Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin opens December with one of its heaviest monthly handovers in weeks, wiping out more than $5,000 in a single slide and dropping straight into the $86,000. While BTC stalls, XRP quietly delivers the biggest ETF print of its lifetime — $289 million in five days — and does it during a week when most majors were bleeding.

SHIB walks into December from the opposite side: the price is parked near $0.000008, structure is thin and every move above or below this band now matters. A bounce can flip the chart into its first real upside window in months, but a slip under $0.0000072 would drag it into the weakest zone of its yearly profile.

TL;DR

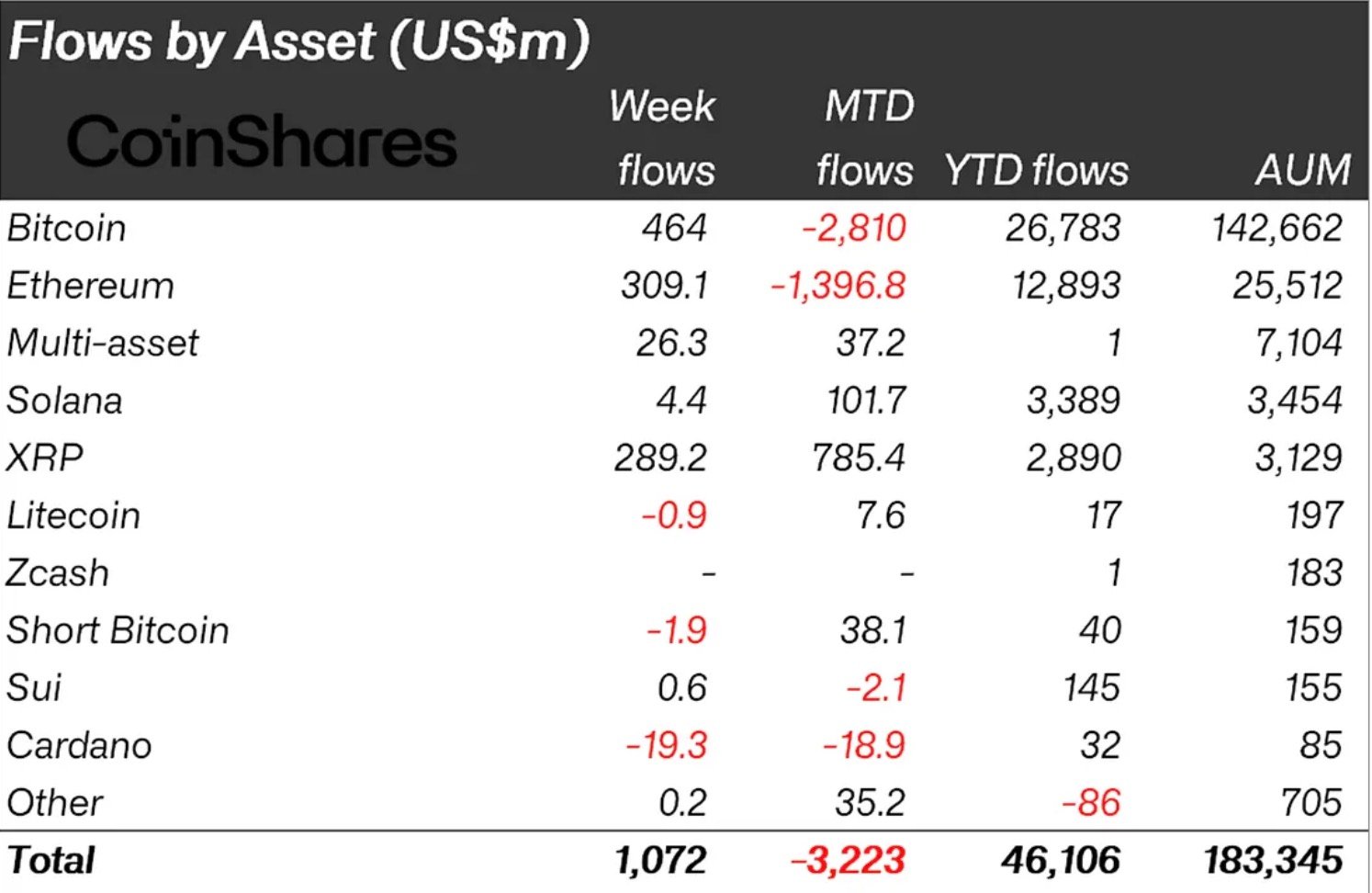

- XRP pulls $289.2 million in a week — equal to about 30% of all ETP inflows.

- Strategy’s CEO Phong Le confirms BTC sales are possible if mNAV slips under 1 and capital access closes.

- SHIB hits December with a deep negative YTD, weak Q4 stats, but at least a narrow recovery opportunity.

XRP achieves $200 million in 324% weekly ETF surge

December begins with XRP experiencing one of the most significant ETF inflows of the year. According to CoinShares, XRP products pulled in $289.2 million in a single week — more than $200 million above the previous week and marking a 324% increase — the largest inflow the asset has ever recorded. Total crypto ETP inflows reached $1.072 billion, meaning XRP alone accounted for 27-30% of the entire market as it headed into a new month.

Analyst Butterfill notes that this six-week run now equates to 29% of all XRP ETP AuM, establishing the asset as one of December's primary flow drivers even before the month begins.

However, the spot price has not reacted; XRP has slipped from $2.20 to $2.03, following Bitcoin’s drop, and forming a rare setup where heavy ETF demand arrives while the spot price corrects.

Strategy may sell Bitcoin, says CEO Phong

In December, Strategy’s CEO Phong Le provided the clearest explanation yet of when the company would sell Bitcoin: only if mNAV falls below 1 and capital access closes completely. mNAV tracks the amount of BTC remaining per share after debt has been deducted and the company has allowed it to fall much lower without selling.

In 2022, for example, mNAV hit 0.54 with far less leverage, yet the company still held onto its Bitcoin. Currently, the figures stand at 0.905 basic, 1.009 diluted and 1.169 EV-adjusted, providing Strategy with ample room before any forced action is required.

Phong breaks down the math behind their decisions: selling BTC would only be a final liquidity measure to cover up to $750 million in annual preferred dividends. If the stock trades at 2x mNAV, issuing $1 billion would create approximately $500 million dilution and $500 million BTC accretion.

Saylor's green-dot post fueled speculation. Historically, yellow dots have meant BTC buys, so green dots could indicate BTC-backed financing, collateral rotation, a hint of a buyback or even a quiet signal ahead of a sale if the premium collapses.

He also transferred some of Strategy’s BTC between custodians last week, making a collateral reshuffle the most plausible explanation. The timing of Phong’s comments was significant, as they were released at the same time as the price of BTC dropped from $91,000 to $86,000, turning every detail into a market trigger.

Shiba Inu (SHIB) in December: Worst and best scenario revealed

Shiba Inu (SHIB) opened in December at around $0.00000800, sitting below its October support level and sliding into the $0.0000072-$0.0000075 range last observed in the middle of the year.

If SHIB repeats its weaker seasonal pattern in December and trading volumes remain low, a breakdown below $0.0000072 would expose the token to the $0.0000060-$0.0000065 range, which aligns with its Q4, 2025, seasonal decline of 32.3%, extending the losses incurred in Q1 (-41%) and Q2 (-7.8%).

For the opposite path to be realized, stability must return to the market as a whole: a recovery to the $0.0000105-$0.0000118 zone would see SHIB return to the territory it lost in October, mirroring its Q4, 2023, rebound of +41%. This would likely require an increase in Shibarium activity or a clearer BTC structure.

Price action over the past year has been characterized by lower highs, and SHIB will only break this pattern once it reclaims the $0.000010-$0.000011 line, which marks the exit from its 14-month downtrend.

Crypto market outlook

December opens with a split: Bitcoin is sitting in a zone where one direct move can either drag the market toward the low-$80,000s or flip the entire structure back into a relief phase, and both XRP and SHIB are pinned at levels where even a small BTC move will decide whether they catch momentum or sink into fresh weakness.

Key levels to watch:

- Bitcoin (BTC): Holding $86,400-$86,800 with upside capped at $89,000-$90,000, and support at $85,000, then $82,000-$83,000 if pressure continues.

- XRP: Trading around $2.03-$2.10, with upside restarting above $2.20, and support at $2.00, then $1.88-$1.92.

- SHIB: Sitting near $0.00000800 with breakout levels at $0.000010-0.000011, and support at $0.0000072, then $0.0000065.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov