Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

TL;DR

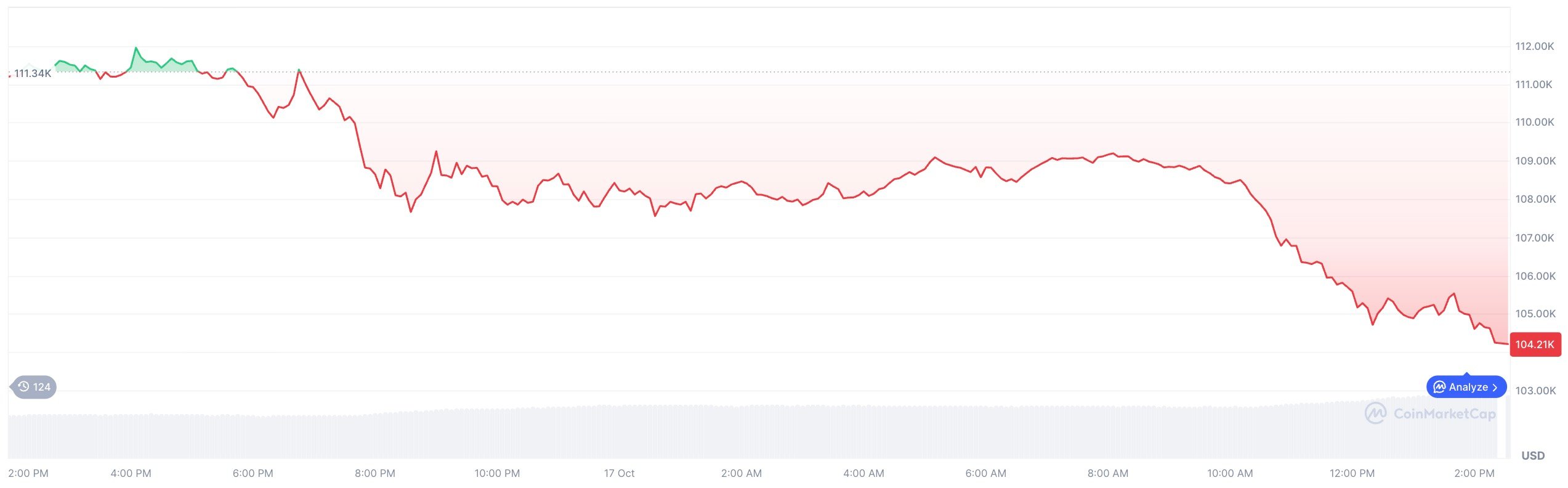

It is Friday, and the crypto board is red across the majors. Bitcoin broke down under $105,000 in its heaviest weekly drop since spring, Ethereum slipped below $3,800, XRP lost more than 11% this week and is down again today at $2.22, while Solana and SHIB followed lower as liquidations cut billions out of leverage and left open interest thinned out.

Ripple, at the same time, confirmed a $1 billion takeover of GTreasury, a four-decade treasury management player, while its legal chief reminded readers again that XRP has no CEO and should not be mistaken for Ripple the company.

In Europe, Binance has been pulled into French anti-money-laundering checks, with regulators tightening the timeline toward MiCA licensing. The backdrop is fragile, and traders are now watching whether Bitcoin can keep $101,000 into the weekend or open the door to a five-figure price.

Bitcoin price loses $105,000

Bitcoin sits at $104,625, down close to 9% on the week and cutting nearly $20,000 off from the highs near $123,000 seen just two weeks ago. The move stands out as the biggest weekly red candle since March, when BTC fell from $98,000 to $82,000.

With sentiment regarding cryptocurrency being extremely negative, the charts now show a demand wall around $98,500-$101,000, right where BTC fell last Friday, while resistance overhead sits locked at $112,000.

The story for Friday and the weekend is simple: does Bitcoin stabilize at $101,000 or not, because under that, the market starts scanning sub-$100,000 zones again.

Ripple CEO Garlinghouse targets trillions in treasury market

While the charts bleed red, Ripple dropped news of its biggest corporate play to date with the confirmation of a $1 billion acquisition of GTreasury, a long-standing treasury management firm with a client list that includes American Airlines and Hitachi.

CEO Brad Garlinghouse jumped on X to frame the deal, saying "astounding amounts of cash are trapped in outdated payment systems" and stressing that Ripple wants to put its infrastructure directly in the hands of CFOs.

For Ripple, the timing is key, as earlier this year, it also spent $1.25 billion to acquire Hidden Road, a prime brokerage firm with deep repo market access. Linking these two moves opens the door for Ripple to deploy balances into yield markets while keeping real-time liquidity flows available.

President Monica Long summed it up by saying this combination can "unlock trillions in trapped capital," which puts Ripple in a position not just as a payments company but as part of the global treasury infrastructure.

XRP has no CEO? Maybe, but XRP price definitely does not

XRP trades at $2.22, down more than 11% on the week and losing another 4% today after dipping into the $2.20 zone. The sell-off comes at a fragile moment for sentiment, but alongside the price pressure, Ripple CLO Stuart Alderoty stepped into a different debate — whether XRP has a CEO.

His answer was direct: XRP does not. The token runs on the XRP Ledger, a decentralized blockchain launched in 2012 by David Schwartz, Jed McCaleb and Arthur Britto. Ripple, the company, has a CEO, but the token itself does not and never has, Alderoty made it clear.

For him the phrase “no CEO” is a reminder of open design, not just a slogan, and at a time when XRP is again under price pressure, it doubles as a statement about the resilience of the network itself.

Binance under fire in France

The other headline of the day is regulatory. Bloomberg reported that Binance is one of more than 100 crypto firms currently under review by French regulator ACPR in a broad anti-money-laundering operation connected to MiCA licensing.

Binance has already been ordered to strengthen its compliance framework or risk losing its chance to be licensed in France, and the deadline is not far away; June 2026 is when full MiCA compliance will be required, but national regulators are already making decisions on who qualifies.

France is Binance's anchor in Europe, and losing regulatory standing there would threaten its ability to serve the EU as a whole. With the world's biggest crypto exchange still leading in derivatives volume and euro stablecoin rails, the French check comes as one of the biggest regulatory hurdles Binance faces in the near term.

Evening outlook

Friday’s close matters.

- Bitcoin sits at $104,625, and $101,000 is the pivot. Below that, liquidity pulls toward $98,500. Resistance remains around $112,000.

- Ethereum trades at $3,737, with $3,500 the risk level and $4,050 the point that bulls must take back.

- XRP at $2.22 has $2.20 as its last support before $1.95 comes into play, with resistance near $2.65.

Solana at $177 risks slipping to $165 unless it reclaims $192. - Shiba Inu at $0.0000095 already lost its base; traders now eye $0.0000080.

The week ends with charts heavy, ETF flows flashing red, Ripple trying to redefine its role in corporate finance and Binance staring down French regulators. The setup into the weekend is uncertain, and all eyes are on whether Bitcoin can defend $101,000 or leave the door open for another break lower.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov