Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

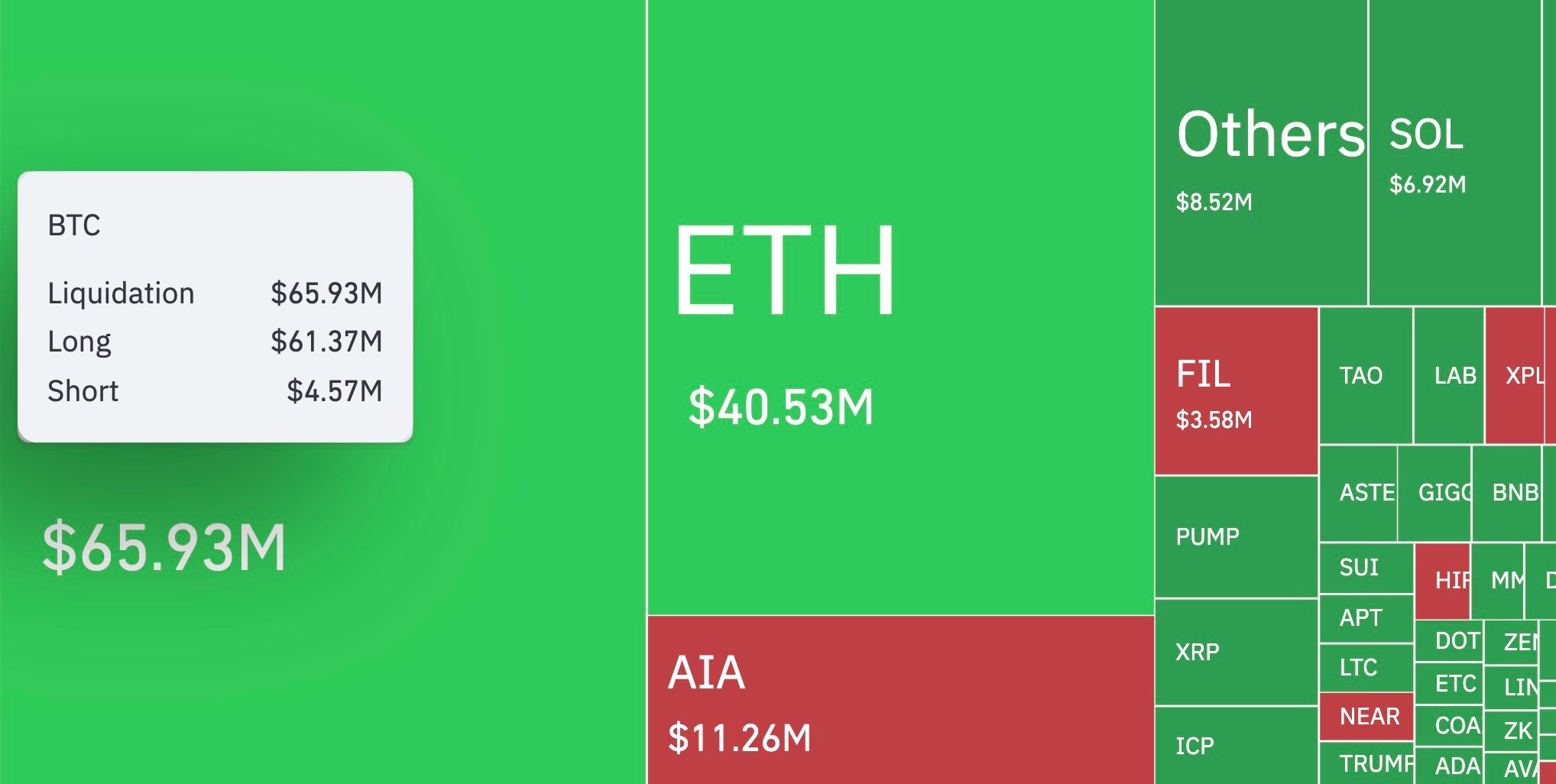

It took less than 12 hours for the market to punish over-leveraged Bitcoin traders again. Roughly $66 million in BTC positions were liquidated overnight, and a staggering 93% of that came from longs. The imbalance between long and short liquidations — 1,342% by CoinGlass liquidation heatmap — highlights how one-sided the bullish positioning had become right before the drop.

The pain began when Bitcoin fell below $101,000, triggering a cascade of margin calls that briefly pushed prices down to $99,200 before a modest recovery. The BTC/USDT chart now shows the coin hovering around $100,100, down about 0.2% for the session, yet still holding onto the symbolic six-figure mark.

This movement coincided with a cooling off in funding rates across major perpetual markets, suggesting that some traders began reducing their exposure while awaiting a decrease in volatility.

$713 million out

Market-wide, $713 million in liquidations erased a full day of speculative leverage. Ethereum accounted for $40.53 million, while smaller currencies such as AVAX and SOL saw $11.26 million and $6.92 million, respectively. The largest single order liquidated on Hyperliquid was a BTC/USD position worth $15.31 million, suggesting that even the largest traders were affected.

Most charts now show liquidity pockets clustering around $98,500 and $101,300 — a range that could determine whether Bitcoin stabilizes or experiences another wave of liquidations into the weekend.

For now, the leverage cycle has reset, but sentiment remains bruised; a single bad candle can erase billions of dollars in fictional gains built up over weeks.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin