Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The Christmas charts are meant to be on the quiet side. XRP did the opposite, bouncing back into the green after a bit of a shakeout during the day. The market tried to put a damper on the holiday mood, but it ended up feeding the bounce.

On XRP/USDT, the session spent most of Dec. 25 trading around the $1.86 price point, then took a nasty dip before buyers stepped in and dragged the price back toward $1.87. By early evening, XRP was at $1.8659, pretty much flat on the latest candle, but the day's story was the recovery after that dip and shining green on Christmas, not doing tiny candle math.

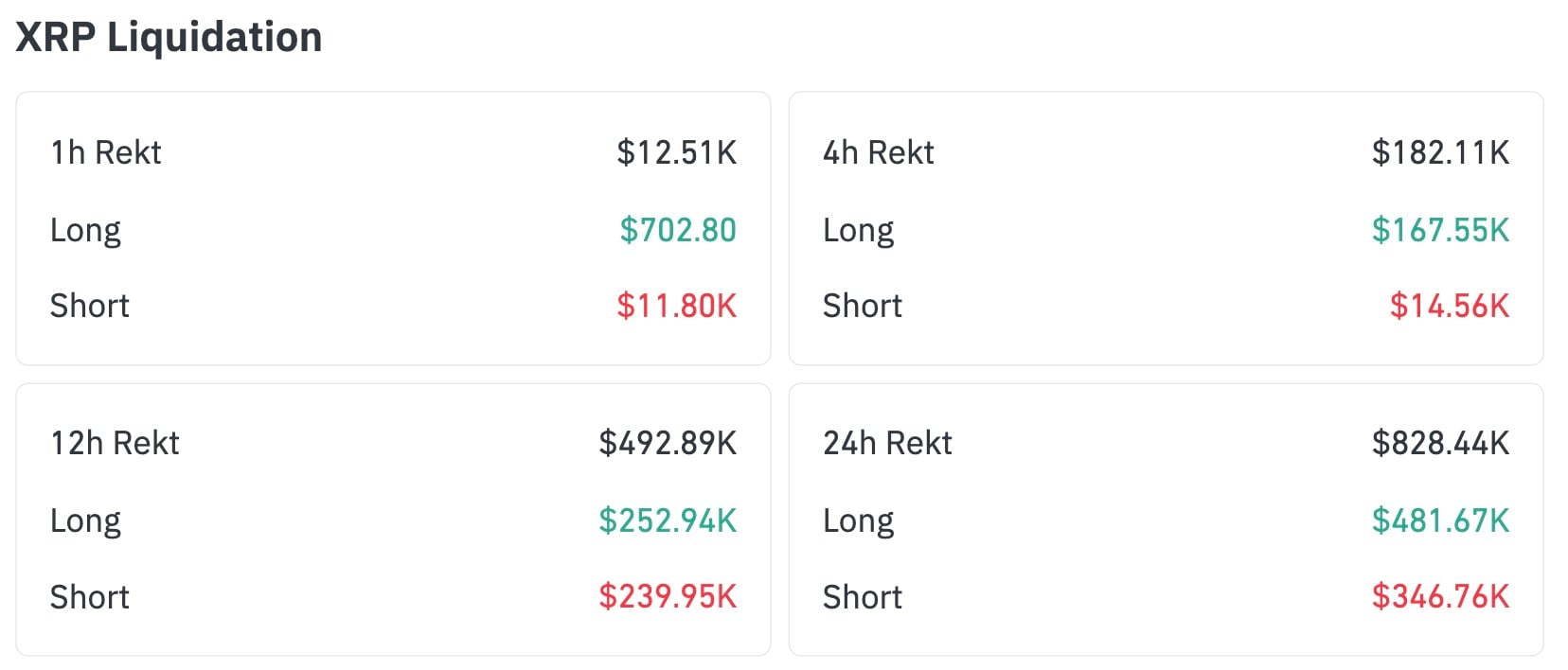

The liquidation heatmap by CoinGlass tells the same story in a way that actually gets attention. In the last hour, the total "rekt" was $12,510, and it was mostly shorts at $11,802 versus $702.80 in longs.

The balance changed when the chart zoomed out: in just over four hours, $182,110 were wiped out, with longs taking 92% of this wave. The 12-hour window shows $492,890, split almost down the middle, and the 24-hour total is $828,440, with longs still leading at $481,670 compared to $346,760 for shorts.

$2 for XRP in 2025: Dream or reality?

Basically, XRP bulls got a gift, but it came with a catch: a bounce powered by short pain on the smallest time frame, while larger windows remind you that late longs have been paying for every fakeout.

The year-end question for XRP is not $1.88 or $1.90, it is whether the coin can reclaim $2 and actually hold it into the December close because a quick tag is just holiday noise, but a month-end finish above $2 is the kind of print that forces investment decisions to be remade going into January.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov