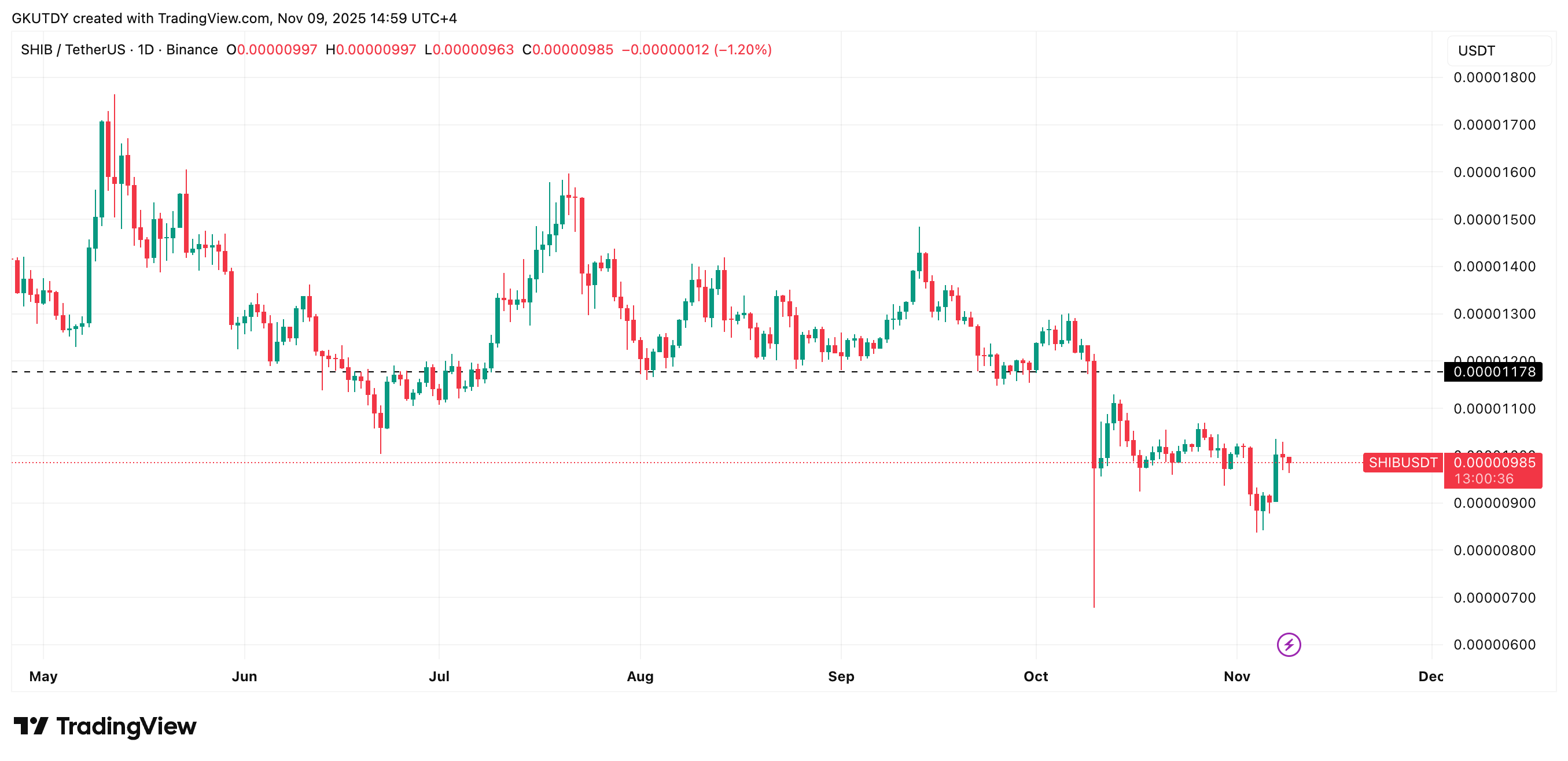

Still, SHIB’s daily chart remains rather bearish after that early-October flash crash to $0.0000072. The token trades 2.31% down today, consolidating under the $0.000010 barrier once again.

If confirmed as a whale exit from Binance, the 73.88 billion token removal could tighten exchange liquidity temporarily, but analysts warn it does not automatically imply bullish intent — many large holders have lately opted for self-custody amid regulatory scrutiny and fee shifts on centralized platforms.

Satoshi-era Bitcoin investor Owen Gunden moves $361.84 million in BTC to Kraken

On-chain watchers, including Lookonchain, spotted another colossal transfer from early miner Owen Gunden, long tracked for holding over 11,000 BTC worth $1.12 billion right now accumulated in Bitcoin’s pre-2013 era.

Eight hours ago, Gunden moved his remaining 3,549 BTC equal to $361.84 million from the address, sending 600 BTC directly to major U.S. exchange Kraken.

Earlier transactions this week included 3,600.55 BTC worth $372.14 million, of which 500 BTC also landed on Kraken. Arkham data confirms the wallet’s balance history dropping to zero — his entire 11,000 BTC archive is now emptied.

Such a dump, if realized on open books, could flood the market with spot supply exceeding 1% of daily BTC volume and trigger further downside pressure near the critical $100,000 support zone.

Bitcoin’s chart on Binance reflects unease: daily candles hover between $101,000-$102,000, threatening to retest $99,200, the recent liquidation low that erased $66 million in longs last session.

Crypto market outlook

- Bitcoin at $101,600: key support at $99,000 must hold to avoid cascade liquidations.

- XRP at $2.26: profit distribution peaks may signal short-term bottom, but structure remains bearish below $2.50.

- SHIB at $0.0000097: exchange outflows support stabilization, yet trend bias is still down until SHIB reclaims $0.000011.

- Macro watch: U.S. CPI print on Nov. 12 and Fed minutes on Nov. 14 are the next volatility triggers.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov