Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

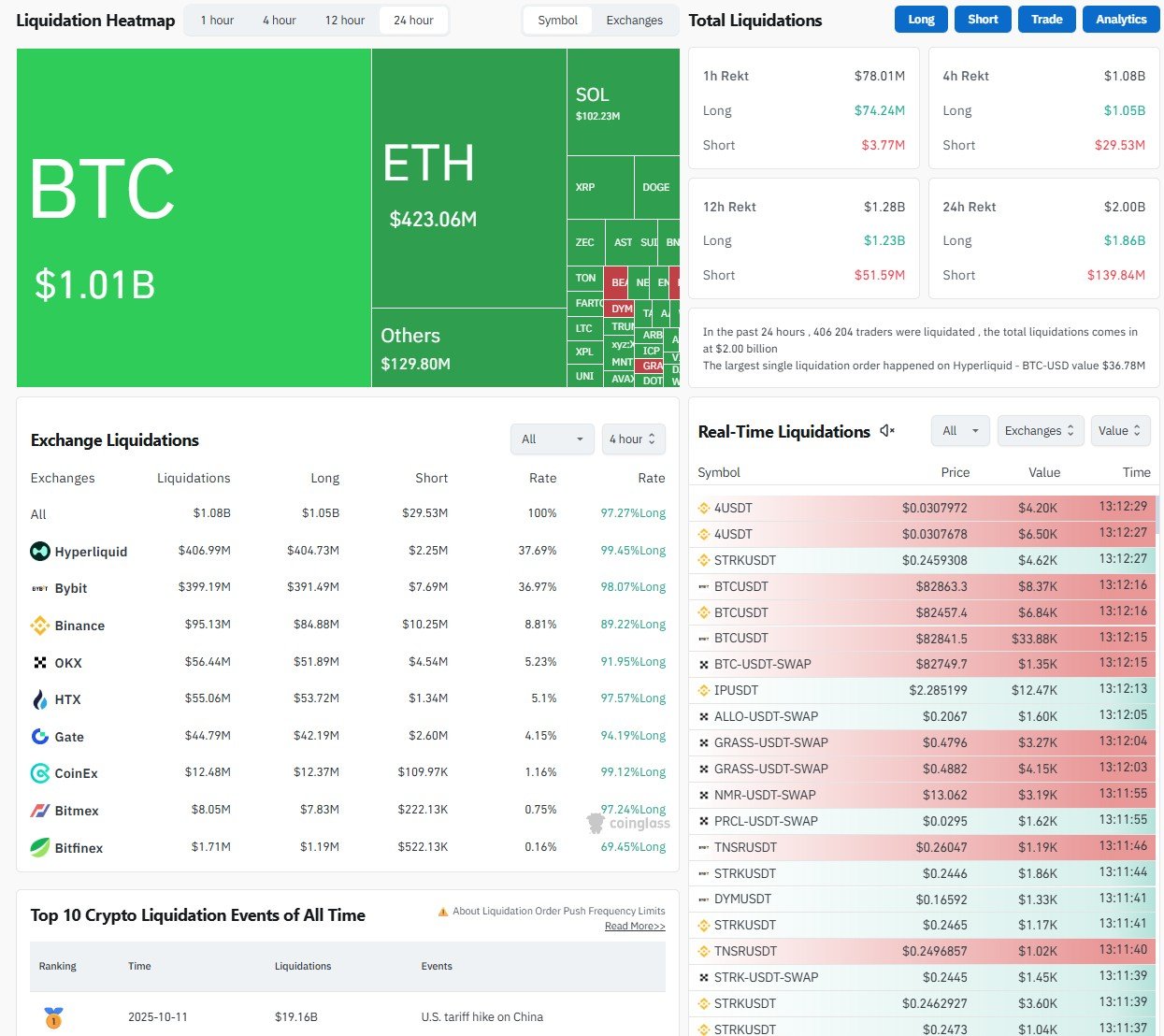

Nearly two billion dollars in crypto longs have been wiped out in one of the most violent liquidation cycles of the year. Bitcoin alone accounts for just over a billion dollars worth of forced long closures, with Ethereum contributing more than $422 million, and XRP suffering alongside the broader market, according to data from CoinGlass. This kind of synchronized liquidation usually marks periods of extreme leverage unwinding, rather than fundamental collapses, but the charts across major assets paint a harsh picture for anyone expecting a quick reversal.

Bitcoin slips

Bitcoin’s chart shows a straightforward story: a complete loss of trend strength after rejection at the 100-day and 200-day EMAs. The breakdown accelerated once BTC slipped under $100,000, and momentum did not stop until the $82,000 area. That level corresponds with a thick liquidation cluster, meaning a huge portion of leveraged long positions were sitting just below that price and got wiped out the moment the market tapped that zone.

RSI is deeply oversold, but oversold does not mean a reversal; it only tells you how brutal the selling pressure has been. Until BTC prints a higher low, or at least forms a base, bulls will be reacting rather than attacking.

Ethereum is not in much better shape. ETH lost the $3,000 support cleanly, and the market kept pushing it toward the mid-$2,600s. Structurally, ETH has broken all major moving averages and is trending under its 200-day EMA, a classic bear-market condition. There is long-term optimism from staking metrics, but price action right now reflects panic, not conviction. If ETH cannot stabilize soon, a retest of $2,500-$2,400 becomes the next logical step.

XRP's drops getting worse

XRP just suffered one of its sharpest single-day drops in months. The descending channel that has been controlling the price since September finally cracked, and XRP is now touching the lower boundary of that structure. This level can act as a “trampoline,” a place where the price historically bounces hard, but that only applies if buyers show up. A breakdown from here opens a path toward $1.70-$1.80, which is the next high-liquidity area.

Is this the end? No. But it is the phase where markets flush out excess leverage and force a reset. Until volatility cools and assets reclaim broken supports, expect uncertainty, not recovery. This kind of liquidation storm often marks the late stage of a correction, but it never feels like it while you are inside it.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov