Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

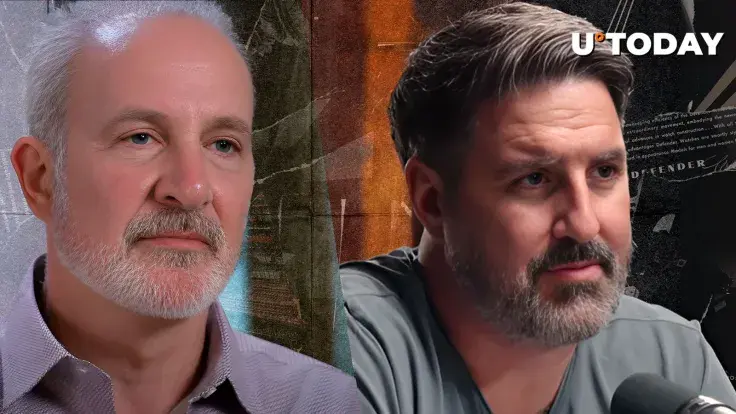

There appears to be a "battle of the Peters" for asset supremacy in the financial space. Show host Peter McCormack has slammed Bitcoin (BTC) critic Peter Schiff on his latest comparison of gold and BTC. In a post on X referencing Schiff’s earlier take, McCormack mocked him for not giving the best financial advice.

Bitcoin outperforms gold by over 25,000% since 2013

For context, Peter Schiff, a well-known gold advocate, had claimed that Bitcoin and Ethereum were on a huge meltdown. He asserted that crypto buyers would soon learn a "valuable but expensive lesson" when these assets crash.

However, debunking his claims, McCormack used historical data on the performance of Bitcoin against gold to show that Schiff’s BTC prediction was wrong.

He noted that the Bitcoin critique has, since 2013, dismissed the asset with the words, "Bitcoin is tulip mania 2.0… it's no better than a fiat currency."

Countering this narration, McCormack observed that since then and now, Bitcoin has gained a staggering 25,280% in value. At the time, Bitcoin was exchanging hands at less than $1,000 per coin on the crypto market.

On the other hand, gold within the same period has only managed to rise by 203.8%. Interestingly, when adjusted for inflation, that value drops to a mere 118% in real terms.

McCormack slammed Schiff for calling Bitcoin worthless since 2013, when the coin witnessed astronomical growth, whereas Schiff’s beloved gold could not keep up with inflationary pressures. The show host noted that, in reality, gold has been a poor investment choice when compared to Bitcoin.

He insisted that Schiff's assessment was "Not the best financial advice." He implied that anyone who listened to Peter Schiff missed out on massive gains that could have transformed their lives.

Bitcoin faces short-term volatility, but long-term confidence remains

As of press time, Bitcoin exchanged hands at $112,057.96, which represents a 2.9% decrease in the last 24 hours. It had previously soared to $116,020.49 in its recovery move before new developments in the ongoing geopolitical trade war escalated, leading to price slips.

This has also affected trading volume, which suffered an 18.81% decline to $76.2 billion. Market participants appear to be exercising caution as the "buy the dip" scenario that played out in earlier drops has not been reflected this time around.

Despite this volatility, Michael Saylor’s Strategy remains focused on Bitcoin accumulation and added 220 BTC to its treasury within the last 48 hours. This is an indication that he is still confident of a market recovery.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov