Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin futures traders got a rude awakening when the latest CoinGlass figures showed a massive imbalance of 1,364% between long and short positions, with a gap of around $187 million between the two sides.

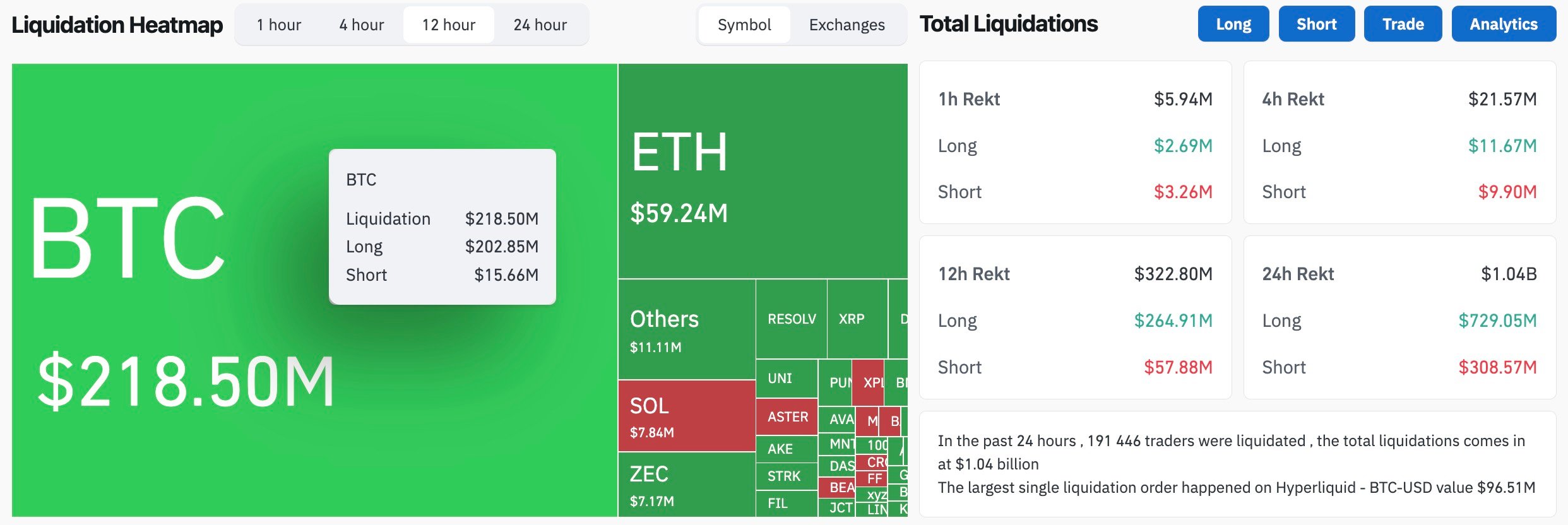

Thus, on the derivatives liquidation heatmap, BTC shows total liquidations of $218.5 million for the period under review, made up of almost 93% in long positions. Basically, that single cluster explains why price pressure went one way for most of the Asian and early European sessions.

The 24-hour picture is not any gentler. Across all assets, the market cleared over $1 billion in liquidations, with 191,446 traders receiving margin calls. Bitcoin alone saw $406.88 million in long liquidations and $163.07 in destroyed shorts over the day, while the largest single order printed on a BTC/USD derivatives pair was $96.51 million.

Bitcoin price tricks

With a market cap of around $91,282.9 per BTC, and a 4.36% loss in the last 24 hours, it is pretty clear that leverage did the heavy lifting.

When you put the liquidation heatmap and the price chart together, they show a session where forced exits on the long side drove most of the action, and spot just followed the path set by derivatives. This turned the $187 million gap into the day's main reference number for Bitcoin.

Short-term windows show how the pressure built up bit by bit. On the intraday spot chart, the price slid from the mid-$90,000 zone toward the $90,000-$92,000 corridor, dipped briefly under $90,000, then moved sideways as new positions replaced wiped-out ones.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov