Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

This morning’s action on the crypto market sits in that narrow zone where price, rankings and perception collide, with Shiba Inu being not just up but literally taking someone’s seat on the market-cap ladder, DOGE sending near nine-figure blocks across the chain at fees that look like typos and COIN stock trying to bounce off the floor while the CEO reminds everyone he is not allowed to trade it like a normal investor.

TL;DR

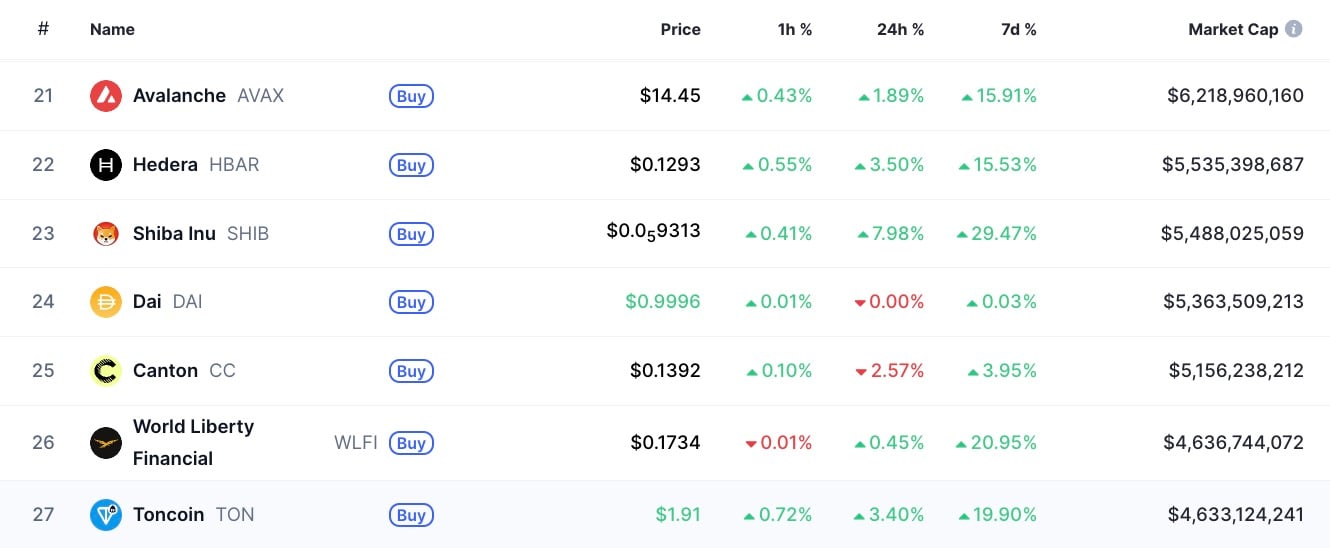

- Shiba Inu (SHIB) surges 26% weekly, dethroning Canton (CC), a so-called "XRP killer," in market cap.

- CEO of Coinbase Armstrong explains the legal block on buying COIN directly.

- Over 874 million DOGE shuffles between wallets, with no explanation at first.

Shiba Inu (SHIB) torches so-called "XRP killer" in 26% run

SHIB just erased Canton Coin (CC) from the CoinMarketCap leaderboard. After weeks of moving sideways under the surface, the Shiba crowd finally got the volume it needed. A 26% rally in seven days put the token at $5.48 billion in market cap, comfortably above CC’s $5.15 billion and enough to kick the so-called XRP alternative back down a notch.

Canton’s entire pitch was that it could outpace XRP with cleaner rails, stronger backing and a network that played nicer with institutions. What it did not have — and what SHIB always does — is a price chart people want to look at.

The breakout was not driven by news or new listings. It was flow-driven and technically triggered. SHIB cracked above the 0.000009 level, confirmed support at that line and started pushing toward the 0.000011 zone, where things get more congested. That zone has not held since mid-Q3, and a move through it could shift the meme coin pecking order again.

For now, the flip is clean. CC is down -2.57% over 24 hours, SHIB is up +7.98% and the distance between them is growing. Market cap rankings do not lie, and market participants are not choosing based on utility this week — they are chasing strength.

Brian Armstrong explains why he cannot buy the dip in COIN stock

Coinbase CEO Brian Armstrong recently went on record explaining why he is not buying COIN stock at current levels; it is not because he is bearish but because he legally cannot. As a Section 16 officer, he is bound to a 10b5‑1 trading plan. That means no live orders, no dip buys, no timing plays. Every trade has to be scheduled and filed ahead of time.

Still, his explanation reads more like a soft pitch than an apology. Armstrong listed what COIN represents inside the Coinbase app: one account, millions of tokens, stocks, futures, loans, DeFi, stablecoins, prediction markets — everything tradable under one roof.

The post hit just as COIN started showing signs of life after months of bleeding. The stock is up +7.77% this week, trading around $254, snapping out of the $230 zone that defined December. The chart still looks bruised, but nonetheless it is printing a bottom attempt.

The CEO cannot press buy, but retail can. Whether the thread brings new flows or just social engagement remains to be seen — but the timing was not random.

Nearly 1,000,000,000 Dogecoin mysteriously vanishes, but where to?

Dogecoin watchers caught something big as, in less than four hours, 874 million DOGE — worth over $131 million — moved across unknown wallets in two massive chunks: one worth $60.9 million, the other $70.4 million, as per Whale Alert.

No tags and no explanations were attached to initial reports as the raw data showed classic “unknown to unknown” labeling, but a deeper trace reveals that both transactions were internal Binance cold wallet shuffles. The main wallets involved — DU8gP and DTSop — simply swapped sides, rotating hundreds of millions in DOGE for what appears to be storage balance adjustments.

One transaction alone moved over 511 million DOGE, with a total fee under $0.09. For perspective, that is $76.79 million sent across the chain with the cost of a gas station coffee.

So, what “disappeared” here is not DOGE, it is labeling, because the alert feed framed it as unknown while the chain view framed it as Binance-to-Binance. That gap matters for how traders interpret flow.

If you think an unknown whale is moving $131 million in DOGE, you start building stories about selling, about custody, about OTC, about something brewing. If you see Binance cold wallets swapping sides, you file it under housekeeping, wallet management, maybe balance distribution and you move on.

Crypto market outlook

The coins that moved were the ones people still care about. SHIB, DOGE, COIN — each had a reason to be watched, and each pulled in real volume. Meanwhile, large-cap alts like AVAX and HBAR had solid seven-day runs, but without the same magnetism. WLFI and TON posted double-digit gains too but did not break into top narratives.

Levels to watch next:

- SHIB needs to push above $0.00001009 to retest the weekly high and flip the $0.00001203 zone from late Q3. A move back under $0.000009 puts the whole breakout at risk.

- DOGE holds bullish structure above $0.149. A daily close above $0.1545 reopens $0.162 as the next target.

- COIN just closed the week at $254.92 after bouncing off $246.50. It needs to stay above $247-250 to maintain the base. A break above $259 puts $275 back in play, but the earnings season will decide how far it goes.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin