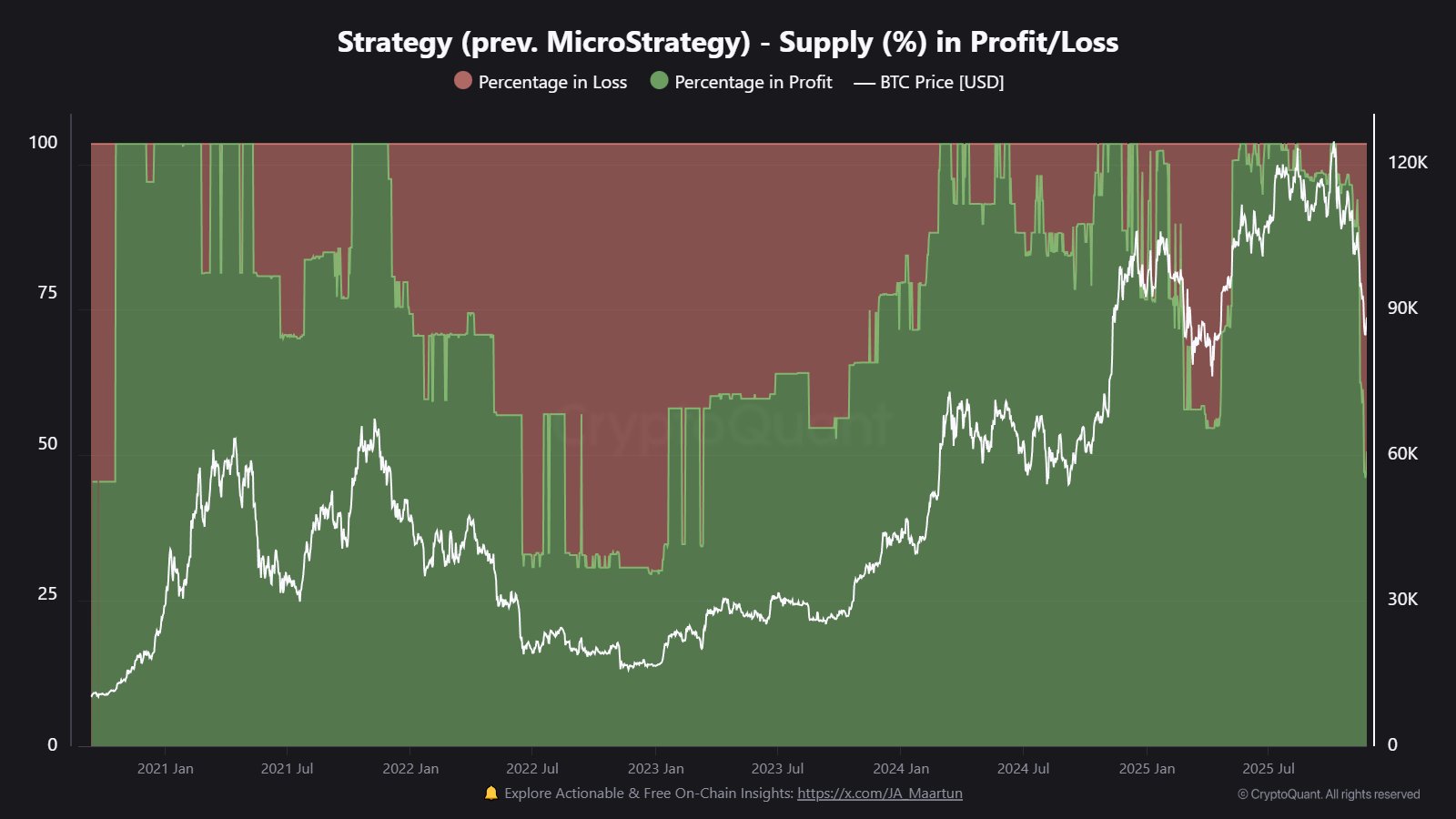

Strategy, the company that built its whole identity around buying Bitcoin nonstop, just ran into a number it really did not want to see. According to a CryptoQuant analyst, more than 51% of the company's whole Bitcoin stash was bought at prices higher than today's, and that kind of stat can totally change how the market sees the firm's position.

As of now, Strategy holds 649,870 BTC, making it the biggest corporate pile in the world with the average cost is $74,430, so the firm is still in the green, with Bitcoin trading near $86,900. But the average is not the whole story here.

The issue is where the purchases were made. A lot of Strategy's coins came from the expensive phases of 2021, 2024 and early 2025. Those were the times when BTC was much higher than it is now. Because of 2025 in particular, over half of the stash is currently sitting below its entry price.

All this came to light after Bitcoin fell from above $120,000 down into the high-$80,000s in a short period of time. That drop dragged BTC right back into the zones where Strategy made a lot of its biggest buys.

The older coins, bought at deep-cycle levels under $20,000, are still holding their gains. The later rounds, the expensive ones, are not.

Stock angle adds more pressure

MSTR is trading near the lower edge of its valuation bands based on Bitcoin. Strategy's market cap is about $49 billion, but the Bitcoin it owns is worth around $56.4 billion. That means the stock trades below the value of the company's own BTC.

The 51% figure does not put Strategy in danger, but it shows how much the company overpaid. It is clear that Bitcoin's success is now tied to it, reaching those levels where it did some of its biggest shopping.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin