Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The cryptocurrency market opens on Tuesday, Oct. 14, under a triple shock: Elon Musk broke his silence on Bitcoin with a pointed rant about fiat being "fake," XRP whales unloaded a jaw-dropping 2.23 billion tokens worth around $6 billion, and China’s escalation of its trade war with the U.S. nuked leveraged longs across the board.

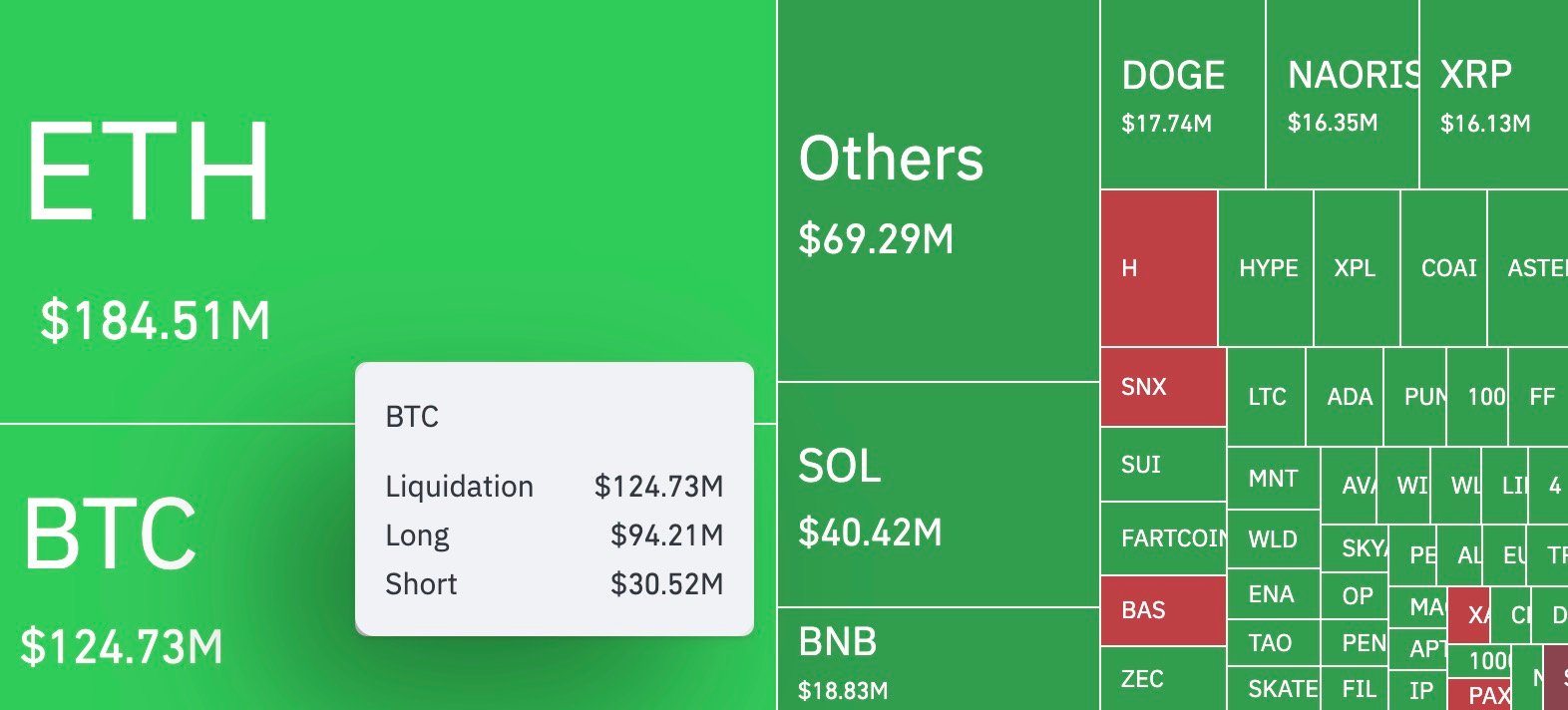

Total crypto liquidations in the past 24 hours hit $624,300,000, with Bitcoin down to $111,900, Ethereum lost $4,000 again and traders are now bracing for fresh volatility as tariffs, ETF deadlines and U.S. macro data collide in the same week.

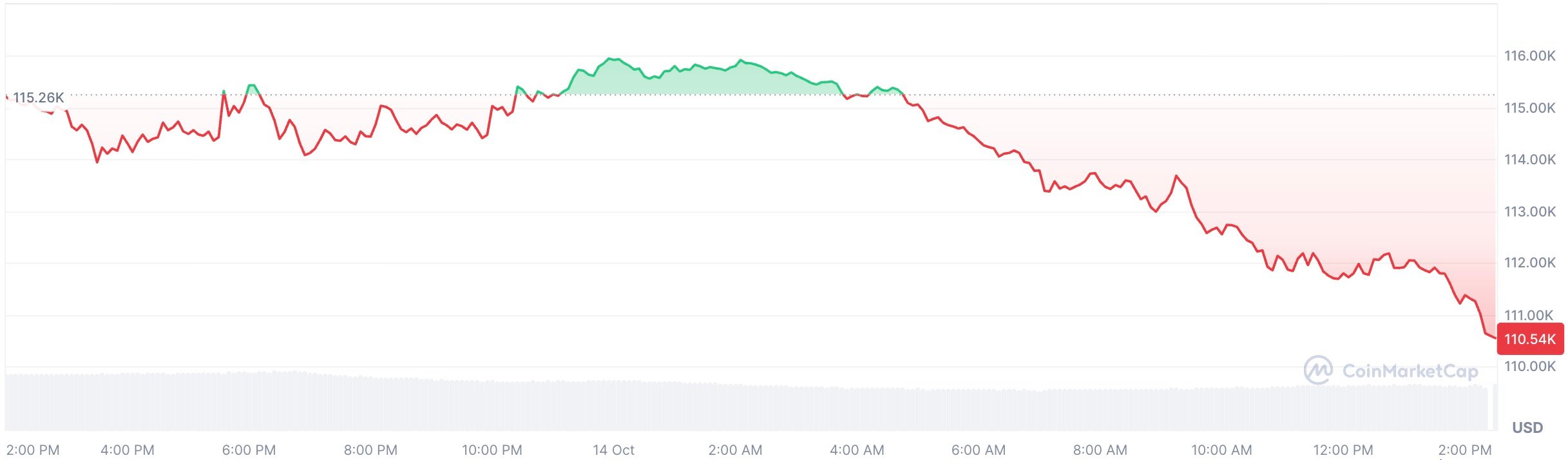

Bitcoin price struggles at $111,000

BTC is trying to hold the $111,000-$112,000 band. Binance futures show lows at $111,883 and highs at $112,172 but no bid momentum above $114,000. Yesterday’s rejection at $117,000 capped upside cleanly.

Liquidations on BTC alone totaled $124,730,000 in the past day, with longs losing $94,210,000. Order books show heavy buyers sitting at $110,800, but if that breaks, $109,500 is the next magnet. Oh, and do not forget the CME gap, which is located exactly there as well and acts like a magnet for traders.

Bulls only get breathing room if $114,500 is reclaimed intraday and $116,000 on a daily close.

China’s tariffs trigger $624,000,000 crypto market flush

Beijing’s position that hit the news this morning was straightforward — China will fight to the end on U.S. tariffs. At the same time, officials admitted that "working-level talks" are ongoing, but the new port levies are already in effect. That means that every ship, whether it carries crude oil, semiconductors or toys, now pays a double tax to the dock.

Of course, the crypto market was the first to fold under fresh headlines, as Bitcoin slid back to $111,000, Ethereum dumped under $4,000 and total crypto liquidations hit $624,300,000 in 24 hours, according to CoinGlass, with more than 211,000 traders blown out. Longs ate $432,910,000 of that, shorts $191,380,000.

It is the heaviest reset since Black Friday of Oct. 10.

Figure of the day: Elon Musk says fiat is fake, defending Bitcoin

For the first time in a long while, the world's richest man, Elon Musk, spoke about Bitcoin and turned an ordinary X thread into the day’s main market debate. He cut straight to fiat versus BTC, contrasting governments running record deficits with Bitcoin’s fixed supply tied to energy.

In particular, Musk called fiat currencies fake ones, which every government on Earth has issued at least once, but it is impossible to fake energy, and that is exactly what the main cryptocurrency is about.

The moral is simple here, as Elon Musk once again reminded everyone that Bitcoin is the one monetary system that cannot be inflated away.

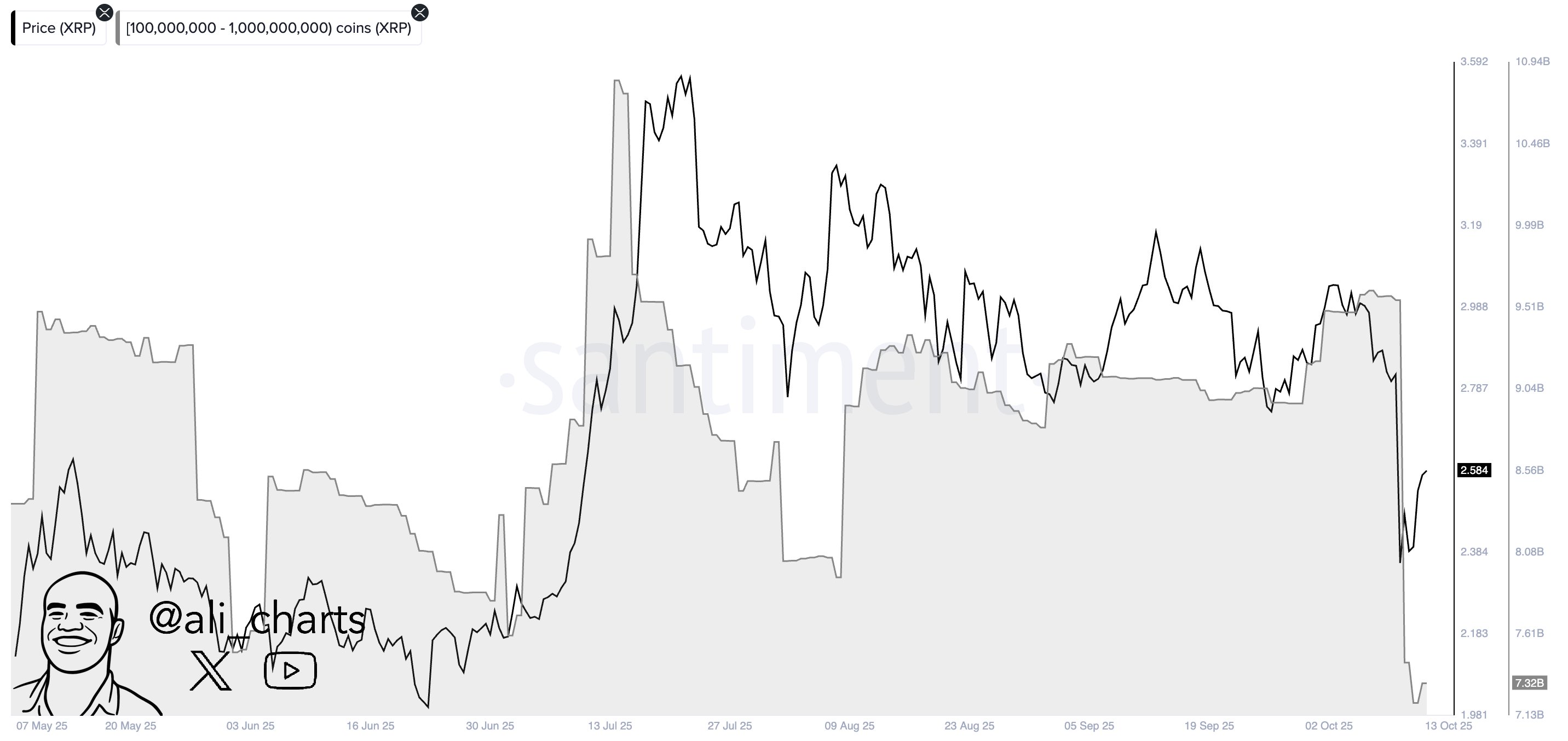

Chart of the day: XRP whales unload $6,000,000,000

Whales just hit the XRP market with one of the year’s biggest exits. Santiment shows that wallets holding between 100 million and 1 billion XRP dumped 2.23 billion coins since Friday. That is about $6,000,000,000 offloaded in just seven days.

Balances tracked on-chain dropped from about 9.5 billion XRP to 7.3 billion. The price followed; XRP fell from $2.98 to $2.38 before finding a floor at $2.58. That is a 20% drawdown absorbed while whales cashed out. With six ETF decisions coming between Oct. 18-24, pressure is not easing.

Traders now call $2.30 the must-hold level, with $2.90 as ceiling resistance.

Evening outlook

- Bitcoin: Must defend $111,000-$112,000; breakdown targets $109,500. Upside only clear if daily close reclaims $116,000.

- Ethereum: Needs to get back above $4,000. Another slip could add to $184,510,000 in long liquidations already recorded.

- XRP price: $2.30 support and $2.90 resistance. ETF review week (Oct. 18-24) sets the fuse.

- Solana: Sitting soft after $40,420,000 in liquidations. Weak liquidity could exaggerate moves if BTC wicks lower.

- Macro headlines: U.S.–China maritime tariffs now active. Watch for retaliatory statements as each one is a risk trigger for crypto.

- Data risk: U.S. CPI later this week. Any upside surprise adds fuel to the sell side already under stress.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin