Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

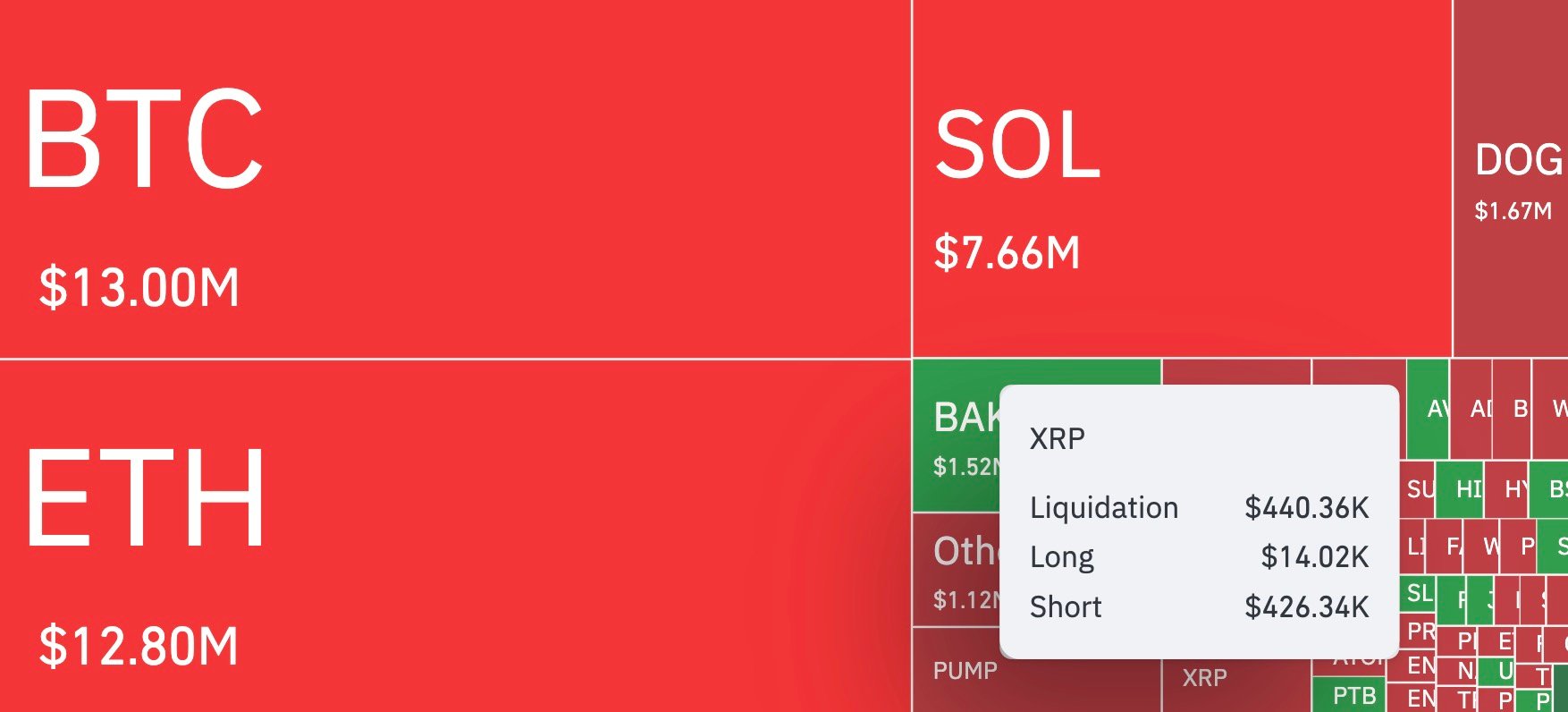

Derivatives on XRP delivered a rare imbalance that is too abnormal to ignore. In the last hour, the liquidation tracker by CoinGlass showed a 3,042% difference between short and long contracts, with most of the losses being taken by the bear side. Roughly $426,000 in short positions were wiped out, compared to just $14,000 from the long side.

This was not the largest figure in absolute terms — Bitcoin and Ethereum each saw more than $12 million liquidated in the same hour — but the difference on the XRP market was huge.

It arrived at the very moment when fresh U.S. inflation data reset expectations across risk assets, forcing a fast reaction from crypto.

Inflation shock

The Producer Price Index for August came in below every major forecast. On a month-on-month basis, the PPI showed a decline of 0.1%, contrary to expectations of a 0.3% increase. Moreover, the annual figure dropped to 2.6% from 3.3%, which is the lowest reading since June.

The shock was reflected in XRP's price too. Within minutes of the release, the token spiked past $3.00, reaching $3.02 before falling back toward $3.00. This sudden increase caught those betting on a further decline off guard, resulting in a one-sided liquidation squeeze.

At press time, XRP was holding at around the $3 price point. Its derivatives market was considerably lighter after the purge, and the next sessions will reveal whether this clears the path for recovery or simply resets the board for another round of volatility.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov