Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

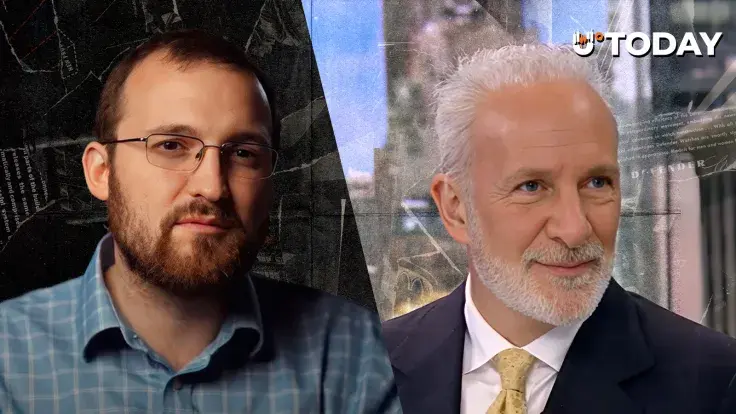

Cardano Founder Charles Hoskinson went head-to-head with long-time Bitcoin (BTC) critic Peter Schiff. Hoskinson argued that Schiff has repeatedly failed in his price forecasts for Bitcoin.

Charles Hoskinson mocks Bitcoin critic

In an X post, Hoskinson dismissed the Bitcoin price forecasts of Peter Schiff. Hoskinson claimed that Schiff’s anti-Bitcoin takes no longer move markets or sways serious investors.

He highlighted previous BTC forecasts by Schiff that turned out wrong. According to Hoskinson, Schiff was wrong when he predicted Bitcoin at $100, $1000, $10,000 and $100,000.

Hoskinson added that Schiff would still be wrong with a $1 million Bitcoin projection. The Cardano founder believes Schiff’s prediction model is broken, as he has been wrong four times.

Note that Schiff has consistently called Bitcoin a "bubble" or "Ponzi scheme" since its early days.

In a recent X post, which Hoskinson responded to, Schiff highlighted a divergence between Bitcoin, the NASDAQ and gold.

Schiff noted that BTC is still far behind in percentage distance from its all-time high (ATH) compared to NASDAQ and gold.

According to Schiff, Bitcoin is still over 10% below its ATH. He added that Strategy stock (MSTR) is down 48% from its record high set in November 2024.

Schiff sees this divergence as proof that Bitcoin is not digital gold but a speculative asset. He concluded that BTC is primed for a crash.

These remarks come shortly after Schiff said buying Bitcoin is a bet against gold. He argued that the value of gold stems from its ancient role as a tangible store of wealth, while Bitcoin remains speculative and volatile.

Current state of Bitcoin

The ongoing discourse raises bigger questions about whether Bitcoin is indeed a revolutionary asset. In 2025, Bitcoin has seen rising adoption from both retail and institutions, forcing proponents like Hoskinson to sharpen their arguments.

In addition, BTC has gained recognition this year from several governments. Strategy Executive Chairman Michael Saylor recently celebrated the U.S. government for recognizing BTC as a treasury asset.

In a related development, French politician Eric Ciotti introduced a proposal to create a national strategic Bitcoin reserve.

As of press time, BTC is priced at $113,036, down 1.8% over the previous day. Still, analysts and investors are bullish on BTC, with some eyeing $116,000 as a short-term target.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov