Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

As revealed by Onchain Lens, one of Hyperliquid's most aggressive and closely watched traders is back, and this time, he is going long on XRP, with $30 million of conviction. This whale became famous for unloading 255 BTC on-chain in December before going on the offensive, with short positions across BTC and ETH.

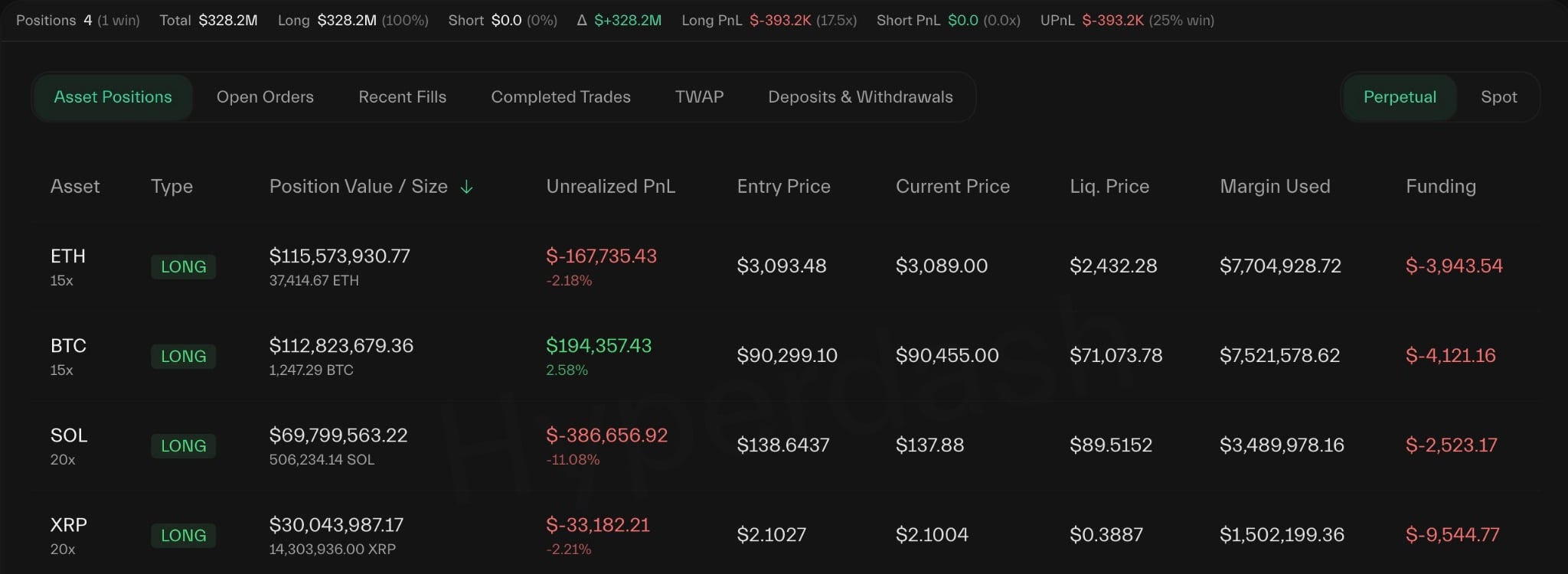

Now, they have done a total 180 reversal, going long on XRP with 20x leverage for a whopping $30,043,987.

Back in December, this same wallet unloaded 514 BTC it had held for over a year, then sold 255 BTC for $21.8 million and used it to fund $80.2 million in Bitcoin shorts and $2.1 million in ETH shorts. That move gave him a big boost in PnL, bringing his total to $8,283,137.32.

The new move is part of a bigger $328 million long position, split across four major assets: 1,247 BTC worth $112.8 million; 37,414 ETH worth $115.6 million; 503,778 SOL worth $69.8 million and 14.26 million XRP.

How risky is the move?

Despite high leverage — averaging over 10.8x across positions — the whale has yet to deploy additional margin, with a $0 withdrawable balance signaling full capital commitment.

His BTC long is currently at 2.58% profit, but he is underwater on ETH, SOL and XRP. SOL is the worst, with a loss of $386,000. The XRP entry at $2.1027 is just above the current market price of $2.1004, which makes it seem like the whale timed the entry during a local spike.

Liquidation for the XRP position is still at just $0.3887, more than 80% below the current price, so it is clear the investor is comfortable with risk.

The move into altcoins, especially XRP, suggests a bet on a breakout leg rather than a passive rotation. It is not clear if it is a volatility play or an early move ahead of new catalysts, but this whale is once again fully exposed — this time to the upside.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov