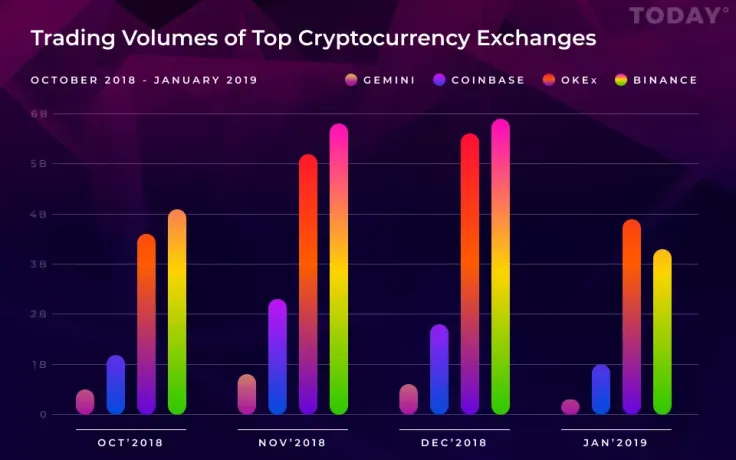

The longest Bitcoin bear market in history expectedly took its toll on the world’s biggest exchanges. In its latest issue, cryptocurrency research startup Diar published a new study that displays a sizeable drop in Bitcoin trading volumes on Binance, Coinbase, Gemini, and OKEx.

Binance is not immune to market bears

Binance, the biggest exchange by trading volume, saw its USD-based market dropping by 40 percent in January. Meanwhile, Coinbase barely managed to surpass the $1 bln mark (a 10-fold decrease compared to January 2018).

Gemini also had an underwhelming start this year — its volumes plunged below $500 mln for the first time since September. Meanwhile, OKEx broke its three-month long growth streak, but remains the only exchange from the pack whose trading volumes actually increased compared to January 2018 (from $2 bln to almost $4 bln).

Stability is a bad thing

While Bitcoin is becoming more attractive to institutional investors, its low volatility directly reflects in declining trading volumes, Diar suggests. Traders flock in droves to exchanges to profit off constant price swings, but that’s not the case when the market remains in limbo.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov