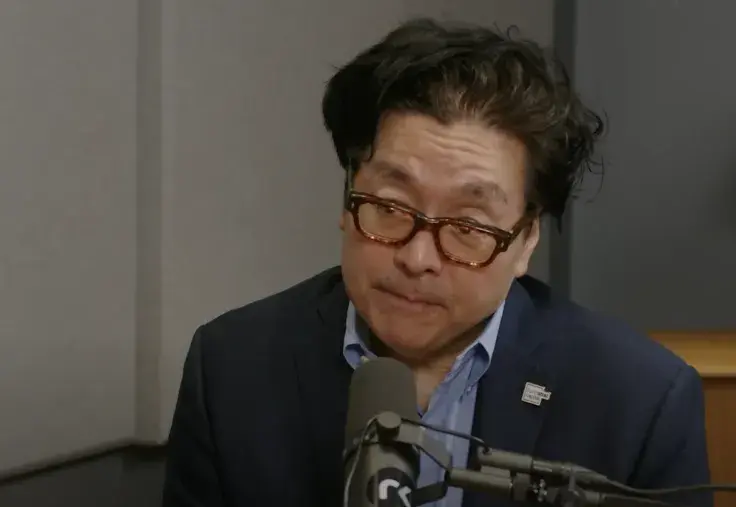

During a recent appearance on CNBC, Tom Lee floated an interesting theory about the strongest gold rally since 1979, suggesting that stablecoins could be behind it.

As noted by Lee, Tether's growing supply, which started to dramatically rise a few months ago, might be fueling gold's non-stop price growth.

"Stablecoins, including Tether, may be one of the largest buyers of gold today," Lee said.

Tether, he argues, is a good "meeting ground" between Bitcoin and gold people.

Earlier today, the yellow metal recorded a new record high above the $4,100 level.

Crypto liquidations are understated

As reported by U.Today, major cryptocurrencies collapsed in tandem with stocks on Friday due to a significant escalation in trade tensions between the U.S. and China. Major altcoins then entered into a complete freefall, with some of the biggest tokens, including XRP, collapsing by more than 50%.

According to data provided by CoinGlass, a total of $19.16 billion was liquidated on Oct. 10.

That said, according to Lee, this figure is actually understated. "It might be four times bigger," he said during the interview.

This is likely due to exchange limits on liquidation push frequency (for instance, it is just one order per second on Binance).

A gift?

During a recent appearance on CNBC, permabull Tom Lee opined that the Friday sell-off might end up being a "gift" for the equities.

"I think the S&P could add, you know, 200 points between today and mid-November," Lee said.

Fundstrat's analyst has added that the sentiment is "not overly positive" as of now, so this does not seem to be the late stage of the cycle.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov