Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The first Dogecoin ETF had real activity but not the explosive growth many traders expected, and the day-one numbers ended up showing the same trends as the DOGE price that has been stuck in a downtrend for weeks.

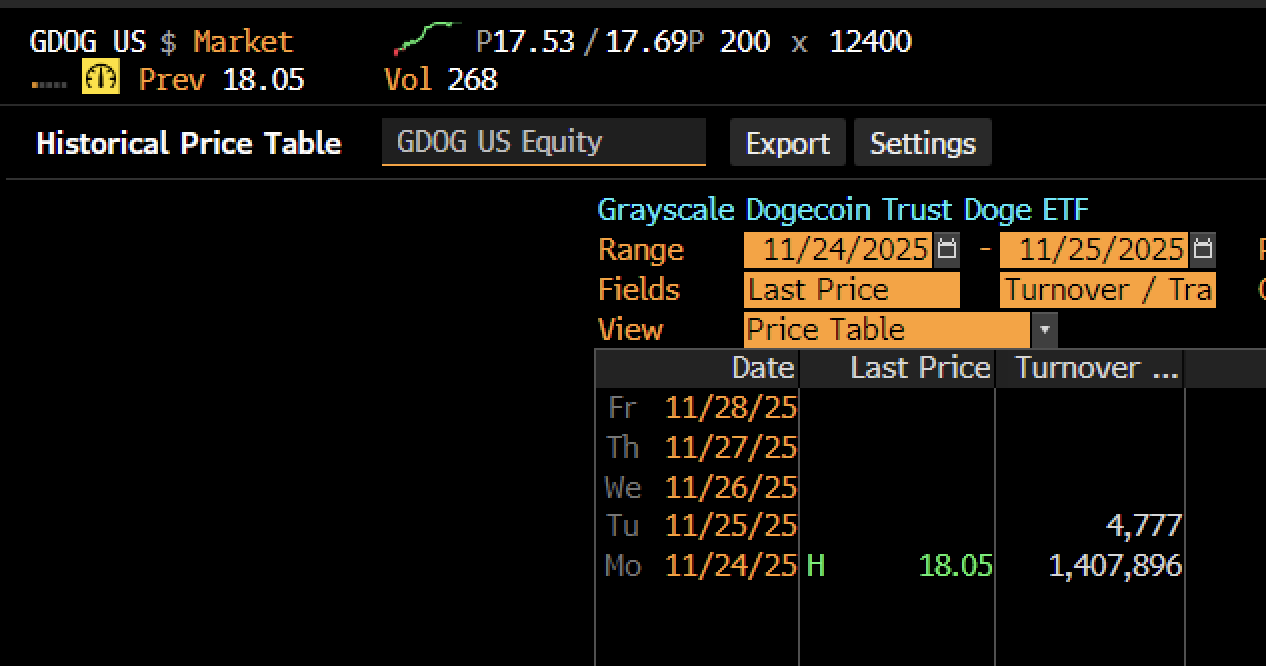

GDOG, the Grayscale Dogecoin Trust ETF, had about $1.4 million in turnover on its debut. Bloomberg's screen shows the product closing at $18.05, with $1,407,896 in dollar turnover and only 4,777 in trade count.

What it shows is that that early interest was concentrated into a short burst rather than forming a wide base of participation across the session. Eric Balchunas said the outcome was "solid for an average launch but low for a first-ever spot product," and that is in line with how DOGE has traded for the past month.

Dogecoin's price chart, in the meantime, shows a market that has had a hard time holding any level above $0.17 since early November. Every time the price bounces back up, sellers take advantage and bring it back down to the mid-$0.14s.

The ETF debut did not change that much because the spot market is still the main driver of sentiment for meme assets.

Bottom line

The last big candles on the chart are all red, including that one deep flush wick in mid-October. That one still stands as a reminder of how quickly liquidity can disappear around this coin when larger names pull back.

Because of that background, the ETF's first day is not strong or weak. It looks like the market is trading lower and waiting for something to give it a boost. A total of $1.4 million is enough to show the door opened but not enough to signal a wave of new capital.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin