The past month has seen Ethereum show mixed price action amid multiple series of deep price corrections. However, whales have continued to scoop up the asset in large quantities despite uncertain market conditions.

On Wednesday, Dec. 10, popular crypto analyst Ali Martinez had showcased data revealing the aggressive accumulation of more than 800,000 ETH in the last 30 days.

The analyst revealed this, showing charts from crypto analytics firm Santiment that show that Ethereum wallets holding between 10,000 ETH and 100,000 ETH had bought over $2.4 billion worth of Ethereum at an average trading price of $3,105. This signals a notable shift in sentiment, as large Ethereum holders appear to have been preparing for a major price shift.

Ethereum regains momentum amid notable price resurgence

While the price of Ethereum had struggled through a period of downward pressure and volatility amid the broad crypto market downtrend witnessed in previous months, whale holdings appear to have steadily climbed.

This resilience portrayed by whales during such accumulation phases signals confidence among high-profile and institutional investors. Historically, moves like this have often preceded significant price movements.

Amid prolonged market volatility, ETH prices have hovered around low levels, even dipping as low as $2,600 in the past month. However, whale activity suggests that large investors appear to have massively bought the dip, positioning themselves for what they believe could be an upcoming catalyst.

As they have expected, the crypto market is now seeing a broad resurgence, with the prices of leading cryptocurrencies showing notable daily gains.

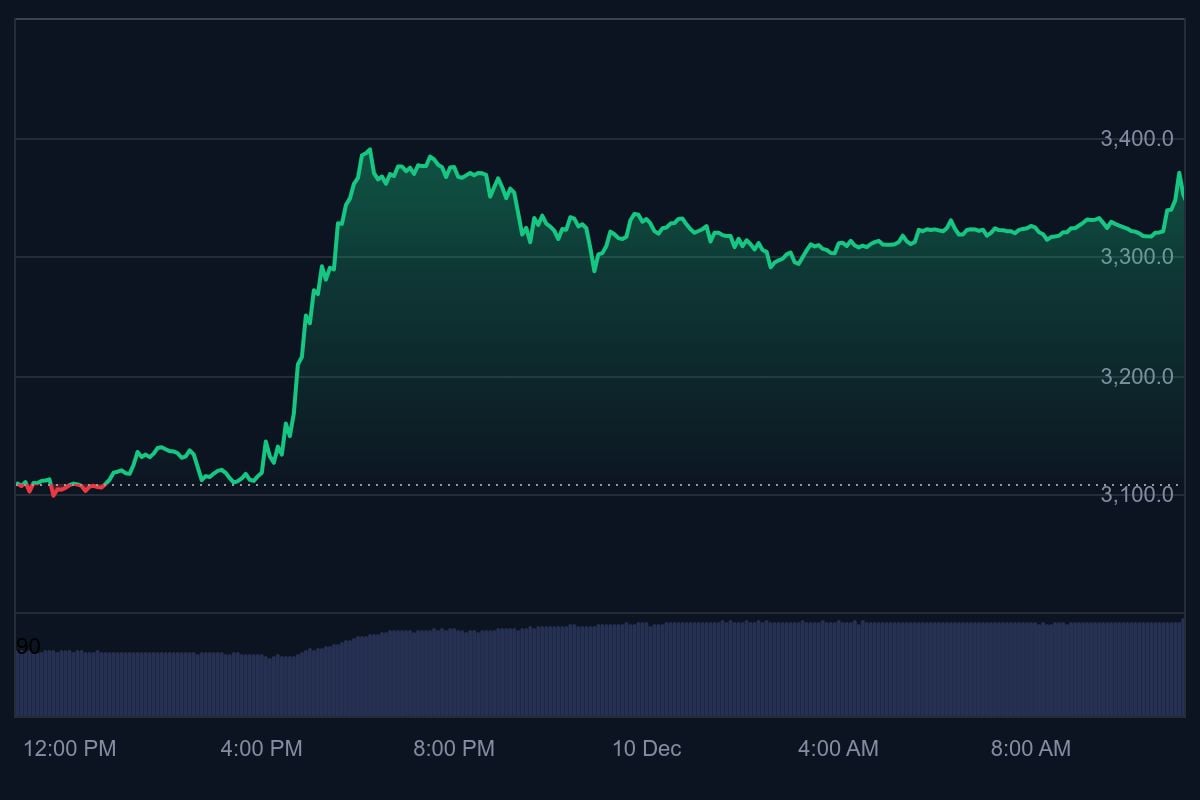

Amid this resurgence, Ethereum has reclaimed its long-lost $3,300 level, surging by over 7% over the last day. Notably, data from CoinMarketCap shows that Ethereum is trading at $3,321 as of press time.

The Ethereum price resurgence is not entirely a surprise as market watchers have noted that similar accumulation patterns in the past have been followed by strong upside momentum.

While the spot Ethereum ETFs had also slowed down in its daily performance over the period, they are beginning to note increasing inflows as momentum returns to the market.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov