Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

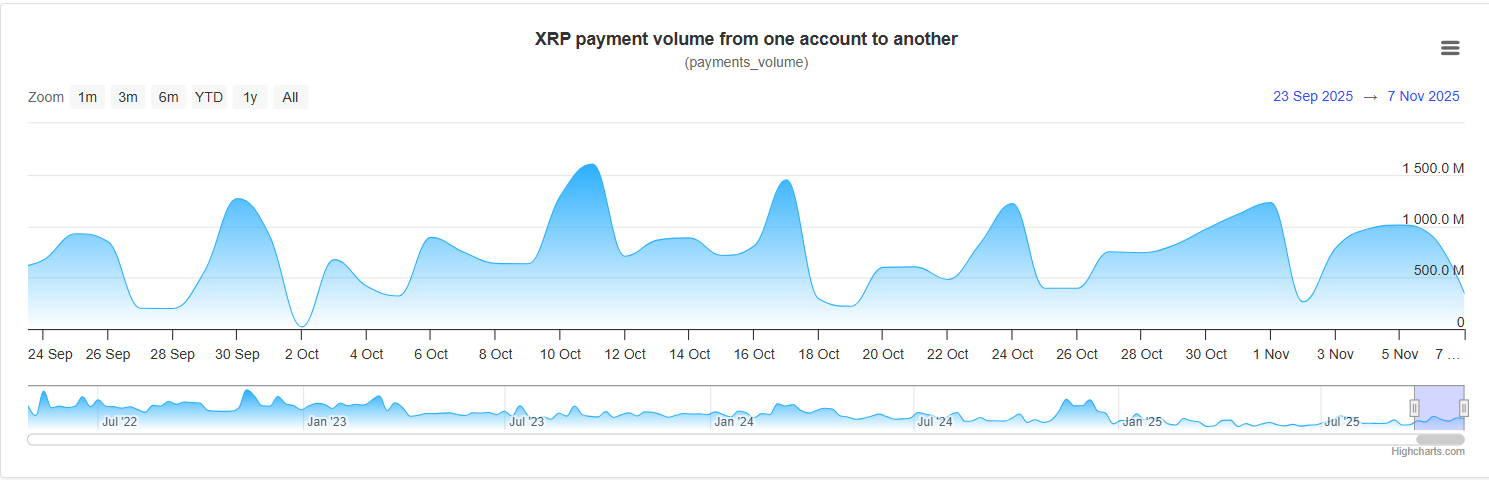

XRP has formally fallen below the one billion daily payment volume threshold, a significant technical and symbolic milestone that highlights the network’s waning transactional momentum. Payment volume has dropped to 903 million XRP, according to data from XRP Ledger metrics, and the number of transactions has also decreased to about 1.98 million. This drop coincides with weakening price movement and rising skepticism about the token’s immediate prospects.

XRP has not improved

On-chain activity provides a clear picture: since late October, there has been a gradual decline in both the total transfer volume and the number of executed transactions, reversing a brief recovery wave. In the past, a cooling off in network utility, fewer inter-account transfers and decreasing transactional throughput throughout Ripple’s ecosystem has been indicated when XRP payment volume falls below the one billion threshold.

In terms of price, XRP has not improved. The token, which is currently trading at $2.17, is having difficulty holding onto important support levels following an earlier attempt this week to break above $2.50. According to the daily chart, XRP is in a sharp decline, with the 200-day EMA becoming solid resistance. The RSI is close to 35, indicating that bearish pressure is still strong but also pointing to a slight oversold situation that might encourage a technical recovery.

XRP's plummeting on-chain activity

Expectations in the near future are muted due to a combination of deteriorating fundamentals and ongoing selling pressure. It is unlikely that market sentiment will change significantly unless XRP can regain transactional traction and maintain payment volumes above $1 billion. The decline in on-chain activity also suggests that institutional usage, which is frequently cited as XRP’s primary motivator, might be temporarily pausing.

Even though XRP is still one of the most well-known digital assets in the industry, its present trajectory appears to be stagnant. Investors should prepare for further sideways-to-downward movement in the upcoming weeks, with a possible recovery only if payment volumes regain the lost billion-level milestone, unless there is a significant technical reversal or a resurgence in real transactional demand.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin