Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bakkt, the Bitcoin futures trading exchange, backed by the ICE, has shown a record of doubling its open interest within one day. On November 6, it totaled $2 mln, compared to the previous figure.

Bakkt total open interest doubled yesterday to $2mln - still some way to go but growing! pic.twitter.com/97FiwH4iAa

— skew (@skewdotcom) November 7, 2019

Is Bakkt volume nearing another ATH?

Apart from the open interest doubling, Bakkt is making substantial progress in the trading volume of Bitcoin futures, which launched earlier this fall.

As per the Bakkt Volume Bot’s Twitter page, on November 6, Bakkt’s trading volume totaled 1096 Bitcoin futures contracts.

The all-time-high achieved on this platform recently was on October 25 and amounted to 1183 contracts traded.

Daily summary of Tuesday's Bakkt Bitcoin Monthly Futures:

— Bakkt Volume Bot (@BakktBot) November 6, 2019

? Traded contracts: 1061 (+96%)

? Day before: 541

? All time high: 1183

Follow @BakktBot for realtime updates. pic.twitter.com/71Suu7EsoU

Bitcoin price keeps declining as China and US negotiate a deal

As reported by CNBC, China has negotiated with Washington that the current trade tariffs will be ditched gradually, in phases. Both countries have agreed to change the current tariffs on some of the goods.

When the so-called ‘trade war’ broke out earlier this year, this coincided with a massive Bitcoin price surge. Many back then believed that the worsening of trade relations between the two super powers had its impact on the Bitcoin price – many Chinese investors started hedging their risks against the falling quotes of RMB.

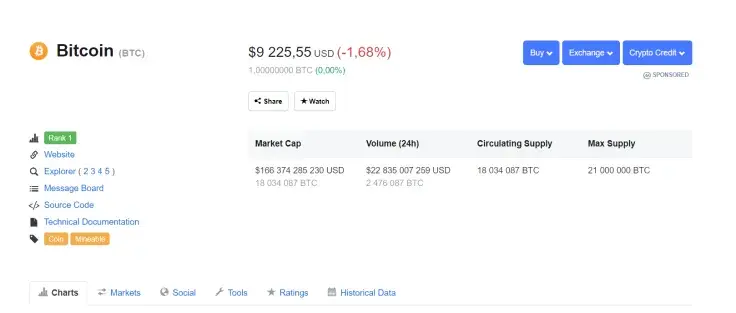

At press time, Bitcoin is trading at $9.225, showing a decline by almost 2 percent.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin