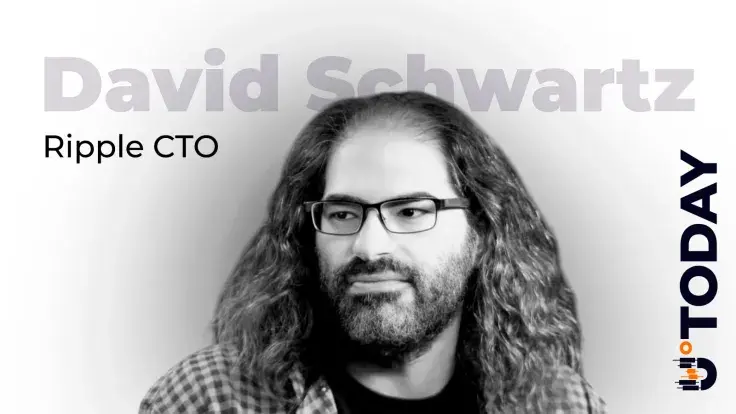

David Schwartz, chief technology officer at Ripple, has opined that new revenue models could reduce the need for XRP sales.

"…how is it better if Ripple feels more pressure to sell more XRP if the price drops? Wouldn't you think other sources of income reduce this pressure?" Schwartz said in a recent social media post.

Ripple's main cash cow

Ripple, the company associated with the XRP token, has two main business arms: XRP sales on the open market as well as enterprise products and services, such as RippleNet and cross-border payment solutions.

A significant portion of Ripple’s operational revenue historically came from selling XRP from its corporate holdings. The Financial Times, for instance, previously reported that the enterprise blockchain firm would not be profitable without selling XRP. Schwartz also previously admitted that XRP accounts for virtually all of Ripple's revenue.

Earlier this year, Schwartz stated that Ripple should act in its own interests when it comes to XRP sales.

Ripple holds billions of XRP in escrow. Each month, it releases a fixed amount to fund company operations and market initiatives. This essentially means that Ripple’s cash flow was tightly linked to XRP's price and market liquidity.

Given that Ripple sold XRP to generate revenue, investors worried about large-scale sales depressing XRP’s price, especially during market downturns.

Diversifying revenue streams

In recent years, Ripple has tried to diversify income through new revenue streams to reduce the company’s dependency on selling XRP. The RLUSD stablecoin is one of them.

Critics argue that new sources of income might be negative for XRP since it could be treated more like a spare asset, but Schwartz sees it as a positive stabilization factor.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov