Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

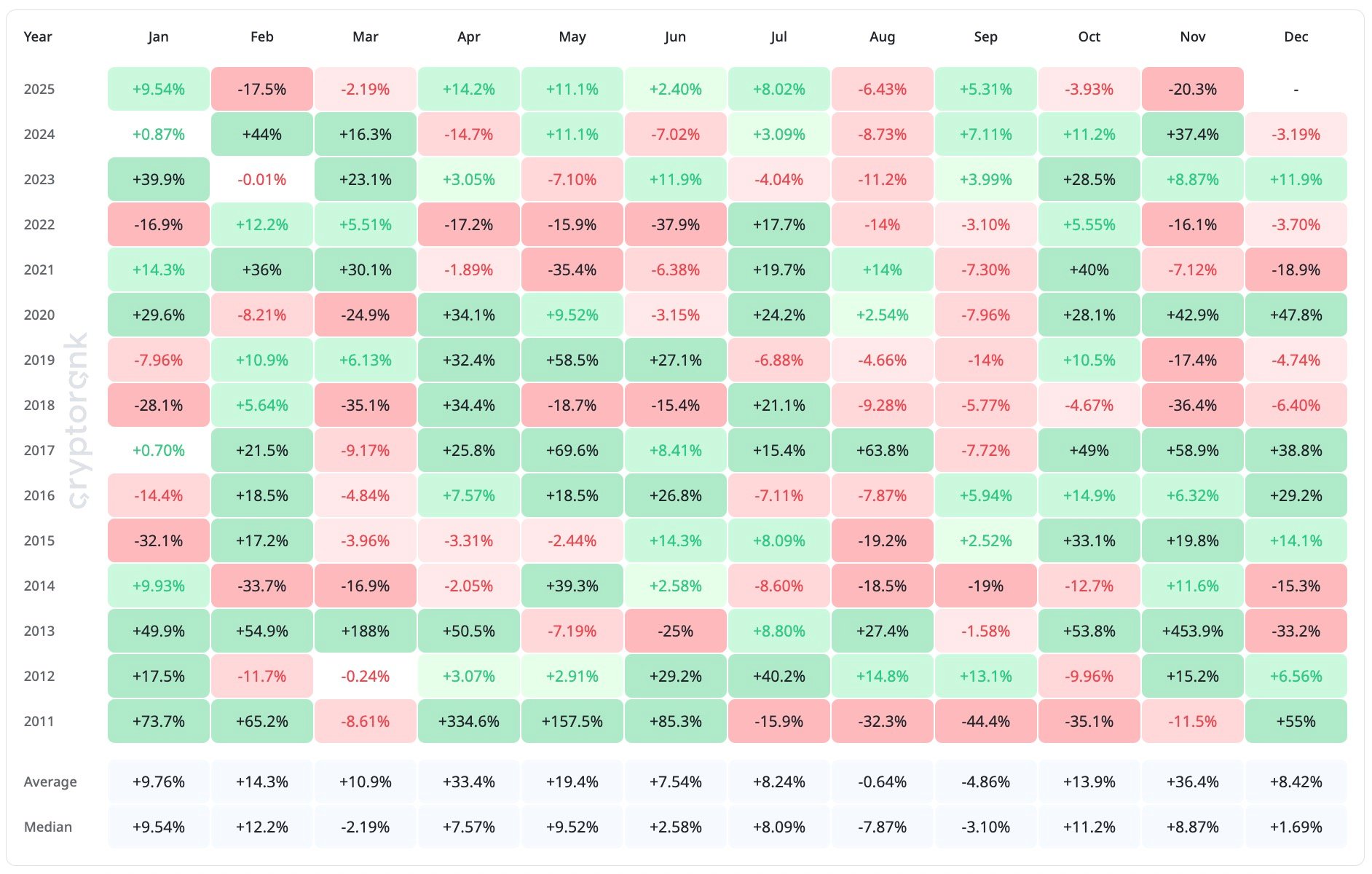

December has always been a good month for Bitcoin. The market usually finishes the month positive and avoids any big year-end declines. But the same long-term data by CryptoRank shows that XRP is an asset with a lot more potential when the last month of the year starts — even though its median December result is actually negative.

Thus, the median December print for the price of Bitcoin is usually positive with the average at 8.42%, and there are plenty of strong years — 2017 (38.8%), 2020 (47.8%), 2016 (29.2%) — that show December to be a month where BTC often holds its ground and often ends higher.

XRP's structure is different and much more aggressive. The token's December median is -3.16%, which is usually a sign for traders to be careful, but the average is a huge 69.6%, thanks to a few really successful years that completely changed the chart.

XRP vs. BTC in December

Those surges are not small. XRP increased by 118.1% in 2014, 531.9% in 2017 and 818.9% during the extended 2017 data sequence. These are one-month moves that rewrite price history and create the kind of upside windows that Bitcoin simply does not produce in December.

That is why XRP's setup in December is seen as its own thing. Bitcoin brings predictability. XRP brings a bit of an imbalance to the table. If history repeats in any form, Bitcoin will stay solid, but XRP is the one with the statistical capacity to outrun it once the month opens up.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov