Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The first weekend of November lands without fireworks but with plenty to digest. Bitcoin trades at $110,513, regaining fast from October’s red close. Ethereum struggles to make it above $4,000. XRP starts the month at $2.51, keeping most of its late-summer surge alive.

Traditional equities are slowing down after heavy corporate earnings in the U.S., giving digital assets their own window to move independently. The importance of macro is also fading for a week — no Fed meetings, no new inflation data until mid-month — which leaves the market to trade on positioning, not headlines.

TL;DR:

- XRP enters its strongest historical month with an 81% average November gain.

- Coinbase closes October with $1.8 billion revenue and over a dozen product rollouts.

- DonAlt flags Bitcoin’s first bearish signal since the $88,000 breakout.

XRP faces its favorite month: 81% average November gain back in play

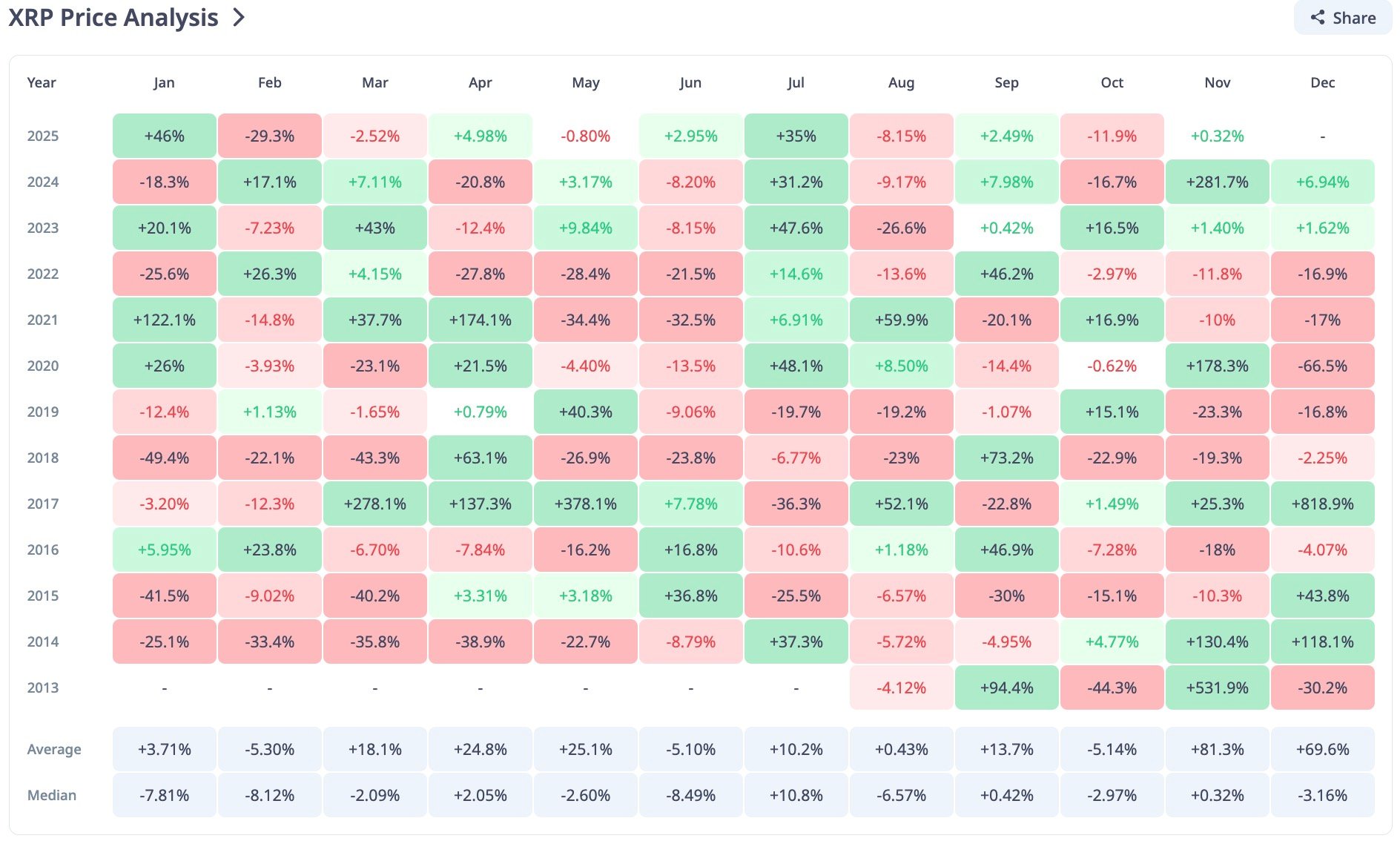

XRP’s calendar advantage is not superstition — it is in the numbers. CryptoRank’s monthly data show November delivering an average 81% move for XRP across the past 10 years, outpacing nearly every other month. The median sits neutral because of flat years, but the outliers are massive: 281% in 2024, 818% in 2017 and 130% in 2014.

At today’s $2.51, XRP is still up more than 200% year-to-date, fueled by the early 2025 breakout that started from $0.80. Support remains at $1.80-1.60, a wide but clean cushion built during the summer rally. The upper zone, $3.10-3.20, remains the same ceiling that stopped the 2021 cycle and where most long-term holders are waiting to unload partial positions.

Trader DonAlt, who caught the 700% XRP leg earlier in the cycle, said he closed his position for about 300% profit, adding that technicals are still good, but he is moving on for now.

Still, XRP’s behavior fits its usual rhythm. Five of the last eight Novembers have ended green for XRP. If the same rhythm holds, the setup window is right now.

Coinbase CEO Brian Armstrong promises "big month" to close 2025

Brian Armstrong summed it up simply on X: "Big month for us at Coinbase. Much more to come — excited to close out 2025 with a bang." For once, the phrasing matched reality. Coinbase just wrapped one of its busiest quarters since listing on Nasdaq, posting $1.8 billion in net revenue and announcing an aggressive set of product releases, partnerships and infrastructure moves.

The October breakdown looked less like a recap and more like an operating report. Coinbase:

- Partnered with Citi to build new global payment rails.

- Rolled out DeFi USDC lending for U.S. users in eligible regions.

- Expanded DEX trading to nearly all users except New York.

- Applied for a U.S. national trust charter via the OCC.

- Invested in CoinDCX, expanding to India and the Middle East.

- Partnered with Samsung, adding crypto functions to 75 million U.S. Galaxy devices.

COIN stock ended October at $343.78, adding nearly 2% for the month and extending its multi-quarter rebound from 2023 lows. Key supports lie near $240, while resistance appears just above $350.

The stock mirrors the general environment in crypto — not euphoric, but steady, and now driven more by real activity than by retail sentiment.

Bitcoin flashes first bearish signal since $88,000

For Bitcoin, November starts on a different note. DonAlt, the same trader behind this year’s long trend call, posted that he is seeing the first bearish signal since $88,000, calling it time to “cool off a little” unless BTC reclaims his “red box” near $113,000.

The newest monthly candle supports his case — the chart shows a fade in momentum, smaller ranges and declining volume after half a year of almost straight upside.

BTC now trades at $110,513, up less than 1% for the week. Support zones remain at $84,600 and deeper at $56,000, marking the two main liquidity shelves from 2024.

Long-term holders are not moving coins, exchange balances are still low, but the short-term crowd is fading out. Historically, weak Novembers have preceded strong December runs once leverage resets — 2016, 2020 and 2023 all fit that same pattern. For now, the message is simple: respect the range, do not chase candles.

November outlook

The market’s composition going into the first week of November looks balanced but nervous — XRP with historical upside, Bitcoin losing heat and Coinbase extending presence.

Short-term watchpoints:

- XRP: breakout confirmation above $2.70, key support at $1.80.

- BTC: hold above $100,000 to preserve trend, but below $84,000 opens correction.

- ETH: mid-range at $3,200-3,400, breakout target $3,600.

- COIN: strength above $350 could attract institutional flows back into crypto equities.

Macro catalysts remain light this week — only U.S. employment data and early ETF flow readings are scheduled. That usually gives room for technicals to drive direction.

Historically, the first half of November sets the tone for the entire quarter, and this year that pattern feels like that. No mania yet, no fear either — just a market figuring out sentiment before the next decision point.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin