Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

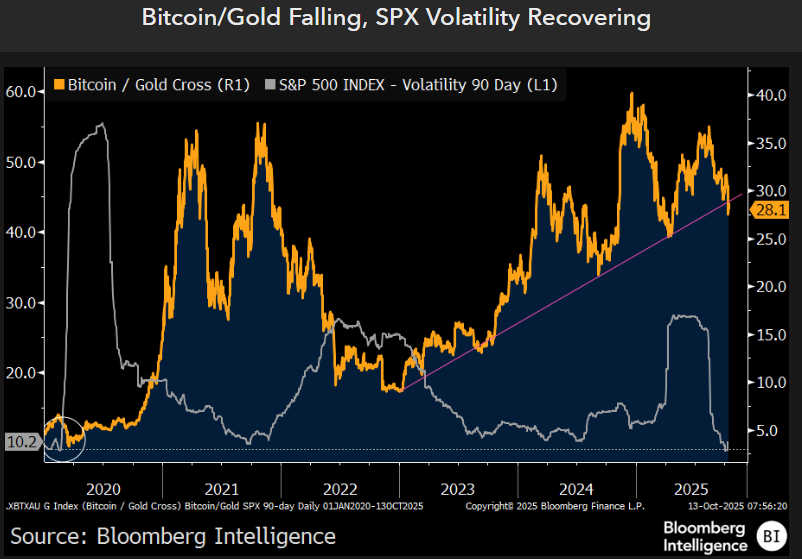

For years, Bitcoin was seen as digital gold, but the latest numbers suggest this comparison may be losing credibility. Bloomberg strategist Mike McGlone sums it up straight: the ratio between Bitcoin and gold is changing fast and could be the first sign of what he calls a great reset.

When it comes to data, the charts speak louder than words. The Bitcoin/Gold cross that once climbed over 50 is now barely at 30, sliding lower while volatility seeps back into equities, and McGlone says that risk assets across the board tend to suffer in this setup while gold quietly reclaims ground.

Bitcoin's price has been all over the place lately, with an early attempt to reach $124,000 falling flat within hours and leaving the coin back under $111,000 by the time U.S. markets opened.

Meanwhile, gold is doing really well, which makes it hard to say that digital scarcity is better than physical scarcity. In just one day, futures went up by $130, ending the day at $4,130 an ounce. This is a new record and a 3.3% gain, which has made the metal's market cap go up by almost a trillion dollars.

More numbers

GLD, the biggest bullion ETF, had $12.5 billion in trades, the second-highest in its history and heavier than turnover in most of the Magnificent 7 stocks.

Gold's RSI just hit 91.8, the strongest monthly reading ever, and the metal has only had four losing months since March 2024.

McGlone has taken criticism for his pessimistic attitude in the past, but on this occasion, the evidence supports him. Bitcoin may be rising in the world of crypto, but when you compare it to Gold, the message is pretty clear — the old metal is winning.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov