Bitcoin has lost over $2,000 of its value over the past 24 hours, crashing to an intraday low of $17,253 at 03:32 UTC on the Bitstamp exchange.

While many traders were caught off guard by the violent move, there are six reasons why this major correction was expected.

The Mnuchin bombshell

The cryptocurrency accelerated its plunge after Coinbase CEO Brian Armstrong expressed his concerns about outgoing Treasury Secretary Steven Mnuchin rushing draconian cryptocurrency wallet regulations:

“If this crypto regulation comes out, it would be a terrible legacy and have long standing negative impacts for the U.S. In the early days of the internet there were people who called for it to be regulated like the phone companies. Thank goodness they didn't.”

Advertisement

Mnuchin — who was personally told by President Donald Trump to “go after” Bitcoin — has been very vocal about the risks associated with the cryptocurrency.

A brutal rejection close to the all-time high

On Nov. 25, Bitcoin once again stopped short of touching its all-time high of $19,666 less than one percent of it. The flagship crypto reached a new 2020 peak of $19,490 at 13:50 UTC before immediately correcting to $19,131 five minutes later.

The overheating futures market

Funding rates across the top exchanges that offer perpetual cryptocurrency futures have been on the rise as of recently. As a result, overleveraged longs got wiped out, with the total Bitcoin open interest shedding 13.69 percent, Bybt data shows.

High social volume

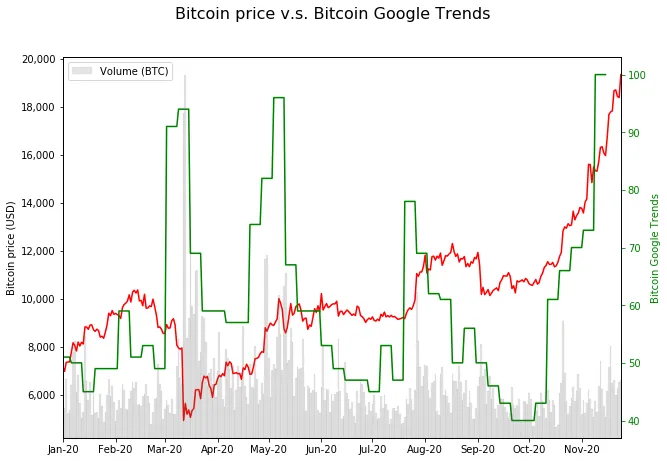

According to crypto analytics platform Santiment, Bitcoin’s social volume has been on the rise as of recently, which signaled that the retail crowd was finally succumbing to FOMO.

One day prior to the plunge, Bitcoin’s search interest hit a new 2020 high after the "silent" rally started to attract more attention.

Whales sending coins to exchanges

CryptoQuant CEO Ki Young Ju notes that Bitcoin whales started depositing BTC to cryptocurrency exchanges a few hours prior to the crash.

However, he still notes that long-term on-chain indicators remain bullish.

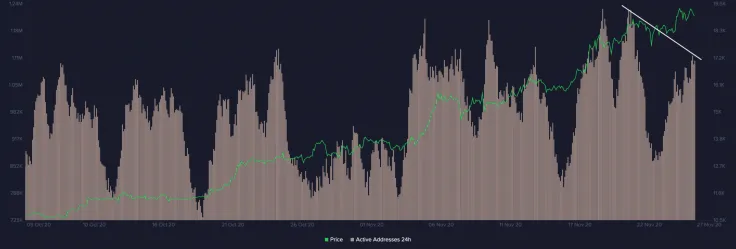

Declining network activity

As reported by U.Today, CNBC’s “Fast Trader” recently pointed out that Bitcoin’s implied address growth was way too high.

Meanwhile, Santiment points to the declining number of daily active addresses (DAA), which is usually a bearish sign.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov