The largest XRP ETF on the market just delivered one of the most unusual daily results of the month: zero dollars in net inflows, despite the rest of the sector continuing to absorb new capital. Canary's XRP ETF, which is listed on Nasdaq and has the largest asset base in its category, finished the session unchanged while its peers added millions.

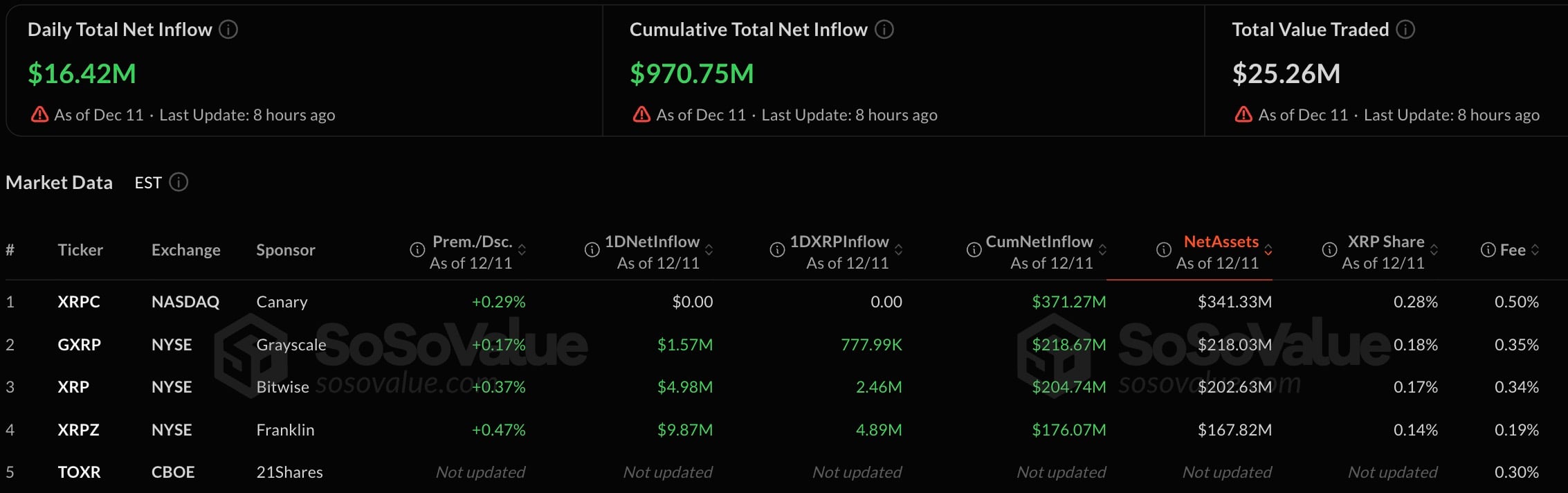

According to SoSoValue, total spot XRP ETF net assets are close to $930 million, with cumulative inflows reaching almost $971 million. Daily activity across the group remained active, with volumes clearing $25 million and several issuers posting positive creations. Canary alone showed nothing: not negative, not redemptions, just zero.

This is important because Canary also has one of the highest fee profiles in the lineup at around 0.5%, compared with products from Grayscale, Bitwise and Franklin at under 0.35%.

In a market where the XRP price has compressed to around $2-$2.05 and ETF buyers have become price-sensitive, the impact of fees is no longer theoretical. It is evident in daily flow tables.

XRP demand meets reality

Canary still controls over $340 million in net assets, which is more than any single competitor, and its XRP share remains the largest on the ETF market. However, the flat day suggests a pause: large allocators are active elsewhere while waiting for either price confirmation or a clearer incentive to pay a premium fee.

In the short term, this creates a favorable situation. If XRP breaks out of the current price range, Canary can quickly regain brand recognition. However, if the price stalls and competitors continue to undercut on fees, investors may continue to bypass the market leader.

For investors, the message is simple. Demand for an XRP ETF is alive. Capital is selective. Fees now compete with conviction, and even the biggest product is not immune to a day of absolute zero.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov