Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

October is shaping up to be a critical time for this crypto cycle. Bitcoin hit an all-time high of $125,782 before dropping to $123,440, while Ethereum climbed to $4,563. The two major cryptocurrencies are setting the tone for "Uptober," with a total market cap above $4.21 trillion.

Globally, conditions are favorable. U.S. fiscal stress, rising debt costs and shutdown speculation have led to increased hedging. Bitcoin, already seen as digital gold, is doing well.

Bitcoin hits $125,782, and El Salvador shows $475,000,000 profit

Bitcoin is making history once again. With intraday highs at $125,782, BTC is holding strong in record territory. Profit-taking has been absorbed pretty smoothly, with $3.7 billion in realized gains in recent sessions offset by fresh inflows.

Adding to the optimistic story is El Salvador. President Nayib Bukele just dropped the latest numbers on the country's Bitcoin holdings, revealing a whopping unrealized profit of $475,000,000. For a country that made global headlines by adopting BTC as legal tender in 2021, this is huge.

BTC is up against some resistance at around $126,000 to $127,000. That's where a lot of derivatives liquidations are happening. If it breaks through this level, it could hit $130,000-$135,000 pretty quickly. The bad news is that $120,000 is the zone to defend.

Ethereum whale sends $426,890,000 to Binance

Ethereum's been all about whales lately. The main altcoin is trading at $4,563, which is almost 2% up on the day, but the bigger story is on-chain flows.

A dormant Ethereum OG wallet reawakened and sent 4,500 ETH ($20,400,000) to Kraken. The address has transferred 5,502 ETH ($23,380,000) to exchanges over four months, still holding 3,051 ETH ($13,800,000).

Even larger flows came from Trend Research, which has sent 96,100 ETH ($426,890,000) to Binance since Oct. 1. Analysts say these are structured moves rather than total exits, but the volumes are worrying.

Ethereum's range is easy to see. The resistance level is between $4,600 and $4,800, and if it breaks out, it could hit $5,000. Support is holding strong at $4,300. Funding rates are still relatively low, which points to healthy growth in leverage. If Bitcoin hits its ceiling, Ethereum might be next to set a new all-time high.

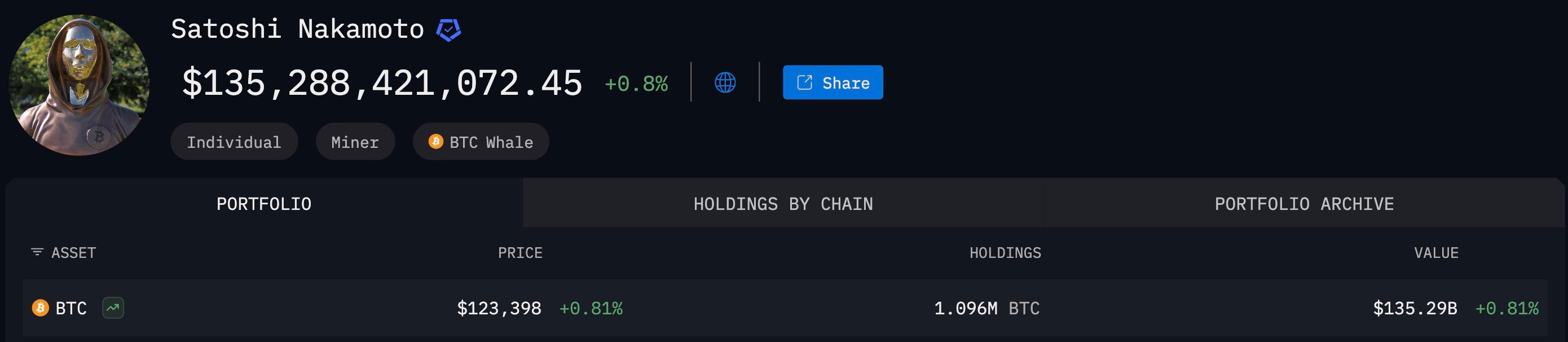

Figure of day: Satoshi net worth hits $136,288,000,000

With Bitcoin hitting new record highs, the wallets linked to Satoshi Nakamoto are now worth a jaw-dropping $136,288,000,000. With 1.096 million BTC unmoved since 2010, Satoshi is one of the five richest individuals on earth — at least on paper.

Right now, Satoshi's holdings are worth as much as Warren Buffett and Bill Gates. If it's liquid, it'd be on par with Elon Musk's peak Tesla fortune.

This contradiction is at the heart of Bitcoin's mystique. The biggest holder disappeared 13 years ago, which only adds to the scarcity of the asset.

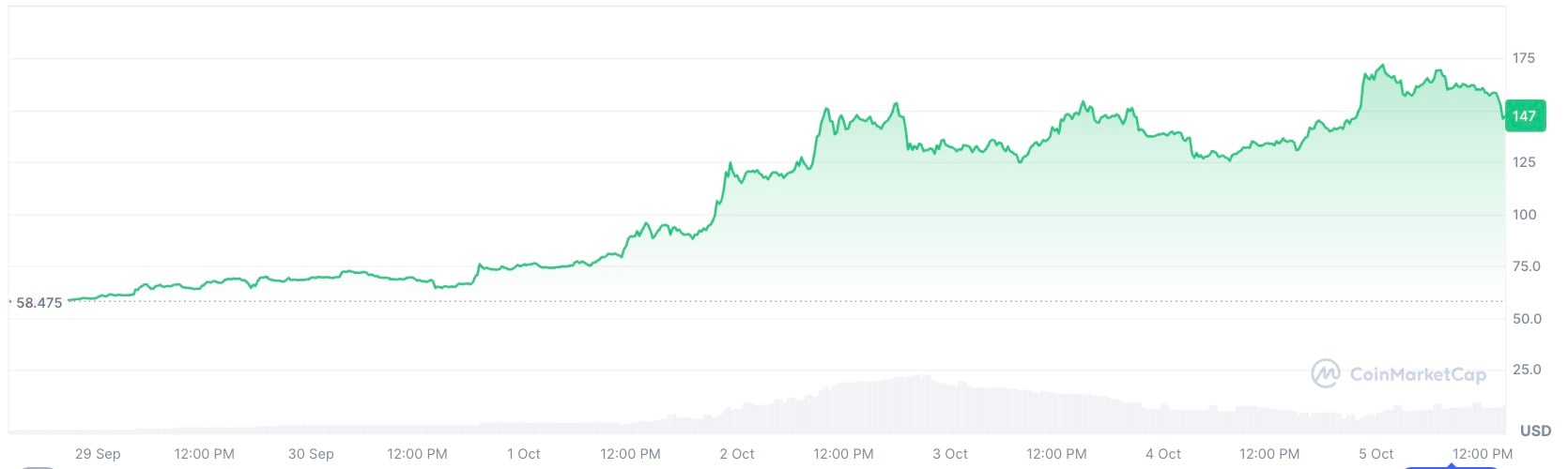

Chart of day: Zcash (ZEC) targets $221 next after 283% surge in week

Zcash (ZEC) is the altcoin story of the week, partially thanks to Naval Ravikant. After being dormant for years, the privacy token has suddenly surged, gaining 154.99% in the past seven days and 283% over the past month. ZEC is currently trading at $155.75, with a previous peak of $176.20. The market cap has risen to $2.57 billion, with $423 million in daily sales.

Fibonacci levels show that $221 and $318 are the next probable targets, with a chance of going even higher, maybe as high as $476-$614, if the current momentum keeps up.

This is happening at the same time as there's been a renewed focus on privacy narratives in the crypto space. Ethereum's Foundation released its own privacy road map, and Ripple discussed confidentiality earlier this month, but ZEC's pure-play status makes it more appealing to traders looking for a speculative rotation.

Don't miss what's next

As of this evening, Bitcoin's key level is $126,000. If the price closes above this zone each day, it could lead to a liquidation cascade, which would push BTC up to $130,000-$135,000. If the ceiling holds, we'll be defending $120,000.

Ethereum's key price range is between $4,600 and $4,800. If it breaks above that, it could go as high as $5,000. But if it dips back down to $4,300, that will probably be a good spot to buy.

When it comes to altcoins, ZEC is definitely the frontrunner. With a 283% gain this month, it could hit $220-$320. SPX token (+68% weekly) and PENGU (+24% weekly) are also showing strong behavior.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov