Tron CEO Justin Sun recently took to Twitter to announce a brand-new listing of BitTorrent’s native token, BTT. The US-based Gate.io exchange became the latest platform to embrace the controversial token by adding two trading pairs — BTT/USDT and BTT/ETH.

#BTT is available on @gate_io, you can trade BTT/USDT, BTT/ETH now. #BitTorrent $TRX $BTT pic.twitter.com/PYUHkGljww

— Justin Sun (@justinsuntron) February 8, 2019

More exchanges are getting on board

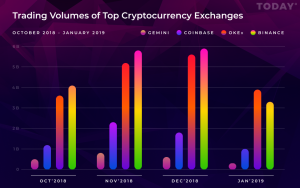

BitTorrent has been already listed by multiple exchanges, including Binance and OKEx, the two biggest exchanges by trading volume. On Feb. 7, BitTorrent announced in a press release that the BTT token would be supported by CoinPayments as well.

There was also a place for controversy, with some speculations floating around that Binance and Tron have cooperated to push BTT behind closed doors. Binance, which conducted the BTT sell-off, was ostensibly chosen as a platform for pumping the token.

Boom or burst?

In spite of these damning accusations, BTT has recently been on a roll with its price witnessing a six-fold increase since its ICO. However, in the long run, it’s still not clear whether Tron will be able to maintain this level of success. As U.Today reported earlier, former BitTorrent exec Simon Morris unleashed a wave of criticism at Tron, claiming that Sun lacks ‘a technical bone’ and the Tron network doesn’t have enough capacity to handle the tokenization of BitTorrent. Whether he’s just bitter or genuinely concerned, BTT’s future remains gleam.

Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Denys Serhiichuk

Denys Serhiichuk Tomiwabold Olajide

Tomiwabold Olajide