Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

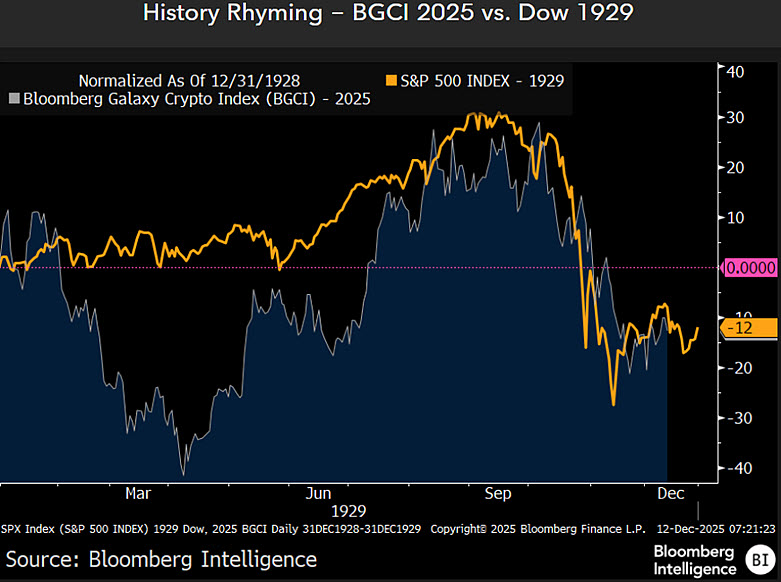

In a recent post, Bloomberg Intelligence’s senior macro strategist Mike McGlone drew a direct parallel between the Bloomberg Galaxy Crypto Index in 2025 and the Dow in 1929, calling the setup "Peak Bitcoin?" and framing the current phase as the early stage of a purge, not a pause — a purge similar to the one that caused the Great Depression almost 100 years ago.

The comparison is not abstract. Bloomberg’s own normalization shows crypto tracking the same arc as U.S. equities did a century ago: a powerful run-up, expanding speculation, then a slow turn lower.

McGlone argues this is exactly when bubble-versus-not-bubble debates explode, usually close to highs, not bottoms. For him, Bitcoin, tightly linked to wide risk markets, fits that script.

First surge, then purge

He describes Bitcoin’s post-2024 surge as a beach ball forced underwater until the 2024 reelection removed political pressure. Since then, the price accelerated fast, speculative appetite followed and excess piled up. Now, in McGlone’s words, it is the cleansing phase that appears to be underway. Bitcoin is down only about 5% in 2025 through Dec. 14, which he frames as resilience that may mask larger downside risk rather than confirm safety.

The warning widens when gold enters the picture. The Bitcoin-to-gold ratio ended 2022 near 10, ballooned during the crypto rally, then fell about 40% this year to around 21. McGlone sees a path back toward 10 by 2026, a move that historically pressures all risk assets.

The most jarring projection by McGlone lands last: Bitcoin’s run above $100,000 may have planted the conditions for a long pullback, with even $10,000 cited as a potential destination into 2026, alongside a broader downturn led by high-supply speculative assets that track nothing tangible.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin