Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Crypto blogger Colin Wu has announced that five major exchanges in South Korea are delisting WEMIX token. This gaming platform has the Microsoft giant among its investors.

South Korean Digital Asset eXchange Alliance (DAXA), which consists of such platforms as Upbit, Bithumb, Coinone, Korbit and Gopax, has found out that creators of WEMIX token provided it with false information before the listing. These platforms will stop trading this coin on Dec. 8.

The five major exchanges in South Korea, Upbit, Bithumb, Coinone, Korbit, and Gopax, announced the delisting of the gaming platform token WEMIX for providing false information. WEMIX just announced a $46 million investment, including from Microsoft. https://t.co/9eCTdUa7zd?from=article-links

— Wu Blockchain (@WuBlockchain) November 24, 2022

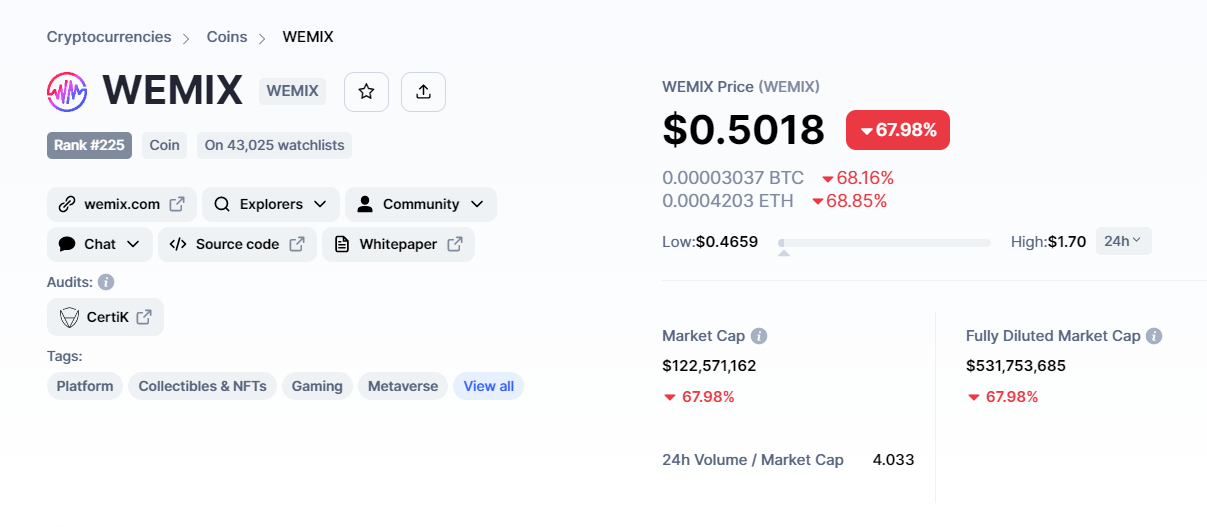

The price of the coin is plunging by more than 68% on the news.

WEMIX is an Ethereum-based token developed by Wemix Pte. Ltd. This is a subsidiary of Wemade — a game developer founded 22 years ago, which created many popular games in South Korea.

It also built the Legend of Mir RPG, which was very popular in China and sold half a billion copies. Recently, Wemade raised $46 million from such companies as Microsoft, Shinhan Asset Management and others.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov