Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

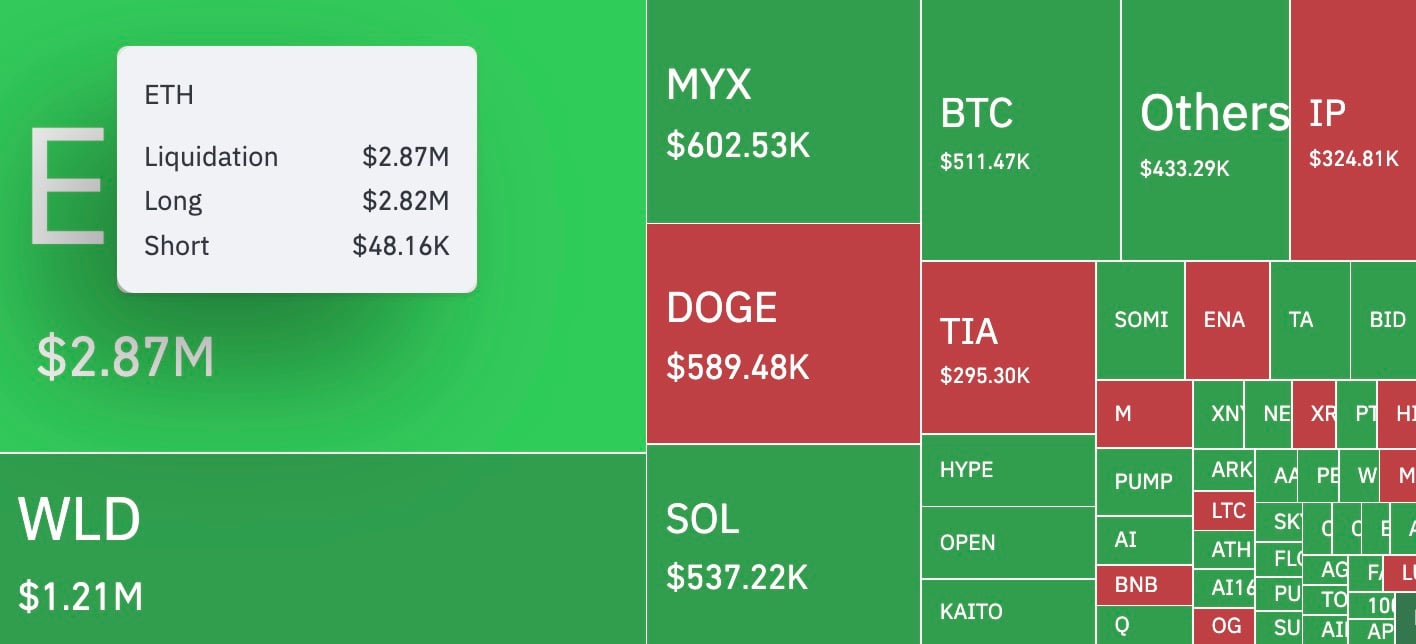

Tuesday's Ethereum trading session on the derivatives market was a bright display of how quickly leverage can tip the balance on orderbooks. According to CoinGlass, over the course of an hour, $2.87 million worth of ETH positions were liquidated, and almost 99% of that figure was longs.

Fresh data indicates $2.82 million in long liquidations, compared to just $48,160 in short once — that is a 5,855% imbalance, making this move stand out among other major cryptocurrencies.

This skew coincided with a visible spike on the one-minute price chart. ETH fell to around $4,328 before recovering almost immediately. Still, the decline was sufficient to trigger a flood of margin calls — mostly against long positions.

Ironically, the subsequent rebound pushed the price back above $4,350 per ETH within minutes.

Overall, for the crypto market, a more balanced picture emerged, with Bitcoin logging total liquidations of around $511,000 and Solana $537,000. Over 24 hours, liquidations reached $341.46 million, $139.91 million and $201.55 million in shorts and longs.

Ethereum (ETH) price reaction

Ethereum's spot price stayed pretty steady around $4,353 at press time, which is up just over 1% on the day. The main message behind this event is still showing how quickly leverage can unwind during small price changes, even when the overall trend looks solid.

For ETH, this was more of a localized reset than a change in direction, but for someone, it was a loss of a substantial portion of the deposit.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin