Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

This week, Bitcoin Cash (BCH) suddenly forced its way back into the center of the market conversation after delivering the strongest performance among all major assets. This move instantly pushed BCH closer to Cardano’s position in the top-10 ranking by CoinMarketCap, turning what used to be a relic of the crypto market into a potential top-10 contestant driven by real capital, not narratives.

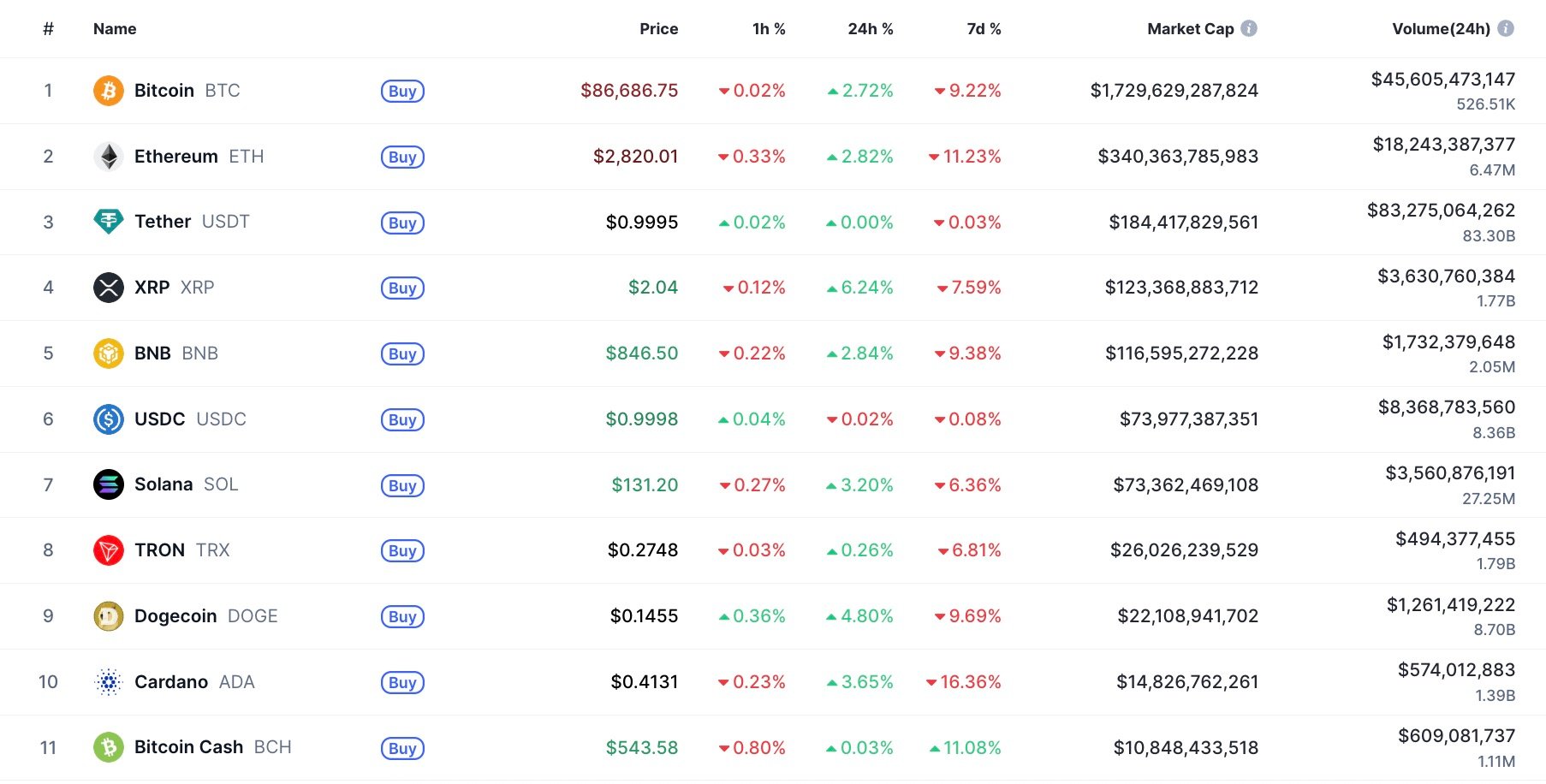

Over the past seven days, BCH gained over 10%, while the rest of the large-caps spent the week under pressure. Just look at the contrast: BTC fell 10.54%, ETH lost 13.13%, SOL is down 9.14%, DOGE lost 13.18%, and ZEC plunged by 19.75%.

This means that Bitcoin Cash was not just the best performer, but the only one with a positive weekly return. With BCH at $544 and a market cap of $10.8 billion, closing the distance on Cardano’s $14.7 billion, the once unreachable gap has begun to shrink in real time.

A major driver behind this move is unusually tangible. MFI International Limited announced plans to acquire $500 million worth of Bitcoin Cash as part of its new "digital asset treasury" strategy.

$500 million for Bitcoin Cash

MFI is a small, Hong Kong-based fintech company that operates trading infrastructure in China and Southeast Asia. No matter how credible the company is, the headline of someone injecting half a billion into the asset everyone forgot about was enough to trigger the bulls.

Combined with the visible surge on the weekly chart, where BCH experienced one of its biggest upward movements since mid-2024, the result is a market in which Bitcoin Cash is no longer considered a legacy "dino coin," but rather one of the few large caps capable of delivering weekly gains while everything else trends downward.

Cardano is now the one defending its position rather than setting the pace.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin