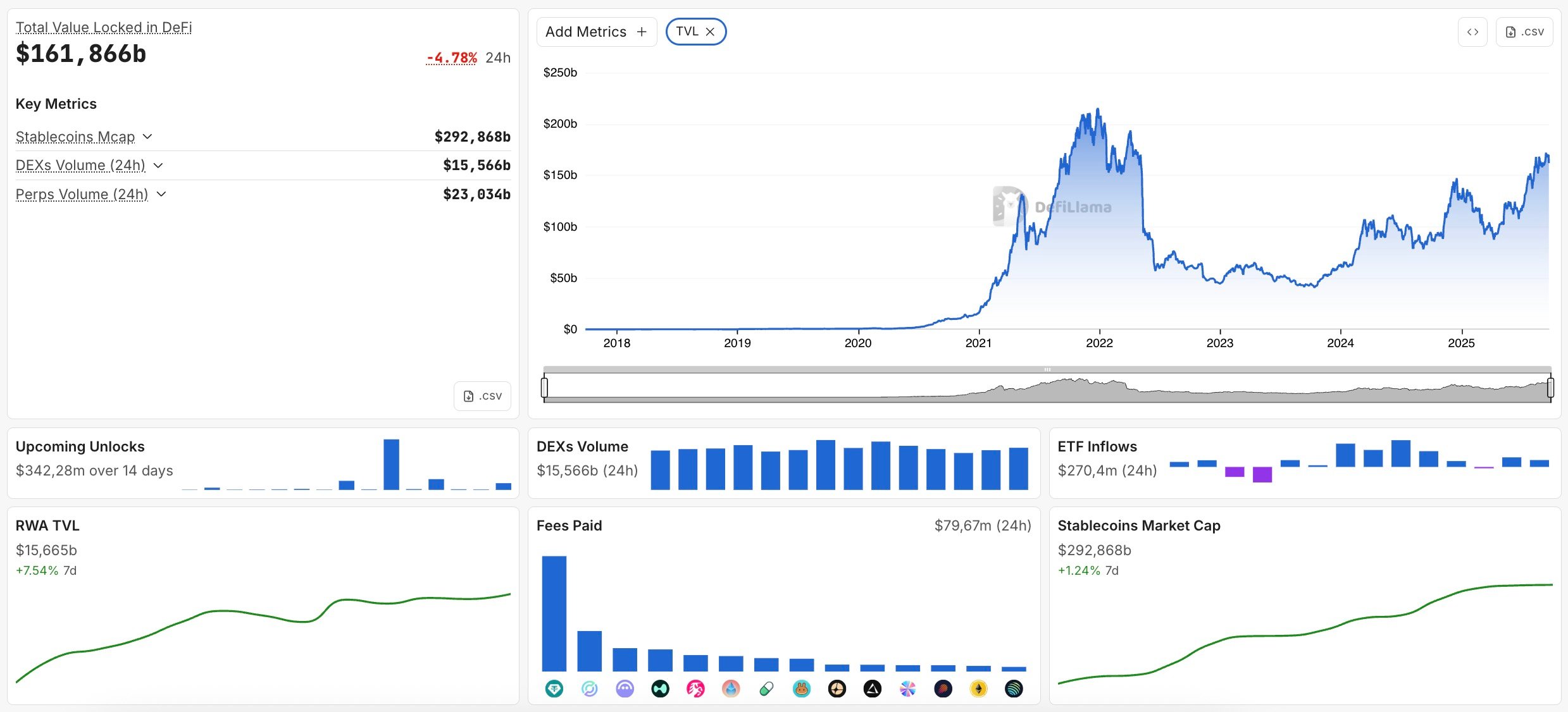

Ripple’s new roadmap makes it clear that XRP, already valued at $180 billion, is being promoted as an institutional DeFi asset at a time when the sector is demonstrating its true size: $161.8 billion is locked in protocols, $292.8 billion in stablecoins, $15.6 billion is traded daily on DEXes and there is $23 billion in perpetuals volume, according to DefiLlama.

The message is clear: XRPL is evolving beyond payments to encompass the compliance, credit and tokenized markets, where billions are already changing hands daily.

Upgrades are now live, with on-chain proof of regulatory status, freeze controls for issuers and simulation tools for reducing errors. These features address regulators' concerns, contributing to the growth of XRPL's stablecoin, which recently surpassed $1 billion in a single month, and its position in the top 10 real-world asset chains, valued at $15.6 billion in DeFi. XRP's role as a settlement asset within this system continues to expand.

The bigger shift will come with version 3.0. A protocol-level lending system will pool liquidity and issue loans natively under KYC/AML standards, creating cheaper institutional credit and direct yield opportunities. The Multi-Purpose Token standard, due in October, will allow bonds and structured products to be issued and traded directly on XRPL.

Bottom line

These are not side experiments but are ways of pulling regulated money into markets where XRP is both the collateral and the liquidity rail.

Privacy is next. Zero-knowledge proofs are being developed to enable institutions to transact and collateralize positions without revealing details while still passing audits.

In a market where ETFs are pulling in inflows of $270 million in a single day and stablecoins are approaching $300 billion, Ripple’s plan signals that XRP is not just surviving but is being positioned to sit at the heart of the largest flows in digital finance.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov