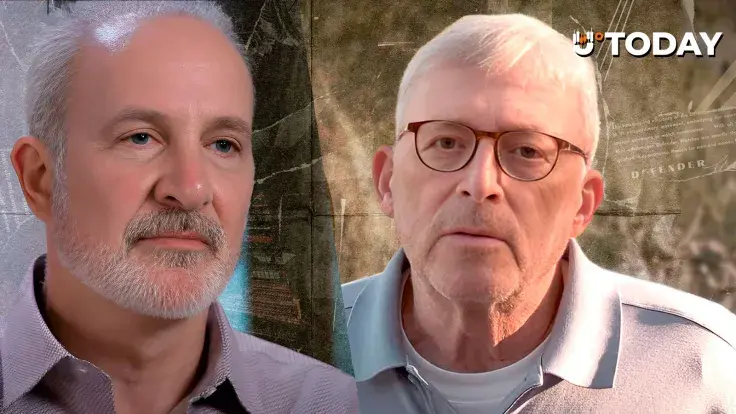

Veteran crypto trader Peter Brandt has taken to X (formerly Twitter) to provide a brief analysis of gold’s long-term performance while highlighting the many long and painful waiting periods that pro-gold advocate and Bitcoin critic Peter Schiff has had to endure over the years.

The post, issued on Wednesday, October 22, saw Brandt take a playful jab at Schiff as gold suddenly flipped negative over the last day, facing a sharp correction from its recent record highs.

Another waiting period?

Following Brandt’s criticism of the sudden gold dump, he shared a historical gold chart suggesting that the asset has put its investors through a tough investment journey filled with long seclusion periods.

The data shows that gold has continued to record deep and long-lasting consolidations, even though it has averaged a 3.6% annual return over the past 45 years.

This trend is particularly evident in gold’s price trajectory during the 1980s. The chart reveals that it took gold 28 long years to retest the high it achieved after a massive spike in March 1980.

A few years later, gold investors faced yet another long and painful seclusion period after the asset recorded a new high in September 2011.

After hitting this peak, gold experienced a prolonged crash, taking about 13 years to break even again, forcing investors to wait that long before reclaiming profits.

It now appears that gold may be replaying these unfavorable trends, as it has begun plunging deep into the red zone shortly after surpassing $4,000. Brandt highlighted this in his post, trolling Schiff for his endurance over the years and raising a mocking question about how many years Schiff will now go into “seclusion.”

Commentators largely agreed with Brandt’s take, emphasizing that his analysis demonstrates how even traditionally “safe haven” assets like gold can take decades to recover or break even.

As such, many commentators consider Bitcoin a better long-term investment option—despite the heavy criticism it often receives during its correction periods.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov